The industry’s growth streak is over, but there’s daylight on the horizon.

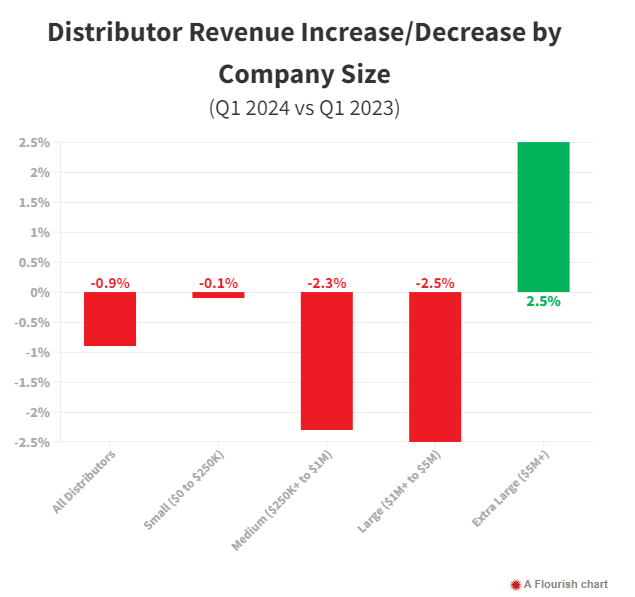

That’s the sentiment among distributors after a difficult Q1 that saw sales decline by 0.9%, according to the just-released Distributor Quarterly Sales Survey from ASI Research. The figure measures promotional products distributors sales in the first quarter of this year compared to the same three-month span the year prior.

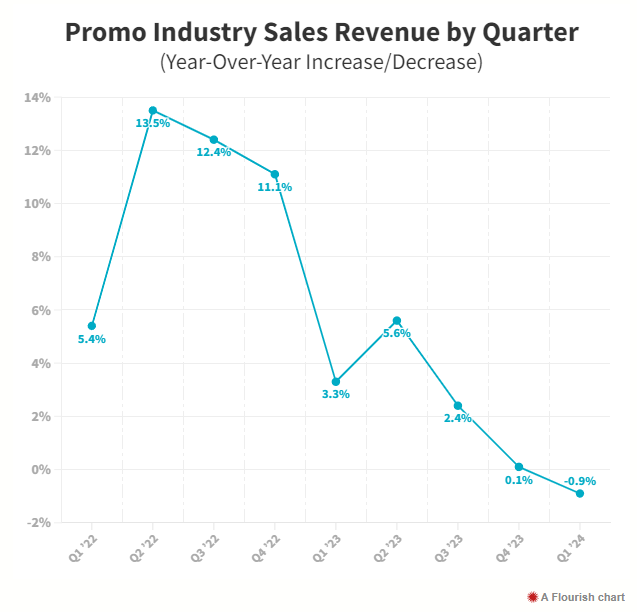

The decline ended a run of 11 consecutive quarters of annual growth. Distributors had engineered those nearly three straight years of quarterly increases following five quarters of declines, which occurred during the sales-depressed days of the COVID-19 pandemic.

As has been the case in recent quarters, promo’s performance trailed the broader economy. U.S. gross domestic product increased at a year-over-year rate of 1.6% in the first quarter of 2024. While up, the GDP increase was below economists’ forecasts and slower than in the two preceding quarters, speaking to what some market analysts say was a weakening economy. The March U.S. jobs report disappointed too, with the 175,000 positions added beneath estimates as unemployment ticked up to 3.9%.

“While a decline in business is not something to celebrate,” says Nate Kucsma, ASI’s senior executive director of research, who spearheads the Distributor Quarterly Sales Survey research, “a less than 1% decline in the face of strong economic headwinds is something to build from.”

Reasons for the Sales Retreat

Topline growth in the promo industry started slowing in Q3 (2.4% growth) and Q4 (.1%), and the trend continued with a sales decline in this most recent quarter. Industry firms tell ASI Media that the same challenges that dampened the second half of last year persisted into early 2024.

Due to concerns about a possible recession (amid still-high interest rates), inflation, a hard-to-read market, and domestic and geopolitical instability, some clients kept the purse strings on their merch budgets more tightly clasped.

That translated into lack of ordering by clients, lower volume orders, and choosing less expensive products than previous campaigns. ASI Research found that more than half of distributors (53%) agree that clients were increasingly more likely, compared to past buying habits, to purchase lower-priced items than higher-priced products.

