Key Takeaways

• Rampant M&A: 2024 has seen robust merger and acquisition activity in the promotional products industry, including the largest deal ever.

• Private Equity Influence: Increased PE involvement is driving major acquisitions, with firms seeking market share and operational efficiencies.

• Global Expansion: U.S. promo companies are increasingly acquiring international distributors, especially in Europe, to meet the needs of global clients.

• Other M&A Drivers: Aging owners, the rising cost of doing business and benefits of scale that come with consolidation are accelerating deal-making, too.

Suffice to say, 2024 has been a doozy for the promotional products industry.

A volatile, unprecedented presidential election. Inflation decelerating, then re-accelerating, then decelerating again, with interest rates finally dropping. Economy-threatening port strikes. Global supply chain upheaval caused by factors like drought and militant attacks. Consumer and end-buyer sentiment in the dumps, even as the stock market soared and gross domestic product grew.

And then, through it all, promo still finding a collective growth trajectory that has the industry on the path to setting another annual sales record.

Wild times.

But amid all the topsy-turvy tumult, it occurred to me that we may have overlooked a defining moment for our market: Namely, that 2024 is already the most historic year for mergers and acquisitions in the promo industry.

A Bevy of Blockbusters

For one thing, we saw the single biggest acquisition in promo’s decades of documented history: Counselor Top 40 supplier S&S Activewear (asi/84358), a more than $2 billion-in-revenue firm and the second-largest supplier in our market, bought multibillion-dollar Top 40 company alphabroder (asi/34063), the third-largest supplier.

It’s a deal that had eyes popping across the industry when it was first announced in August. Questions lingered about what the future will hold given the wedding of these apparel superpowers – topics that S&S CEO Frank Myers addressed at the 2024 ASI Power Summit.

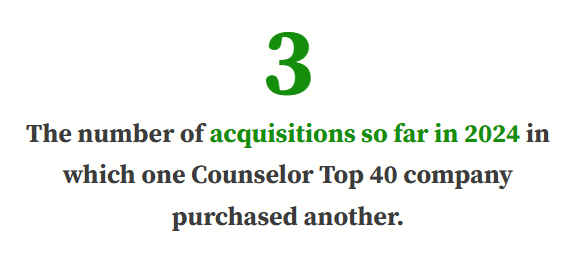

Still, one massive deal doesn’t make a historic year. But of course, there were other blockbusters involving one Counselor Top 40 firm buying another.

In September, Counselor Top 40 distributor iPROMOTEu (asi/232119) purchased fellow Top 40er AIA Corporation (asi/109480). The deal brought together two companies with $365 million in combined 2023 revenue. Back in February, Boundless (asi/143717) kicked off the Top 40 buying run when it acquired then fellow Top 40 firm Touchstone (asi/345631) – companies that jointly had more than $200 million in 2022 revenue.

Meanwhile, Counselor Top 40 distributor HALO Branded Solutions (asi/356000), no stranger to buying other Top 40s in the past, this year reported two more acquisitions, including Think It Then Ink It, based in Middleton, WI. Not to be outdone, Stran Promotional Solutions (337725), a Top 40 distributor, acquired the assets of Gander Group, a California-based provider of casino continuity and loyalty programs that generated more than $34 million in 2023 revenue.

M&A was chugging on the international front, too. Counselor Top 40 distributor Overture Promotions (asi/288473) made its first acquisition in Europe, buying Brandon, a distributor headquartered in Gothenburg, Sweden. During the winter, Top 40 distributor Myron (asi/278980) acquired German distributor Schneider GmbH.

Elsewhere, Counselor Top 40 firm BDA (asi/137616), which was already operating in key European markets like the U.K. and Germany, continued to build its cross-Atlantic presence by snapping up U.K.-based sports merch firm The Great Branding Company. Certainly, Top 40 distributor Geiger (asi/202900) can’t be overlooked: The Maine-headquartered business has been consistently acquiring companies in Europe since 2018, including this year’s acquisitions of Brandelity in England and WER GmbH in Germany.

Of course, it wasn’t just Top 40s growing through acquisition.

The Specialty Company (asi/341203) made its fifth acquisition since 2020. Proforma Printhouse (asi/491465), a Counselor Top 40 Proforma (asi/300094) affiliate but independently owned company that will do over $4 million in 2024, made two acquisitions this year. Whitestone Branding (asi/359741) announced two acquisitions in as many weeks over the summer, while Barker Specialty Company (asi/132690) bought Wolfepromo (asi/362771).

M&A Rocket Fuel

You can get a bit breathless listing all the deals. And for sure, the list could go on, but I think you get the idea.

