Key Takeaways:

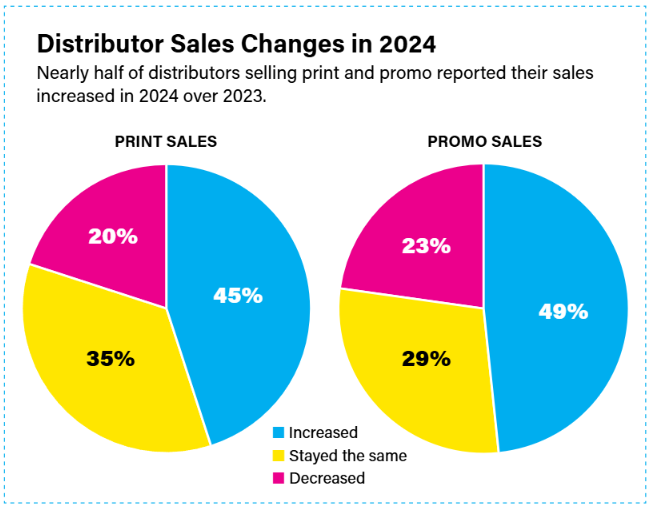

• Print Remains a Vital Marketing Channel: Despite digital trends, print continues to thrive as a powerful tool for branding and marketing, with 45% of distributors reporting increased print sales in 2024 and 35% maintaining steady business.

• Growth Opportunities in New Print Products: Distributors see strong potential in expanding print offerings—especially in underutilized areas like large-format printing and kitting services—highlighting a path for innovation and differentiation.

• Challenges Include Tariffs, Labor, and Costs: Rising tariffs, labor shortages, and equipment costs are major concerns. Distributors are adapting by outsourcing, investing strategically, and focusing on efficiency and customer service.

• Sustainability and Longevity Shape the Future: Environmental regulations and client expectations are pushing the industry toward greener practices. Meanwhile, many successful print companies have thrived for decades by evolving with market needs.

Backed by ASI Research, this new study of distributors selling both print and promotional products highlights where the print market is – and where it’s going.

The print industry is enormous – perhaps even bigger than some of the people in it would grasp.

According to the most recent Economic Census report by the U.S. Census Bureau, printing-related activities, including sign manufacturing and business services like copy centers, amount to nearly $109 billion. When you add newspaper printing, periodicals, and book and directory publishing, that number tops $208 billion. Finally, add in packaging and paperboard printing, and you’re over $310 billion. The packaging printing aspect alone accounts for $102 billion.

Size tells a story for sure. But there’s another story that PPM tells with each issue: the convergence of the print industry and the pro-motional products world. Collecting data can add new perspective to these two overlapping markets – complementary worlds that form a specific new space unto itself.

To create a snapshot of what this nascent industry looks like now, ASI Research in conjunction with Print & Promo Marketing conducted a study asking distributors who sell both print and promotional products to elaborate on their business – what they sell, who they sell it to, what challenges they’re facing and how they perceive print industry health.

“In ASI’s 2024 State of the Industry survey, nearly three-quarters of distributors reported that they sold print to supplement their promo business, so when the opportunity came about to conduct the first ever SOI for the print market we couldn’t wait,” says Nathaniel Kucsma, senior executive director of research for ASI. “Our hope over the next few years is to provide the print professionals and ASI members the most in-depth profile of the print sector available so they can best succeed in this gigantic industry.”

There’s no doubt that it’s a difficult time for the industry. In the short time between when this survey was fielded (Q1 2025) and publication, fresh concerns have arisen due to sweeping tariffs that will affect importing and manufacturing, pricing and sales of print and promotional products.

Even with that uncertainty, though, distributors know that print is abundant and touches almost every aspect of the marketing process. The belief is that print’s longevity and resiliency, as always, will prevail.

Tom D’Agostino, CEO and founder of print/promo distributor Smart Source (asi/328914), is one such believer in print’s power as part of a larger promo products and branding ecosystem. “Print is a critical part of the promotional products and branded merchandise world,” he says. “It’s one of the most popular and reliable ways to add logos, designs and messages to products, making it essential for brand visibility.”

Sales Gains & Opportunities

The numbers show that there are good reasons for the air of quiet confidence in print.

According to ASI Research, 45% of distributors selling print saw their print sales increase in 2024 over 2023, and 35% reported that business held steady. That means in an industry that some folks claim is dying, only 20% of distributors noted a decrease.

