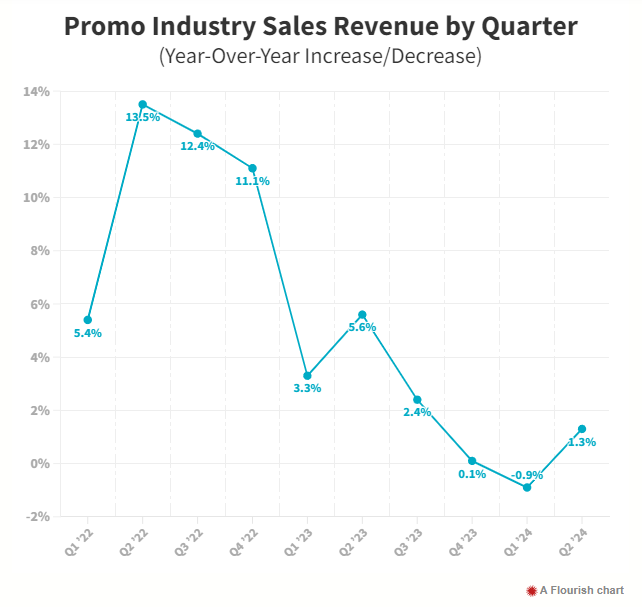

The retreat was short-lived; the promotional products industry is growing again.

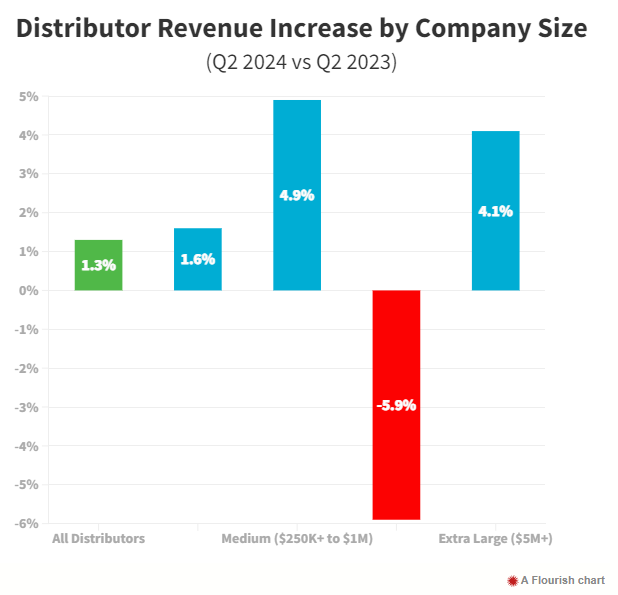

The just-released Distributor Quarterly Sales Survey from ASI Research shows that distributors collectively increased sales, on average, by 1.3% in the second quarter of 2024. The figure measures distributors’ promo industry sales in Q2 of this year compared to the same three-month span the year prior.

While not a huge gain and coming in below the rate of inflation, the performance marks a return to growth after distributors’ sales fell by 0.9% on an annual basis in Q1 – the first quarterly sales decline in nearly three years.

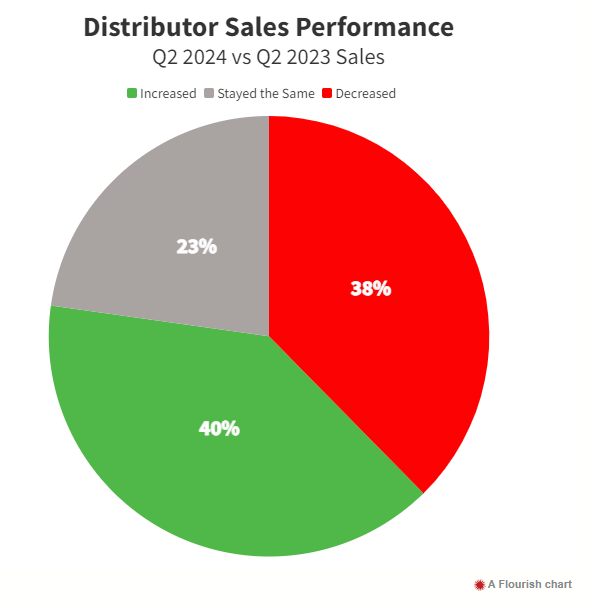

Despite that drop, distributors had told ASI Research this spring that business was picking up at the end of Q1 and in early Q2 – a reason many felt they’d do better in the second quarter. In the end, 40% of distributors increased sales in Q2, while 38% experienced a sales retreat, propelling an overall performance that resulted in a gain.

Nate Kucsma, ASI’s senior executive director of research, says preliminary indications are that even better days could be ahead during the second half of 2024.

