Tax season is behind us. Our accounting friends can go back to their normal sleep and work schedules. Maybe you got a nice little return that you’re using for something fun. Or, maybe, you owed Uncle Sam a few bucks. Tax time is different for everyone. And when we say “everyone,” we really do mean everyone. After all, as the old adage goes, it’s partners with death as the only true inevitability of life.

So, that makes tax forms just about the most universal print item you can think of, right?

While taxes are unavoidable and universal, evolving technology in a digital world has made e-filing the norm, which makes it a little more difficult for print suppliers. The key word there is “difficult,” not impossible.

Melodie Keizer, brand manager for Nelco, Grand Rapids, Michigan, laid out some of the changing regulations from the government as they pertain to paper tax forms versus e-filed forms.

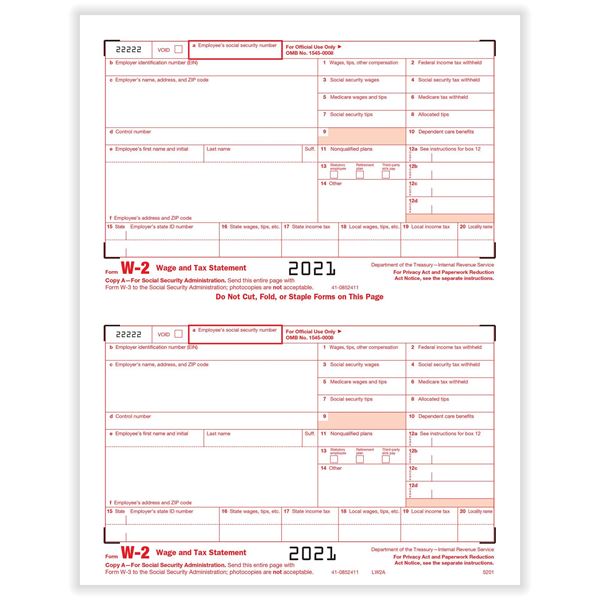

“The IRS has finalized regulations that lower the e-file threshold for this coming 2023 tax season,” she says. “This will require businesses to file the red federal copy electronically if filing 10 or more forms. This regulation includes the total for all aggregated forms filed — W2, 1099, etc. There are other provisions in the regulations as well. This is a significant change, and will impact many businesses. Although impactful to most federal forms filings, there still will be demand for the delivery of employee [and] recipient copies.”

That new regulation takes effect on Jan. 10, 2024, and as Jessica Wenz, product marketing manager for Wilmer, Coldwater, Ohio, warns, it means distributors could lose sales from smaller customers.

With an added challenge, that means print distributors who sell tax forms need to be even more on their game in preparation for tax season.

How to Stand Out

When asked how print distributors should go about this, Wenz sort of echoed another old adage: Know your enemy.

“They should know who their competitors are in this space, what forms they offer, and what they are charging for their forms,” she says.

After that point, she advises that distributors should do everything they can to stay stocked to meet demand when it does come in, and avoid simple mistakes that could make a big difference in the sales process — especially one as time-sensitive as tax season.

“With the volatility in the print industry, it is good to have plenty of inventory on-hand,” Wenz adds. “When inventory gets low, replenishment can take a little while. The common mistakes that we have come across have been with envelopes. Either [they don’t fit] the forms properly, or customers ordered the wrong envelope for their forms. From the start, it would be helpful to list the forms that your envelopes are compatible with.”

Ask Your Customers Questions

The simplest way to be certain you’re offering the right product for the right use is to ask. If you can be as clear as possible about your approach, you can plan accordingly. Making sure you ask your customers the right questions is crucial. It’s at this point when you can dig deeper than the surface and find out additional needs your customers have beyond simple W-2 forms.