Smart Source, for one, experienced year-over-year growth with print sales across all of its buyer categories. “Whether it’s direct mail, digital printing or other methods, print turns everyday neutral items into powerful marketing tools,” D’Agostino says.

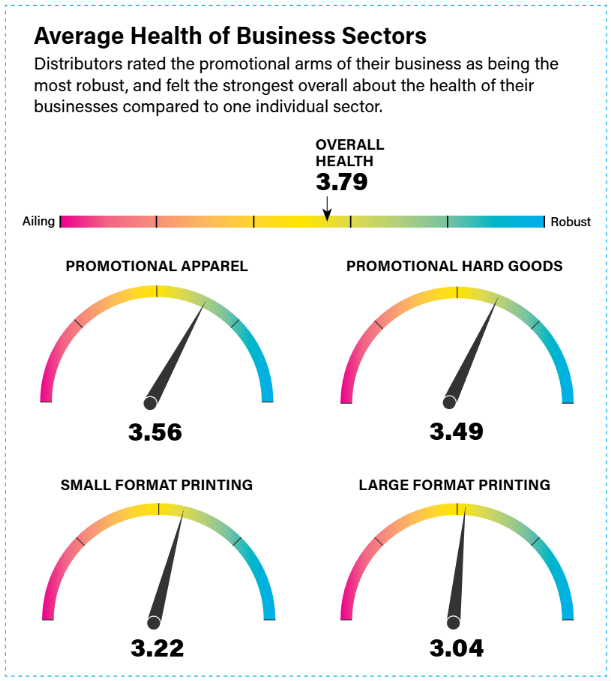

Notably, nearly two-thirds of survey respondents (63%) said the overall health of their business was solid – an increase of five percentage points from the previous years.

Promotional apparel stood as the strongest business sector; 60% described it as “robust” going into 2025 – up from 54% for the previous year. Only 18% described the market as “ailing.”

In terms of average health, small-format printing ranked 3.22 on a scale from 1 to 5, and large-format printing ranked 3.04 (the two lowest of the sectors surveyed.) Even still, those sectors were closer to healthy than they were to ailing.

Asked what they see as having the strongest potential to grow their promo business in the next three years, 60% of distributors responded “offering new print products.” This could mean things like kitting capabilities, in-house printing for things like fliers or inserts, signage and beyond.

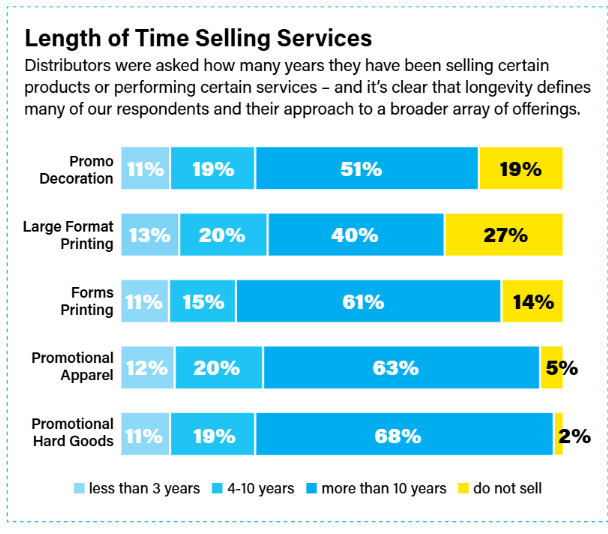

ASI’s data found that large-format printing was also the product category that the largest percentage of print distributors (27%) reported they did not sell, indicating there is space in the market for distributors to jump in with limited competition.

Looking at a different metric – time – as an indicator of industry health, we can see that plenty of businesses have maintained competitiveness for relatively long stretches of time.

ASI Research found that among firms that sell both print and promo, 61% of respondents have been selling print forms for more than 10 years. This can be products like invoices or other forms sold to product verticals like the automotive industry or financial industry. The same data found that 40% of companies have sold large-format printing like signage for more than 10 years.

The Pain Points

Even amid optimism, distributors certainly are facing challenges.

