First, it was Nalgene.

Then, it was Yeti.

After that, it was S’well, Hydro Flask, Stanley, Owala – an ever-growing list of water bottle brands making their mark on the cultural zeitgeist.

In each of these “it” brands’ moment of glory, they dominated both retail and promo. S’well generated over $100 million in revenue from its stainless-steel bottles in 2016, as reported by Forbes, and Hydro Flask’s association with the “VSCO girl” aesthetic of the late 2010s catapulted it to the top-selling water bottle brand of 2019.

The rapid ascension of these brands is rooted in more than the ability to carry liquids. Social media drinkware aesthetics and consumers’ increasing brand awareness have transformed water bottles into lifestyle accessories, says Tommy Gomez, account director at distributor Brilliant (asi/146116).

“Before, you could get away with a generic bottle or a no-name brand,” Gomez said. “Now, clients are coming and saying, ‘We want the Yeti, we want the Stanley, we want the Nalgene.’ They know the brands by name.”

Because of social media and consumers’ increasing hyper-awareness of trends, drinkware has entered the “it” brand cycle, which has powerful, consistent momentum that influences buyers to indulge in the next big thing, even for a reusable product that is meant to last.

The Power of a Brand Name

In promo, there was a time when end-buyers asked for “anything but a water bottle,” says Marissa Carlino, chief merchandise officer at Creative Solutions (asi/170769).

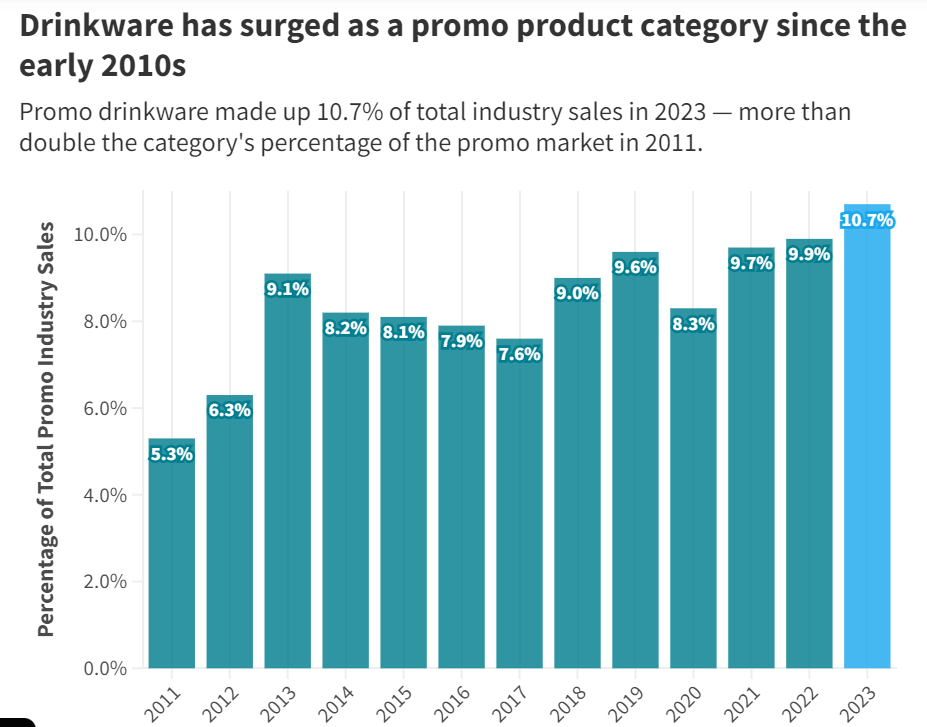

But the category has surged over the last decade and a half. In 2011, drinkware accounted for 5.3% of total industry sales and was the eighth-most popular product category. Last year, drinkware accounted for almost 11% of overall promo product sales – second only to T-shirts, according to ASI’s 2024 State of the Industry report.

That growth is the culmination of two related trends: the increasing popularity of reusable water bottles and the rise of drinkware brands that were breakout hits in retail.

