President Joe Biden is increasing tariff rates on $18 billion worth of imported Chinese products and keeping in place other levies that his predecessor Donald Trump implemented on more than $300 billion in goods brought into the United States from China.

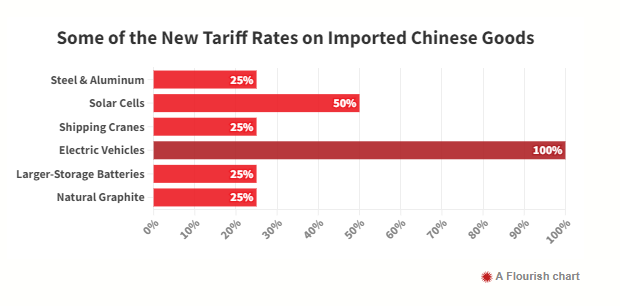

The Biden Administration announced Tuesday, May 14, that the increased rates will apply to steel and aluminum, electric vehicles, battery components, natural graphite, permanent magnets, solar cells, legacy semiconductors and medical products that include syringes, needles, and personal protective equipment like respirators, face masks, and rubber medical/surgical gloves. Other older Trump-era levies remain on the 12-figures worth of goods/products.

The Trump tariffs contributed to price increases on products in the North American promotional products industry, which imports the majority of items from China. The levies also accelerated what were then already-underway (and currently ongoing) initiatives by promo suppliers and other industry importers to move some production out of China, though that nation remains dominant in industry supply lines for many goods, including electronics.

Promo has largely adapted to the Trump-era tariffs, but there had been hope among some industry leaders that the levies could be reduced or nixed. A takeaway from Tuesday’s announcement is that it appears that will not be happening soon, analysts said.

“Biden’s decision caps years of tortured debate within the administration over the tariffs Trump originally put in place,” The Wall Street Journal reported. “Those duties, implemented in 2018 and 2019 and augmented by Biden’s new steps, are now a seemingly permanent feature of U.S. policy toward China.”

It wasn’t immediately clear if the Office of the U.S. Trade Representative (USTR) would extend the more than 400 current Trump tariff exemptions that are in place. The levy exclusions are set to expire May 31. Attorneys for WilmerHale maintained that “although it is not explicit, it appears that USTR does not intend to extend existing exclusions, including those for certain medical-care products and products related to the U.S. response to COVID-19.”

“It is unclear from the report what the administration will do with the existing exclusions, which expire in 17-days,” said Nate Herman, senior vice president of policy at the American Apparel & Footwear Association. “Ending this relief rather than making it permanent puts manufacturers and their workers at a significant disadvantage and adds further inflationary pressures.”

Promo Impacts & Reaction

The new Biden tariffs haven’t taken effect yet. Next week, the USTR is expected to publish further detail on the levies, including which specific products under the Harmonized Tariff Codes will be subject to the tariff rate increases. Still, analysts indicated it’s likely the levies will make it on the books, with some going live this year and others over the next couple years.

Under the newly announced increases, the key tariff rate on China-imported aluminum and steel is slated to jump from 7.5% to 25% this year. Such items are used in products that the promo industry sells, including reusable drinkware, writing instruments and housewares.

“There are going to be consequences for any USA end-markets that utilize imported Chinese aluminum and steel, with the promotional products market being no exception,” Chris Anderson, CEO of Top 40 supplier HPG (asi/61966) and a member of Counselor’s Power 50 list of promo’s most influential people, told ASI Media.

Anderson said that in the face of what could be increased selling prices due to the higher tariffs, demand for Chinese products containing aluminum and steel will drop and demand for “reasonable substitute products will increase. Instead of purchasing an imported stainless-steel water bottle, an end-user (and, by extension, their promotional distributor), may elect to direct their spend to a USA-made recycled PET water bottle.”

Should the tariffs persist over the long term, suppliers will be further incentivized to move sourcing for aluminum and steel products outside of China, “just as we have experienced with other categories, in the face of tariffs and trade restrictions,” Anderson said. “This will not happen overnight, with the time required depending on the production and supply chain complexities of the specific category of goods, which in the case of aluminum and steel are not insignificant.”

Longtime promo executive Jeff Lederer, a Power 50 member whose investment firm owns Top 40 distributor Myron (asi/278980), said the tariffs could lead to increased production costs associated with items like drinkware, pens and household goods, among others that contain steel/aluminum. “Importers could turn to domestic sources for these items, which could be more expensive due to increased demand,” he told ASI Media.

Like Anderson, Lederer maintained that the tariffs on steel and aluminum will lead to continued diversification of supply chains as companies look to nations other than China for manufacturing to mitigate the cost impacts of the levies. “While infrastructure and supply chains in other East Asian countries may not be as sophisticated as in China, they are making gains and offering competitive services,” said Lederer. “Companies may also look to India, Pakistan and Turkey for their manufacturing needs.”

CJ Schmidt, CEO of Top 40 supplier Hit Promotional Products (asi/61125) and a Power 50 member, isn’t too concerned about the new tariffs.

“I think we are making more of it than it needs to be,” Schmidt told ASI Media. “The U.S. does not import that much steel from China as a whole, and although our industry is heavily skewed towards stainless and aluminum drinkware, the impact for the country overall looks to be minimal. If these levies do come into play, we will adapt as we did years ago when many more products/categories than just steel were impacted by tariffs. Our business and the industry have survived and thrived since those tariffs were placed.”

Some other promo leaders said they’re waiting for the product-level tariff impact information that’s anticipated to come from USTR next week before determining business or industry impacts. “I think we will have to wait for more clarification before knowing exactly where we stand,” said Peter Hirsch, president of supplier Hirsch (asi/61005).

Jeffrey Nanus, president of New York-based AAA Innovations (asi/30023), a supplier of eco-friendly hard goods, said the cost of shipping products manufactured overseas to the U.S. is poised to increase, at least temporarily, because of the new tariffs.

Nanus’ sourcing partners were telling him to expect container rates to jump (maybe as much as $1,000 per container for some routes) beginning the middle of the week of May 12, as manufacturers in China flood transport vessels with products they want to get to the U.S. before the heightened Biden levies take effect.

That rush to beat tariff deadlines and other factors, like cargo carriers avoiding the Suez Canal due to military conflict in the region, are contributing to less readily available ship space and not enough shipping containers, which spurs up transport pricing. Elevated transportation costs can, if in place long enough, contribute to increases in how much suppliers charge distributors for the products sold to end-buyers.

“Shipping rates are rising quickly and availability is becoming an issue,” Nanus told ASI Media. “If it continues, it will impact pricing to distributors.”

Under Biden’s plan, a 25% tariff is being placed on permanent magnets, which are essentially powerful magnets that maintain their magnetic properties for considerable time. These types of magnets are often used in automobile manufacturing, loudspeakers, hard disk drives, refrigerators, magnetic pump drives and also jewelry. Earrings, bracelets, necklaces, and beads contain permanent magnets that ensure they clasp together.

Biden said the tariffs are intended to protect American jobs and businesses against China’s alleged unfair trade practices, which the president’s administration said include saturating global markets “with artificially low-priced exports.”

China has panned the Biden levies and vowed to take “all necessary actions” to respond. The nation’s Commerce Ministry said the tariff hike “will seriously impact the atmosphere of bilateral cooperation.”

Promo leaders will be watching what retaliatory measures China advances.

“Impacts from these tariffs will certainly be felt beyond the promo industry and by the broader economy,” Lederer told ASI Media. “The full extent of the impact will depend on the response from China and what policies the Biden administration puts in place to protect and support the industries affected.”