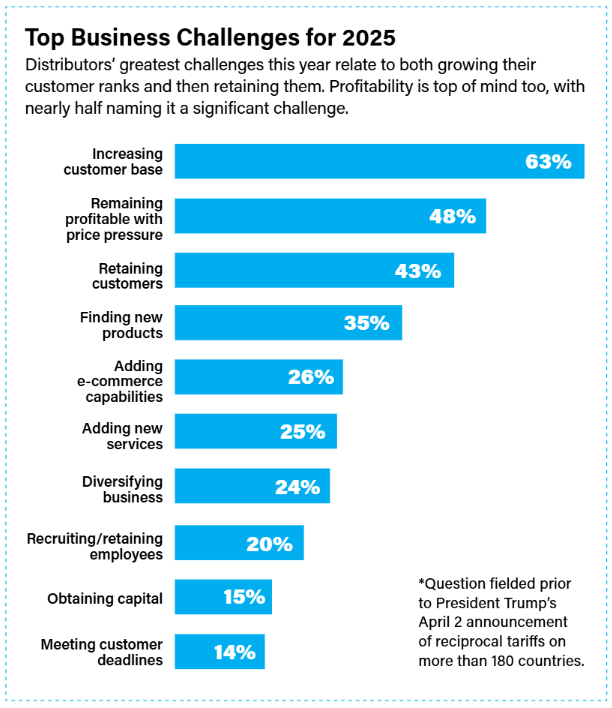

Of the distributors surveyed, 63% said that the biggest roadblock they’ll face in 2025 is finding new customers and increasing their base.

Using Smart Source again as an example, D’Agostino acknowledges that while sales in some categories have declined, that was often a matter of budget allocation to different products rather than disappearing marketing dollars, so the firm has tried to skate to where the puck is going, so to speak, with its print offerings. That has allowed the company to attract new clients.

“One of our most impactful strategic moves was to increase our capabilities and breadth of resources on point-of-sale and point-of-purchase and retail displays,” D’Agostino says. “By focusing on this ever-changing and evolving print marketing landscape, we have secured new clients and significantly improved our revenue.”

D’Agostino personally believes that pricing, due to rising costs of materials, labor and shipping, will be the biggest difference maker in print in the near future.

“Keeping prices competitive while still delivering high-quality work is a continuing challenge,” he says. “We don’t see these challenges going away any time soon. While things may improve slightly overall, factors like inflation, labor shortages, cross-border tariffs and high demand will likely keep these issues in play for the foreseeable future.”

Steven Osterloh, vice president of sales and marketing for Ennis Inc. (asi/52493), which placed first in PPM’s “Top Print Suppliers” list for 2024, says that the biggest challenge he and his company face is keeping up with the growing demand for digital print products, which often comes with added investment in equipment. That investment necessity speaks to cost pressures.

“Digital printing technologies are amazing and have added many positives for our industry, but there are also some drawbacks,” he says. “For example, a traditional piece of offset printing equipment might have a life expectancy of 15, 20, 30 years-plus, giving us a long time to pay back the investment, while a digital piece of equipment might have a life expectancy of as few as seven years.”

Equipment prices continue to rise, and the time to pay back the initial investment is short, and resets with each new purchase.

“These rising costs and shorter life expectancies make it difficult for us to justify some of the payback schedules when looking at new equipment,” Osterloh adds.

Being such a specialized market, print requires certain expertise when printing in-house. You need people to operate machinery. “Attracting and keeping a skilled labor force has become more difficult since the pandemic,” says Jeff Flowers, director of marketing for Counselor Top 40 supplier Gill Studios Inc. (asi/56950) – sentiments echoed by 20% of respondents who listed recruiting and retaining employees as a top challenge.

“We’re in a competitive market with many large companies within a few miles. We constantly review employee compensation, benefits, vacation, PTO, 401(k) and continually make adjustments to ensure that we can compete with those around us.”

One challenge that very recently developed is tariffs.

“The biggest challenge most certainly is the volatility and potential impact of tariffs,” says Kevin Walsh, president of Counselor Top 40 supplier Showdown Displays (asi/87188).

As of PPM’s deadline, the U.S. currently has in place new 25% tariffs on steel and aluminum imports from any country, which could create pricing difficulties for companies like Showdown Displays that manufacture signage. Additional country-by-country tariffs announced by the Trump administration are also poised to have an impact. Experts in promo and print at various suppliers anticipate price increases to follow as the spring and summer goes on.

“While things may improve slightly overall, factors like inflation, labor shortages, cross-border tariffs and high demand will likely keep these issues in play for the foreseeable future,” D’Agostino says. “The key is to stay flexible, deliver innovation, build strong and strategic supplier partnerships, and keep looking for ways to improve processes and drive efficiencies for our clients.”

Top Customers for Print & Promo

In terms of where to find new customers, there are plenty of places to look.

One real positive about the print market is that the customer verticals are almost endless. Even as the world transitions to digital, print is still something that appeals to virtually any customer base – especially when you look at things like direct mail or signage.