While big-name water bottle brands seem like a recent development, one of the category’s forerunners – Nalgene – first gained notoriety in the 1960s and 1970s, with durable wide-mouth bottles mainly popular among hikers and outdoor enthusiasts. Decades later, the rise in eco-conscious activity during the 2000s caused an outpouring of demand for reusable water bottles as consumers began to replace single-use plastics.

When Yeti expanded its insulation technology from coolers to drinkware in the mid-2010s, the brand exploded, and so did the popularity of stainless-steel vacuum-insulated water bottles. Yeti’s profits shot up more than 400% between 2014 and 2015, spawning a renaissance in drinkware with a wave of competitor brands each bringing their unique spin to the category.

End-buyers now are purchasing more promo drinkware, but the growth of the category is also attributable to the premium that they’re paying for top brand names. Customized 40-oz. Stanley Quenchers, for example – ASI Media’s 2023 Product of the Year – can cost around $65 each, says Sarah Whitaker, owner of Williams Advertising (asi/360402).

Some of that value stems from branded drinkware becoming a status symbol, especially with exclusive color drops and branded collaborations; Stanley’s partnership with preppy women’s lifestyle brand LoveShackFancy earlier this month is just one of many recent examples. The full Quencher lineup from the collaboration sold out in less than a day.

“These bottles have become an extension of our clothes and our accessories,” says Gomez, ASI Media’s 2023 Up-and-Comer Sales Rep of the Year. “I do think that people like to switch them out in the same way that one would switch out a phone case.”

Considering the speed with which consumers churn through trends today, there’s one big reason demand for drinkware brands have gone into hyperdrive.

Social Media Buzz

Stanley was already big in the fall of 2023, but it was a viral TikTok showing a Stanley 40-oz. Quencher intact after a car fire, with ice still shaking around inside, that aided in consumers’ postholiday craze for the brand. As of January, the hashtag #stanleycup had almost 7 billion views on the platform, and Ben Pawsey, vice president of marketing at Counselor Top 40 supplier HPG (asi/61966), says the firm sold more Stanley Quenchers in Q1 than it did in all of 2023.

The social media-fueled demand for drinkware has been ongoing for a few years now. Hydro Flask’s initial popularity spike in 2019, for example, was due to its connection to VSCO girls, a preppy teenage aesthetic associated with the photo editing app VSCO. And it was only when Stanley started catering to a female audience with an extensive lineup of bright colors and patterns – and a dedicated group of influencers championing it – that the brand blew up.

Beyond just brand names, increased time at home turned hydration as a whole “trendy,” says Whitaker. A worldwide focus on wellness included watching TikTok influencers sip from the latest “it” drinkware on camera, and the apparently controversial #WaterTok has continued the hydration trend with water “recipes” to modify regular water with syrups or flavor packets.

That means more eyes on drinkware.

“The interesting thing about TikTok is that it might not even be a video about that brand, but it’s there,” Whitaker says. “And people pick up on it visually.”

A key piece of social media and the brand cycle, though, is that there’s always a next big thing. And with water bottles becoming more about status, it’s driving consumers to covet whatever is new and fresh.

So, as Stanley has hit its peak (according to several distributors) drinkware company Owala has positioned itself as the next “it” brand. Thanks to its many viral color combinations and unique spout design, TikTok and Instagram Reels views from Owala’s brand page alone have reached the millions.

ETS Express (asi/51197), an independent subsidiary of Counselor Top 40 supplier PCNA (asi/66887) and Owala’s exclusive promo supplier, is selling Owala Freesip bottles almost as fast as it can get them. The popular Owala Freesip bottles aren’t expected to be restocked by ETS until next March.

“It’s a fever pitch,” says Adam Stone, vice president of sales at ETS Express. “It’s definitely unique. We do have other popular items, but I would say the noise is louder for this one.”