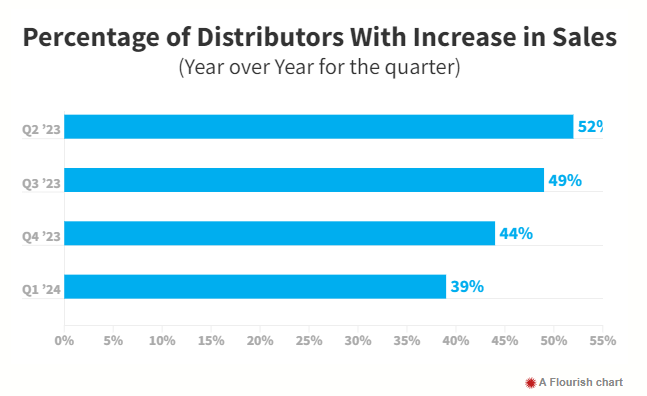

Amid the challenges, only 39% of distributors reported a sales increase – the lowest percentage since the first quarter of 2021.

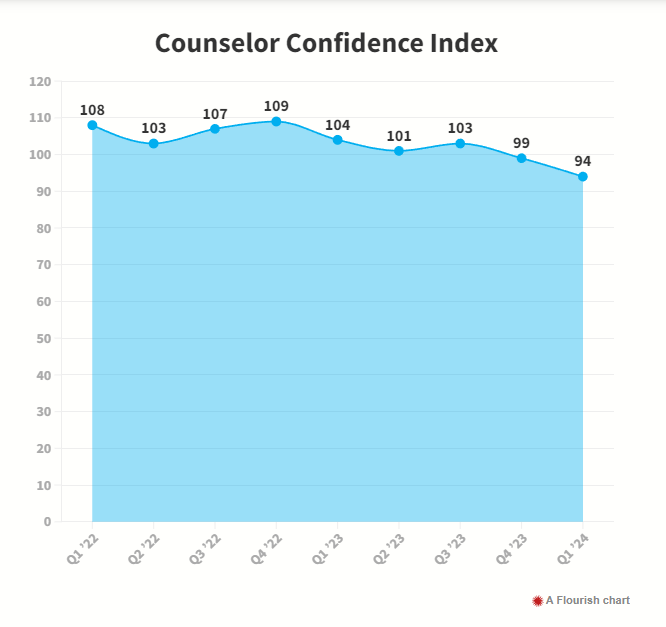

Not surprisingly, the Counselor Confidence Index fell to its lowest level since the first quarter of 2021, tallying a reading of 94 in Q1 2024. That’s down from 99 the previous quarter and below the baseline reading of 100 for the index, which has a 23-year history of measuring distributor financial health and business optimism.

A Case For Optimism

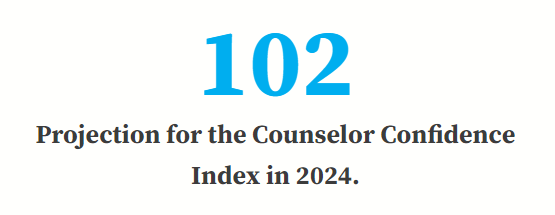

Despite the rocky first quarter, distributors are encouraged that business could pick up as 2024 progresses. Consider: When ASI Research asked distributors about their outlook for 2024 as a whole, they responded positively enough to raise the projected Counselor Confidence Index reading for the year to 102. That’s telling, says Kucsma.

“While there’s no denying that Q1 was a challenge,” Kucsma says, “the Counselor Confidence Index clearly shows that distributors are optimistic about the remainder of 2024.”

Tim Holliday, co-owner of Florida-based distributor Children’s World Uniform Supply/Business World Promo Supply (asi/161711), is among those seeing positive signs.

His company suffered a sales decline in Q1. The drop was partly a result of a tough year-over-year comparative: He had a large, one-time project occur in the previous year’s first quarter that wasn’t repeated in 2024. Still, the second quarter has started strong, with business for the month being about 180% of April 2023’s level before this year’s month had even concluded.

“I’m hopeful that 2024 sales will exceed 2023, and judging by the start of the second quarter, I think that’s a strong possibility,” says Holliday, whose firm is among what ASI Research classifies as large distributorships – those that generate between $1 million and $5 million in annual revenue.