Basically, any company that needs to get the word out is a potential customer.

“There’s not really a vertical market we don’t sell to,” Flowers says. “We have such a wide variety of resellers across the U.S., we really sell to everyone.”

Showdown Displays, which primarily sells its soft signage and displays through distributors, sees its products go to a wide variety of end-buyers. Still, the firm has some verticals generate stronger sales than others. “We developed a process in 2013 in our graphics workflow that catalogs the graphics provided into 21 vertical markets,” Walsh says. “Based on this data, the top five vertical markets are healthcare, food and beverage, education, finance and technology.”

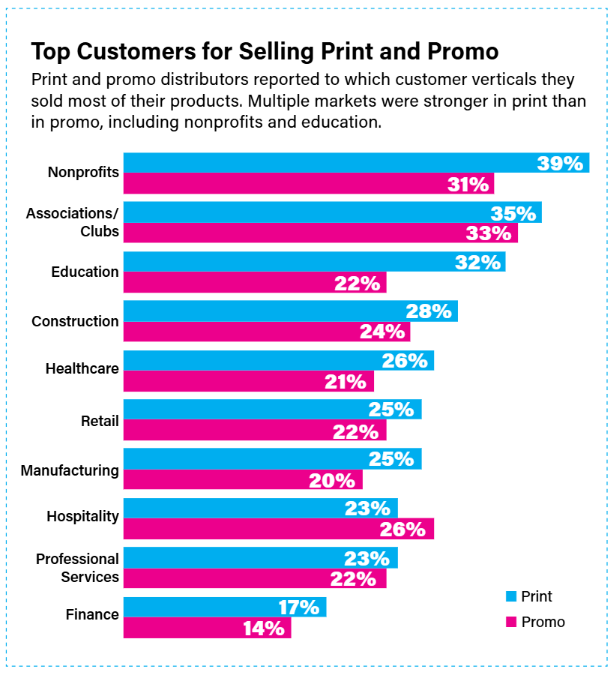

Among surveyed distributors, top sales verticals are largely similar. Looking only at print revenue, the top-ranking customer is the nonprofit sector, followed by associations and clubs, education and construction.

In fact, the data found that the hospitality sector was the only vertical where respondents sold more promo than print. Osterloh reports that at Ennis, many of their products are printed for the insurance, manufacturing, healthcare, automotive and distribution industries. “But our products reach far and wide,” he says.

Landing a big-name campaign is great. But just like politics, getting such a large print job often starts at the local grassroots level.

“As a printer that does a lot of political work, last year for us was very busy,” Flowers says. “It’s neat to see large orders going through the plant for presidential candidates, because there’s obvious name recognition, but even a yard sign order for a single, working mother from Davenport, IA, running for the school board is just as important to us. We’ve seen decline in some product categories, but others are growing. It’s just the ebbs and flows of this business. Find the tailwinds when you can and set sail.”

To Print or Not To Print

Maybe you’re already in print and you’re thinking of expanding your capabilities, or you’re in promo and thinking of adding print to create a more well-rounded product offering.

Either way, you have a question to answer: Should you print in-house? This could mean printing paper products or decorating promotional products.

The answer depends on how comfortable you are with investment – both time and money.

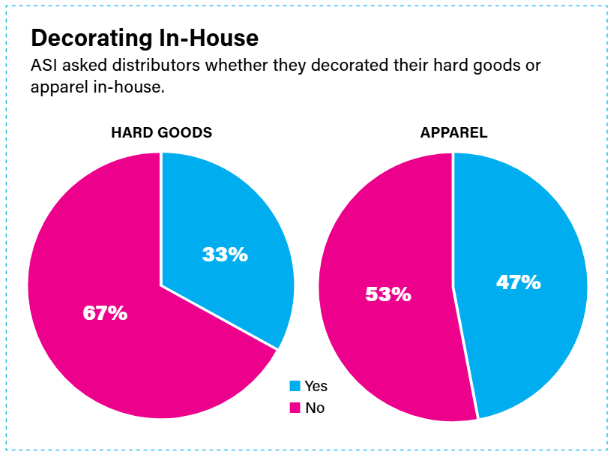

When you look around the industry, there are plenty of companies that sell both print and promotional products but don’t actually print or decorate themselves. Looking at print in particular, some 67% of distributors who sell both print and promo said they do not decorate hard goods in-house, and 47% do not decorate apparel.

With the distributor model, print distributors can take what D’Agostino calls a more consultative approach.