So, what’s driving all the M&A? Well, it’s a variety of factors in my opinion – but a top accelerator is the increased presence of private equity (PE) money in promo, particularly when it comes to the mega acquisitions.

To wit, S&S, Boundless and iPROMOTEu all have PE backing. PE’s fingerprints are all over the biggest acquisitions of the last decade and a half. Back in 2018, ASI Media reported how the influx of PE cash into promo would lead to more M&A in the years ahead, and the prediction has proved prescient.

Simply put, PE perceives opportunity in the merch space. We’re still a largely fragmented market – one in which PE executives see a chance to generate strong returns through capturing market share. This is a strategy spurred, in part, by streamlining efficiencies and making accretive acquisitions after purchasing one company in our space. S&S’s multiple acquisitions since being bought by PE firm Clayton Dubilier & Rice in 2021 is evidence of the approach.

Undoubtedly, some see PE’s presence as a threat to the promo business – to independent small- and medium-sized firms and even the traditional supplier/distributor model. Others welcome PE, saying the expertise that comes with quality PE backing will elevate the entire merch medium – a rising tide that lifts all ships. I’m not here to say which perspective is correct, or if there are perhaps shades of truth in both, but one thing’s undeniable: PE has definitely helped fuel promo’s M&A push.

Surely, though, it’s not all about PE money.

Geiger is family-owned and has been as aggressive as any branded-merch company on the M&A front, especially when it comes to international deals. And that brings up another driver of M&A activity: to meet the needs of large clients with a presence in multiple countries, top industry distributors have increasingly felt it’s necessary to have a boots-on-the-ground presence in high-value international markets, particularly in western Europe. That’s why North American Top 40s have stepped up their business-buying in places like England and Germany.

Other sparkers of M&A are in play, too. The cost of doing business is going up, a rise ushered in by factors like increased technology/cybersecurity expenses and client demand for various services. In order to stay viable, some firms have looked to join forces with a bigger company, creating economies of scale that allow them to compete and turn a reasonable profit.

There’s also the fact that promo is aging. Some independent owners in the baby boomer and older Gen X age brackets are looking to the next chapter in their lives. With no family member or other heir eager to take on their company, some want to sell their books of business at a nice return that helps set them up for retirement.

Globally, M&A deal value increased 27.6% year over year through the first nine months of 2024, while the number of deals rose 13.3% on an annual basis during that time. (Pitchbook)

Also, roll this perspective around: M&A activity in promo was muted in the latter half of 2023, as inflation and interest rates were prohibitively high. Industry M&A experts have said that pause led to some pent-up deal-making starting to come to fruition this year as inflation moderated and the prospect of lower borrowing rates took shape.

This pattern has repeated in recent years, with economic forces dragging down deal-making and then leading to demand that explodes the following year. The pandemic in 2020 led to record-setting deal-making across all industries globally in 2021. (That too was a big year for promo acquisitions, though not at the scale we saw this year.)

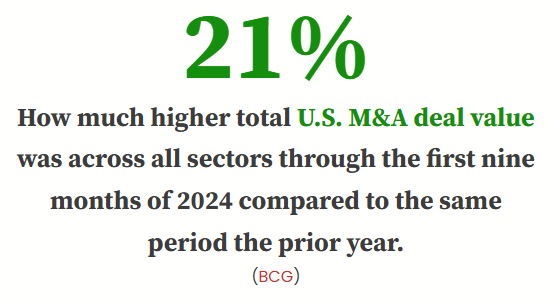

Analysis varies, but M&A deal values have broadly increased in the U.S. in 2024 compared to 2023, according to research firm BCG. Globally, both M&A deal value and counts have risen through the first nine months of this year, Pitchbook reports.

Despite new federal merger guidelines that make M&A more challenging, particularly for large-value acquisitions that ascend into the billions-of-dollars stratosphere, some analysts think deal-making will further accelerate domestically in 2025 if interest rates continue to lower and as what some see as a more business-friendly presidential administration potentially eases regulations.

It will be interesting to see how things play out in promo. Will 2024’s big Top 40-buying-Top 40 deals prove an anomalous occurrence, or was this year the watershed moment that begins an age of industry-redefining M&A?

Maybe the truth will be somewhat in the middle.

Even if we don’t see repeats of multiple mega acquisitions in 2025, I, for one, expect to see merch M&A to continue at a quick clip in the years ahead. Too many factors are pushing the market in that direction for the phenomenon to wither and disappear. That said, I think there’ll continue to be ample room for small- and medium-sized independent firms. Consolidation may increase, but we’re not about to be rolled into a handful of merch multinationals just yet.