“Eventually there has to be pent-up demand that needs to have an outlet, and there are signs that we’re getting really close to that point,” says Kucsma, who spearheads the Distributor Quarterly Sales Survey. “For instance, companies in the U.S. are experiencing record profits and the stock market continues to ride high. I wouldn’t be surprised if Q4 was unusually strong as companies and departments that have budgets, but have been reluctant to spend, start to realize they need to by the end of the year – lest they lose those budgets the following year.”

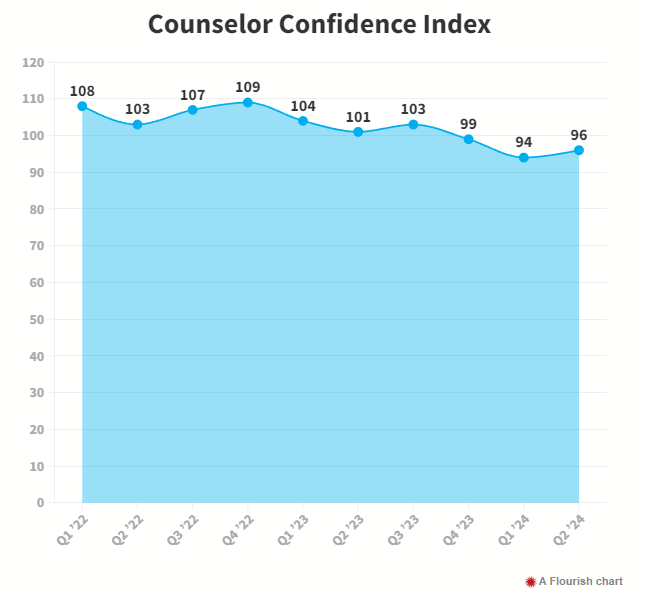

Certainly, some confidence is percolating among distributors. While it would be a mischaracterization to say firms are buoyant industry wide, optimism ticked up in Q2, with the Counselor Confidence Index rising from a reading of 94 in Q1 to 96 in Q2.

The index, which has a 23-year history of measuring distributor financial health and business optimism, remained below the baseline reading of 100 in the quarter. Still, when asked about confidence in their businesses for 2024 as a whole, distributors were upbeat enough to elevate the projected full-year index reading to 102.

“We are super optimistic that our year will continue to trend upward, and we are pacing for our stretch goal,” says Dominique Volker, vice president of sales at Whitestone Branding (asi/359741), a Counselor 2024 Best Place to Work projecting over $20 million in revenue for the year that also recently made a pair of acquisitions.

“While clients are still wary,” Volker continues, “we’re finding that we’re able to unlock more dollars through client education, solution solving, and offering fulfillment as a lever for clients to spend more at one time with low-cost storage solutions.”

Success for Distributors of Different Sizes

Lee Advertising (asi/439024) authored its own success story in Q2.

The distributorship, an affiliate of Counselor Top 40 firm iPROMOTEu (asi/232119), increased sales upwards of 30% year over year in the quarter. Leveraging referrals into new opportunities and also expanding business with a client who owns multiple companies were key reasons.

“When you give clients great service, they trust you with more orders and larger orders, and they don’t mind referring you,” says Laurie Buchbinder, a principal at Lee Advertising. “We’ve had success with that approach.”

So did other medium-sized distributors like Lee Advertising.

The Distributor Quarterly Sales Survey groups distributorships into four annual revenue categories – Small (firms that produce $250,000 and below in yearly sales), Medium ($250,001 to $1 million), Large ($1 million to $5 million), and Extra Large (more than $5 million).

Small, medium, and extra-large distributors all increased sales on average in Q2. Medium-sized distributors like Lee Advertising did best, registering a 4.9% average year-over-year revenue rise while also representing the highest percentage of distributors to report a sales increase – 44%.

In pinpointing why medium-sized firms fared well, companies ASI Media spoke with cited a variety of factors. For instance, they said certain clients that had put the brakes on merch investments hit the accelerator again. Such distributors also brought on new customers, better capitalized on seasonal opportunities, and deepened relationships with buyers already on their client rosters.

Sew It All Miami (asi/323919), a medium-sized South Florida distributorship with an in-house embroidery operation, more than doubled sales on an annual basis in Q2.

Some clients’ needs peak in the summer, and the Sew It All team made the most of that business, especially by supporting one of its largest customers with outside-the-box solutions and on-time deadline-crunched fulfillment, says Owner Juan Diego Tamayo.

“We’ve positioned ourselves in the past year as innovators and problem solvers,” says Tamayo. “Miami is a city with growing industries, talent, and events, where existing and new clients know they can count on us to help their businesses succeed. I’m confident our sales will grow again in Q3 and Q4.”

In terms of growth, the industry’s extra-large distributors (more than $5 million) were just a few steps behind medium-sized ones, registering a year-over-year quarterly sales increase of 4.1%.

Whitestone was among the winners. In Q1, the firm aggressively started pursuing new business development, strategically prospecting to score new clients. The approach bore fruit in Q2. “We saw a big spike in the second quarter thanks to those initiatives, as well as clients who were tighter on budgets at end-of-year 2023 coming back to spend those dollars with us,” says Volker.