Owala vs Stanley

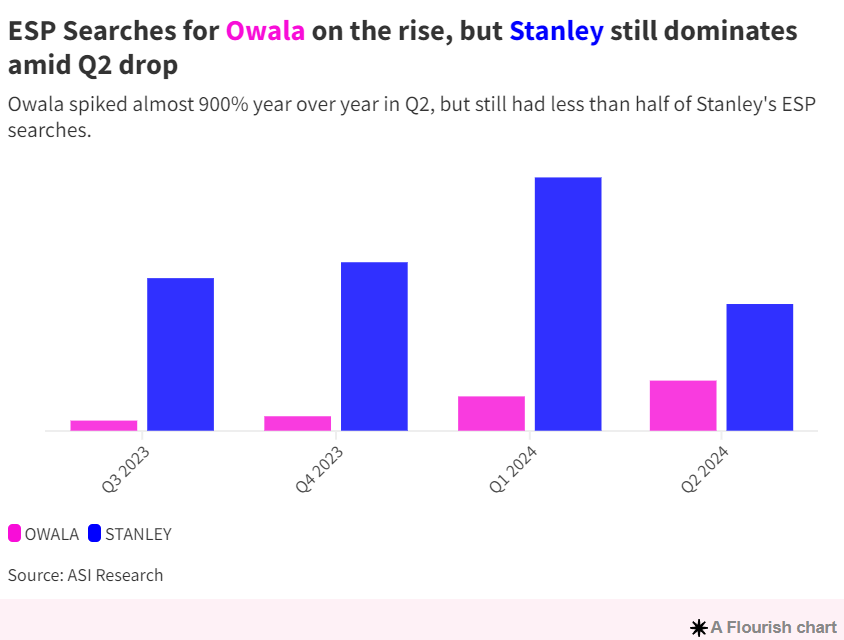

Owala is the next big thing in drinkware, but is it bigger than the phenomenon it’s trying to supplant, Stanley? Demand for Owala isn’t quite as high as it was for Stanley, says Marissa Carlino, chief merchandise officer at Creative Solutions (asi/170769). ESP data supports this – Q2 ESP searches for Owala spiked almost 900% year over year but still represented less than half of searches for Stanley products.

Whitaker says the supply delay from viral products creates a huge market gap in promo and limits the industry’s ability to capitalize on these trends. There’s demand for Owala, for example, because of consumers’ awareness of the brand from social media and retail, but distributors have to go through limited channels to fulfill orders. Instead, they have to purchase Freesip bottles from retail if their customers need them this year – a pricy solution that often means clients back out.

“We’re going to continue to get asked for retail brands,” Whitaker says. “I wish promo could just be a little bit more proactive to be able to respond to those needs.”

Timing Is Everything

But where does that leave drinkware brands that were previously social media darlings? While a few select styles endure in overwhelming popularity (such as the Yeti Rambler), others seek to reinvent themselves and expand their product lines, says Carlino, who along with her sister Lorin Carlino Ogawa was named ASI Media’s 2023 Distributor Salespeople of the Year.

S’well and Hydro Flask, for example, have pivoted to other promo product categories, like ice cream coolers, shaker sets and soft coolers.

In addition, brands find their lane. Hydro Flask is a well-liked pick for the education sector, says Jolene Slama-Saenz, director of marketing and customer experience at supplier Diamondback Branding (asi/49546) – though it’s far from a top seller.

[Swell]

The timing for a hot drinkware brand is critical, and jumping on a potential new “it” brand too early doesn’t always work. Whitaker says she was showing both Stanley and Owala roughly six months before each exploded in popularity.

End-buyers didn’t want them – until they were everywhere online and on retail shelves.

“We’re so ‘me, too,’ as consumers,” says Stone. “It’s not that much different, but it’s different enough that you have to have that new version.”

In addition to its makeover as a lifestyle piece, drinkware has thrived in the last decade due to a steady stream of innovation. As Carlino points out, Yeti’s coolers and tumblers were trailblazers in insulation, and it was that novelty that helped embed the brand into the cultural lexicon. The physical features do matter to drinkware devotees; for example, people love that Stanley tumblers fit in the cupholder of most cars, unlike some other brands.

Mix together aesthetics, a good product and a hefty dose of brand cache, and a consumer might feel like they have to add just one more bottle to their collection.

“You need a bottle that’s durable, you need a bottle that looks good, you need a bottle that represents you,” Carlino says. “And you need a new bottle every now and then because you’re using it more.”