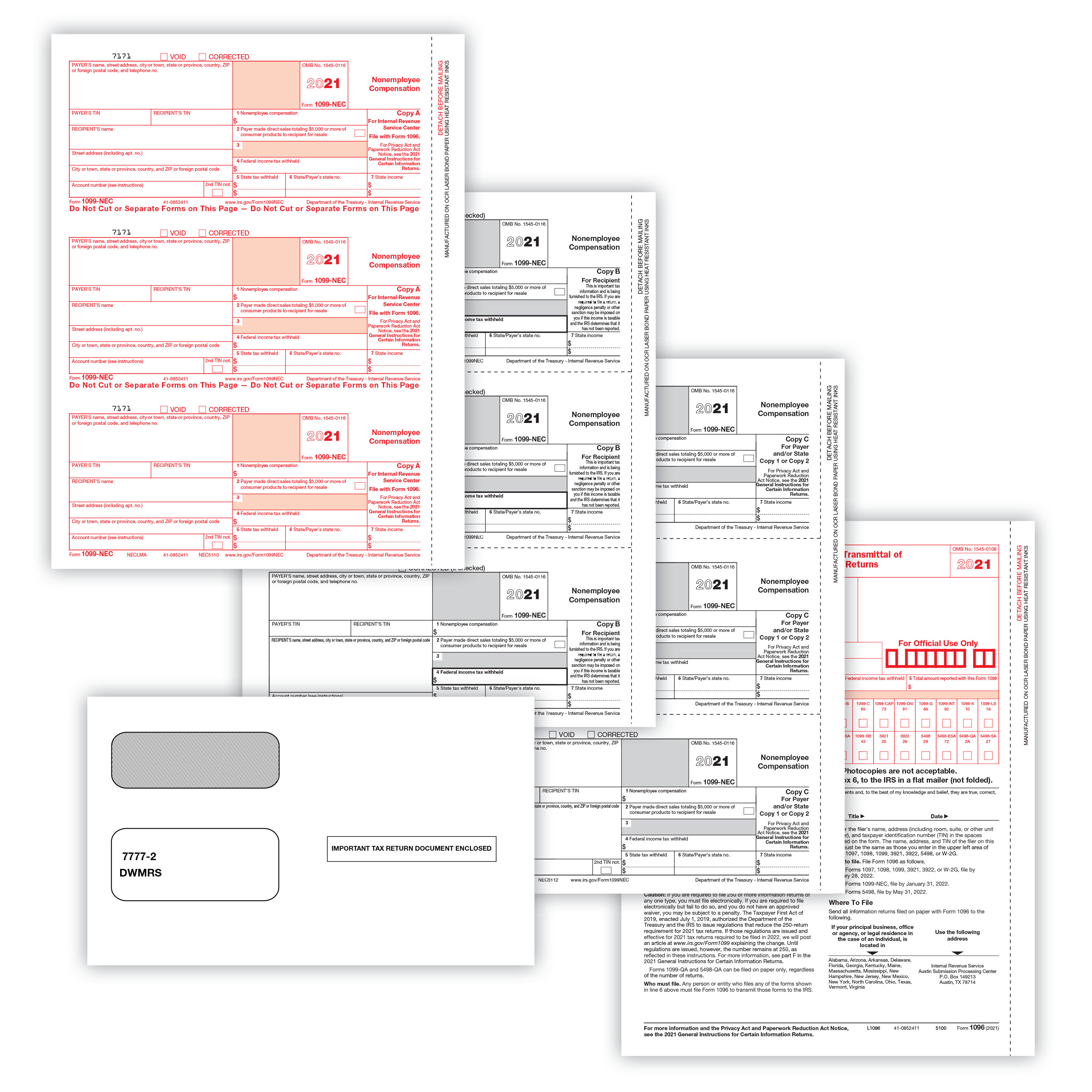

“Distributors should simply ask if customers do their own wage and information reporting,” Keizer says. “It’s important to understand that even if a business doesn’t have a large number of employees, they may have a high-volume 1099 reporting need. Distributors should inquire beyond a prospect’s W-2 needs and find out if they have any other types of 1099 or 1095 reporting needs.”

Wenz also recommends asking your customers what software they use for these types of things, what printing capabilities they have in their own offices, and how many employees or contractors they have.

Handling Shortages

The paper shortage has been a narrative in print for years at this point. It’s now just another factor print distributors need to consider. To combat longer lead times, distributors should plan enough in advance so they can deliver the product well before for the Jan. 31 deadline.

“We have had to order our stock two-plus months before tax season to have adequate inventory on-hand,” Wenz says. “This has helped us avoid major delays with customer orders.”

For Wilmer, the busiest season for tax form products is between July and January. “We start promoting and marketing tax forms during the summer months, but in the fall, we start to incentivize customers with percentage discounts off their tax form orders,” Wenz says.

Keizer says that Broker Forms also works all year, rather than just in the months leading up to tax season, to keep sufficient inventory to handle demand. They get most of their orders from September to November, though.

“In the last two years, we helped many distributors who turned to us during the shortages without compromising our own long-term customer relationships,” she says. And, hey, would you look at that: It’s June right now.

Package Deals

Much like in the promotional products sector, kitting can accomplish multiple marketing tasks in one package. Wenz says the idea of kitting translates over to print, too, and that distributors can incorporate it into their tax forms sales. Kitting can also help distributors avoid issues we brought up earlier, like incompatible envelopes.

“Packaged sets of tax forms are a great way to make sure your customers have everything they need for filing,” Wenz says. “Instead of purchasing each individual form, packaged sets combine the necessary forms and can even come with compatible envelopes. Packs of 25 and 50 accommodate customers with different numbers of employees.”

These kinds of initiatives help end-users, and that’s the best thing a distributor can do. Being a problem-solver and specializing in solutions is really how you can stand out.

“With the IRS and supply chain issues causing disruptive changes to the industry over the past few years, we have seen that expert support, dedication to our customers, early planning, and timely communication [are] key to helping distributors supply tax forms through the hectic tax season,” Keizer concludes.