“Because we aren’t a manufacturer and don’t have a vested interest in pushing products, filling presses or production lines, we provide independent printed product consultancy and innovation on behalf of our clients at the briefing stage and then manage production and delivery through our vendor network across the U.S. and the world,” he said.

“We employ a proven and tested people-enabled-by-technology approach to managing our client’s marketing print and fulfillment needs across marketing ecosystems to drive efficiency, cost savings, inventory optimization and the highest levels of customer support.”

Walsh, whose company does manufacture the products they then sell to reseller partners, recommends that distributors getting their sea legs first outsource their products and scale from there.

“Begin with finding a great outsourcing partner on whom you can depend,” he says. “Explore the opportunity for growth with your clients and leverage the capacity and expertise of your outsource partner.

As you build the interest and volume in those outsourced products, then consider the opportunity and value proposition to insource those items. This provides the greatest flexibility and will enable exploration and growth prior to capital investment.”

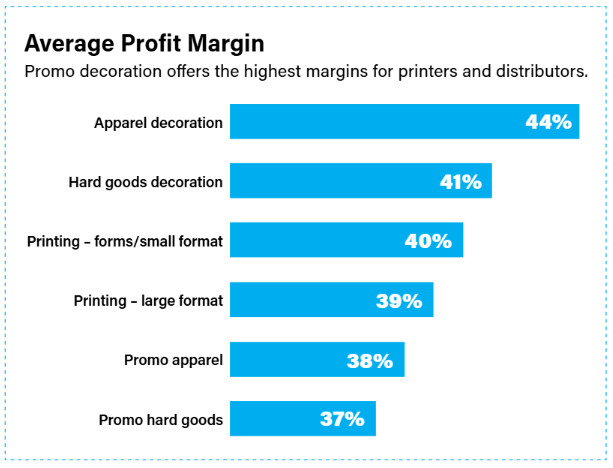

In print, whether printing in-house or outsourcing, finding products that create return on investment is key.

“Our top product categories are stickers, yard signs and labels,” Flowers says. “Coasters is a growing category for us as we continue to expand into products that people don’t typically think of Gill for, like leather and stone. Calendars is another category that continues to do well. I know everyone carries a battery-powered calendar in their pocket these days, but it seems tactile nostalgia is on the uptick.”

Walter Kurt, MAS, president of Three K Consultants Inc., breaks down the most popular products for his top sales verticals.

“For elections and political events, colorplast signs, cardboard signs, pamphlets, stickers and buttons,” he says.

Keeping things in the print space, for customers in the construction industry, he sees a lot of business for stickers for hats. And in the government sales vertical, he sells a lot of cardboard banks.

The Green Revolution

Over the last few years, and into the beginning of 2025, there has been a whirlwind of new legislation. Sustainability is at the forefront of many of these changes.

In February, for instance, Washington’s Department of Ecology (DoE) included printing inks in its Safer Products report. This fight dates to 2022, and in January 2024 the Washington DoE petitioned the Environmental Protection Agency to increase its limits of inadvertent polychlorinated biphenyls in pigments under the Toxic Substances Control Act. The EPA denied this request in April 2024, but the Washington DoE is trying again, arguing that there are non-chlorinated alternatives for these substances. If enacted, it would force some printers to change their inks and invest in different materials.

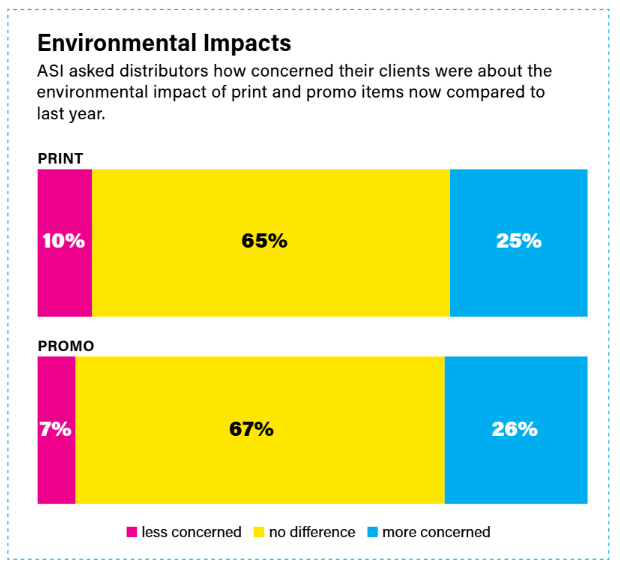

Among those surveyed by ASI, 26% of print sellers said their clients are more concerned about the environmental impact of print items than they were last year, with 67% saying they were as concerned as they were the previous year.