Rad Wear (asi/303195), an extra-large distributorship and a 2024 Counselor Best Place to Work, spurred a 23% annual-basis revenue jump in Q2, says Radley Ruland, co-owner and vice president. Turning referrals into new business opportunities, providing stellar customer service, and consistent prospecting that included monthly marketing campaigns featuring spec samples from different suppliers all helped stoke sales, according to Ruland.

“If the country doesn’t go into a recession, I think our industry should be strong in the second half of 2024,” he says. “For our business, we have lots of big projects set for Q3 and Q4 and everything still seems to have the green light. We are getting referrals daily, so fingers crossed we have a good rest of the year.”

Large Distributors Struggle but Anticipate Improvement

Meanwhile, the Q2 picture was darker for large distributors – those in the $1 million to $5 million revenue range. These industry companies experienced an average sales decline of 5.9% and were the only revenue collective to see a drop in sales. Some 56% of large distributors reported that their sales fell year over year in Q2 – also the most among company size classes.

Factors that may have influenced the drop include weakened demand from the education sector. Another negative influence was likely a pullback in spend from some midsized corporate clients that were leery of outlay amid a sense of economic uncertainty due to variables like inflation, still-high interest rates, and domestic and global geopolitical instability.

“Numerous companies put holds on or reduced their marketing budgets in Q1 and Q2 as they wanted to see how the quarters played out compared to last year,” shares Jason Cohn, senior partner at Ontario-headquartered Impact Machine Brand Solutions (asi/231846), a large-sized distributor that contended with a sales decline in Q2.

Jason Pond expresses a similar sentiment. “Consumer uncertainty was the driving force for sales dropping in the second quarter,” says Pond, president of Utah-based large-sized distributor theLogoShop Inc. (asi/255308). “Businesses were laying off employees, and the media talk about inflation was a challenge.”

For some large distributors, the Q2 sales slip was “just one of those things” – an unfortunate setback that happens to even the best businesses at some point or another.

“Our office took a hit in Q2 when we lost a rather large annual order,” says John Simonetta, chief marketing officer at Proforma Green Marketing (asi/491309), a Texas-based affiliate of Counselor Top 40 distributor Proforma (asi/300094).

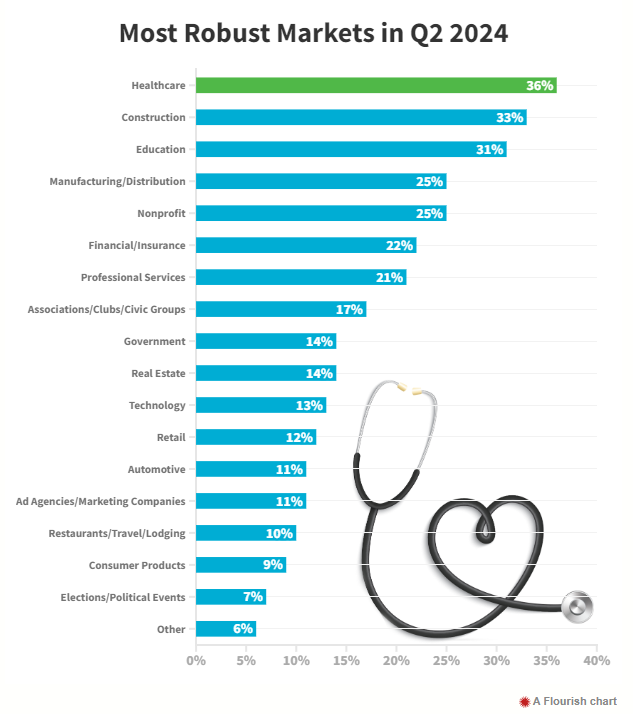

Still, Simonetta is upbeat. The firm attended a construction industry trade show for the first time recently and captured a wealth of strong leads in the market, which distributors listed as the second most robust for promo sales in Q2. That, along with business churning in other verticals, has brighter days dawning for Proforma Green Marketing.

“Sitting at the halfway point of 2024, I believe we have a very good chance of catching and surpassing our 2023 sales,” Simonetta says.

Cohn thinks things will pick up for Impact Machine Brand Solutions, not least of all because of greater demand from clients for higher-margin custom products.

“We see 2025 as the year in which we will start to see more sustained growth again,” Cohn says, “but we are cautiously optimistic that we will experience an upward trend in Q3 and Q4 as we move into a traditionally strong part of the year with back-to-school promotions leading into the holidays.”

For sure, distributors of all sizes see potential challenges ahead – from company-specific issues like managing growth and staffing to more macro factors like potential supply chain disruption and demand drops if the economy wobbles. Still, they’re plowing ahead, trying to push their companies (and the industry) forward. “Business,” says Pond, “will stay steady.”