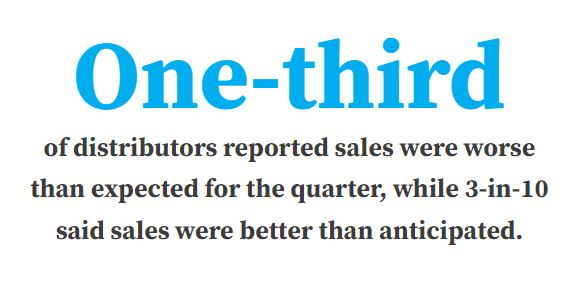

Sales dipped in Q1, but some distributors started to experience a positive turnaround as the quarter neared its conclusion. Consistent with that mixed-bag marketplace, distributors often used words like “challenging” and “slow” as well as “steady” and “good” to describe Q1 when surveyed by ASI Research.

Paul Kraml, owner/creative director at New Jersey-based distributorship Kraml Design (asi/245602), a firm with under $250,000 in annual revenue, had a positive perspective to report, too.

Business was off in the first couple months of the year, but picked up in March. As such, Kraml was able to get first-quarter 2024 sales about level with Q1 2023. The momentum continued into April, which has Kraml thinking he stands a chance of outpacing 2023’s annual revenue total.

“Clients have been doing more trade shows – more displays and show giveaways,” says Kraml. “The garment requests have also been on an uptick, and I’m getting new clients.”

Top 40 distributor Quality Logo Products (QLP, asi/302967) was among the 45% of extra-large distributorships ($5 million+ in sales annually) who contended with a year-over-year decrease in the quarter.

Company President Bret Bonnet says a factor in the drop was that Q1 2023 was the firm’s best quarter ever, so the year-over-year comparable was tough to beat. QLP competes heavily in the direct-to-buyer merch e-commerce vertical, and volatility with organic and paid search likely hurt business, Bonnet says. Even so, there are enough positives in play that Bonnet believes QLP could increase sales by 5% or so on an annual basis over the whole of 2024.

“Bright spots for us have been growth from established customers and increased diversification in client acquisition strategies,” Bonnet shares. “As a company, we experienced significant lift in existing customers order volume, which helped keep the Q1 decline in the single digits during the period of search volatility.”

Still, extra-large distributorships had the best quarter among all revenue classes by growing promo industry sales in Q1 by 2.5%. The other three revenue classes of distributors – small ($250,000 and below in sales), midsized ($250,001 to $1 million), and large ($1 million to $5 million) all had declines.

Nonetheless, the fact that the industry’s largest companies produced a gain may bode well for promo as a whole, some executives say. The performance of such companies sometimes bellwethers broader trends for the market.

When promo’s recovery from COVID began, it was the industry’s biggest distributors that were the quickest out of the gates in terms of sales acceleration. When the recovery started to wobble last year, it was the industry’s largest firms that saw slower growth and revenue setbacks first. While far from a guarantee, if the pattern holds true in 2024, more wins could be on the way for distributors of all sizes, executives say.

IdentiBrands Powered by Proforma (asi/491827), a distributor in the $1 million to $5 million revenue range, is working hard to shrug off a down Q1. Principal Greg Marks has recruited new sales professionals and the whole team is doubling down on sales-generating activities.

“With our new sales team and a lot of strong marketing, we have great new momentum rolling,” Marks tells ASI Media. “Worst case scenario, we expect the run rate by Q4 to be comparable to 2023.”

Consistent with long-running results, education and healthcare were selected as the strongest end-markets for sales in the quarter.

Certain extra-large distributors that increased sales in the first quarter anticipate continued growth in 2024. Top 40 firm Myron (asi/278980) is among them. Last year, an investment firm co-led by Counselor Power 50 member and longtime promo executive Jeff Lederer purchased the flagging distributor, intent on turning it into a powerhouse again.

The growth mission is progressing, Lederer tells ASI Media. A retrained sales team, improved tech stack, more intense and strategic customer acquisition strategy, and focusing on serving medium-sized to large businesses instead of small to medium-sized companies is all bearing fruit.

“With the turnaround portion of our company’s journey ostensibly behind us, we have been able to focus on best practices and growth,” Lederer says.

Top 40 distributor Zorch (asi/366078) executed 10% annual-basis order growth in Q1 – a feat achieved through new account activity and consistent buying patterns in the large corporate programs the firm orchestrates for clients.

“Unless something weird happens, 2024 will certainly be higher than 2023 for us,” CEO Mike Wolfe says. “First, we’re off to a good start. Additionally, the run-rate of new accounts signed last year, along with some recent signings that are in the process of implementing, will contribute to solid year-over-year growth.”