The Tariff Impact

Tariffs have been one of the signature initiatives of President Donald Trump’s second term. Since February, he’s announced a series of tariffs on China, Mexico and Canada as well as aluminum and steel.

The rates are staggering for countries like China, Vietnam, Bangladesh, Thailand and Taiwan – major countries for importing consumer goods like apparel, hard goods and electronics.

Trump added an additional 34% tariff rate to products coming from China alone. On top of a 20% higher rate he implemented over two orders earlier this year, this means tariffs on imports from China have been saddled with an additional 54% duty from what they were at the start of 2025. Considering the number of products imported by suppliers from China, this alone is enough to worry promo pros. As of publication, the Trump Administration and China have agreed to suspend the inordinately high tariffs on Chinese goods for 90 days, dropping from 145% to a relatively lower (but still disruptive) 30%.

“These tariffs will have broad and deep impacts across the economy – and our industry isn’t exempt from the pain,” Chris McKee, chief revenue officer at Counselor Top 40 distributor Geiger (asi/202900), told ASI. “Clients will undoubtedly reassess their promotional spending in light of rising costs on their end. It’s difficult to imagine a scenario where they proceed with purchases as originally planned.”

Trump had used tariffs and trade as a central theme of his campaign for the presidency in 2024 and wasted no time following through on his promises once he arrived in office for his second term. Still, the extent of his tariffs – the highest in the country since the 1930s – went beyond what industry pros and experts predicted, and stoked fears of a economic recession.

“The extent and depth of these tariffs will have a massive impact, not only on the promo industry but on the whole economy of the U.S. and the world,” said Counselor Power 50 member Jose Gomez, CEO/president of Counselor Top 40 supplier Edwards Garment (asi/51752). “The immediate impact will be price increases that will hit manufacturers, distributors and consumers in the coming days and weeks.”

Beyond just promo, the tariffs could create economic turmoil that would limit traditional end-buyers from spending on promotional products. “Costs are higher, and I suspect we’ve lost some orders to fruit baskets, gift cards and non-industry products,” said Counselor Power 50 member Craig Nadel, CEO/president of Counselor Top 40 distributor Nadel (asi/279600), after the tariffs were announced. Despite the fear, optimism still shines through.

“Don’t count our industry out,” McKee said. “Our medium remains one of the most cost-effective tools for brand communication, and a consultative salesperson will always find a path to success.”

For more coverage on the ongoing tariff situation, check out ASI Media’s tariff coverage.

“Sustainability is a big one,” D’Agostino says. “Both customers and legislation are continuing to push for eco-friendly materials and processes, which means we have to carefully choose products and partners that prioritize things like recycled goods, water-based inks and reduced waste.”

Meanwhile, there’s new legislation that impacts the way printers are doing business. Osterloh isn’t immediately concerned about these laws for his own business, but is certainly keeping an eye on them.

“We’re having to follow these changes closely,” he says. “We don’t see this legislation making an immediate impact on our business, but time will tell as some of these states try to control these aspects of the business.”

The FDA announced last March that it would phase out PFAS on food packaging completely in the U.S. On the state level, PFAS legislation already exists in California, Colorado, Connecticut, Hawaii, Maryland, Maine, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington.

“It’s clear we cannot clean our way out of this issue,” Kirk Koudelka, Minnesota Pollution Control Agency assistant commissioner, said at the time Minnesota enacted its own laws in 2024. “So how can we work on preventing PFAS pollution? Because it’s the least costly and helps remove all the negative impacts we’re seeing as we get further into management and cleanup.”

The Fine Print

While times are changing, the print industry has proven resilient and is evolving.

And there’s indeed long-term success to be had in print. To that point, the 2024 Print & Promo Top Print Distributors list features some companies that have been around for 30, 50 or even 100 years. Top-ranked Ennis Inc. has been in business since 1909. Tenth-ranked

Independent Printing & Packaging (asi/62554) was founded in 1935. And Gill Studios Inc., which found itself in the fourth position, was founded in 1934.

“Market and product trends come and go, but print companies that have found their place, their niche in the markets they serve, tend to be the ones that have surpassed or are creeping up on semicentennial anniversaries,” Flowers says. No doubt, the print industry has a ton of moving parts – and we don’t just mean inside the machines. But the brave salespeople who can harness its marketing power and find the spaces where their customers aren’t having their needs met, can succeed and prosper.