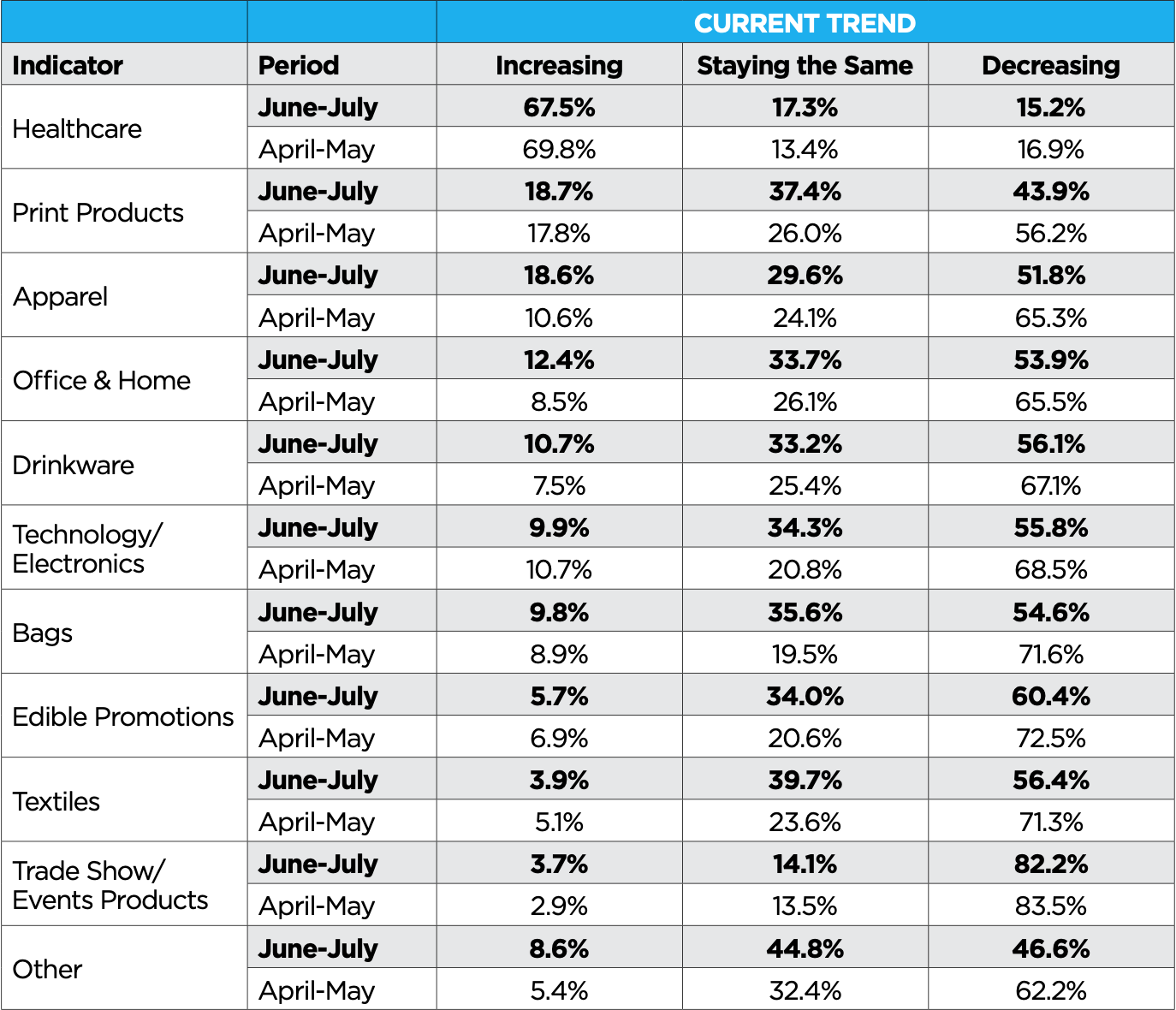

In June, we looked at the product categories seeing the most demand a few months into the COVID economy. Unsurprisingly, health care products were the only strong performers, with 69.8 percent of businesses surveyed in our COVID-19 Promotional Products Industry Recovery Research study reporting increasing sales in the category, versus 16.9 percent reporting decreasing sales. Now, with the second installment of the study, produced in collaboration with NAPCO Research, we have some new insights into promotional products sales trends.

Health care products remained atop the list, showing little sign of slowdown. For the June-July period, 67.5 percent of surveyed companies reported increasing sales, while 17.3 percent said sales in this category remained the same compared to April-May. The percentage of companies reporting decreasing sales in the category actually went down, from 16.9 percent in April-May to 15.2 percent in June-July. As we’ve seen, masks, hand sanitizer and other health products have carried the industry since the start of the pandemic.

The big surprise this time around, though, is the apparel category. Apparel has been battered since the start of the pandemic, with various sources reporting apparel shipments (overall, non-promo-specific) have fallen dramatically compared to 2019. But the category is showing some signs of life. After health care and print products, apparel was the third best performing product category for the June-July period, with 18.6 percent of promo companies reporting increasing sales, compared to just 10.6 percent for the April-May period. That 8 percent increase is the biggest jump for any product category.

The flip side, of course, is that 51.8 percent of companies said sales in apparel were still decreasing, but that’s a marked improvement over the 65.3 percent reporting decreasing sales a few months ago. While the apparel market remains a shell of what it once was, there are at least signs of life. “Apparel sales were off significantly in April/May but have rebounded a bit stronger with warmer weather,” said one survey respondent.

“Most sales are PPE based right now,” said another. “I do have apparel orders and caps, and those seem to be steady right now.”

A few other promotional products sales trends from the full report:

• As noted above, print products was the second best performing category for June-July, holding steady from April-May. The number of respondents reporting increasing orders in the category remained almost the same at 18.7 percent (versus 17.8 percent in the prior period), but 37.4 percent of companies said demand was staying the same, up from 26 percent in April-May.

• The office & home and drinkware categories saw minor upticks in companies reporting increasing demand. Office & home went from 8.5 percent increasing in April-May to 12.4 percent increasing in June-July, while drinkware went from 7.5 percent to 10.7 percent. The bags category also saw a small uptick in the “increasing demand” column, moving from 8.9 percent to 9.8 percent.

• Aside from health care and print, every category saw at least half of respondents still reporting decreasing demand. However, those numbers showed signs of leveling off across the board. In the bags category, for example, 54.6 percent of companies said demand was decreasing in June-July, compared to 71.6 percent in April-May. In all 11 product categories listed in the survey, the percentage of respondents reporting that demand was staying the same in June-July was higher than in April-May.

• Despite this stabilization, a few product categories still lagged noticeably behind others. Technology/electronics, edible promotions and textiles all saw fewer respondents reporting increasing demand for June-July than in the prior period.

Here is the full data table:

“The current period sees significant improvements in the percent of businesses reporting increases in both quote activity (30.9 percent, up from 18.0 percent) and new orders (32.3 percent, up from 16.2 percent),” we wrote in the full report. “Confidence levels indicate a tempering of both positive and negative expectations, as 34.6 percent expect business conditions to improve over the next month (down from 38.2 percent), 24.2 percent expect conditions to stay the same (up from 16.4 percent), and 19.4 percent expect conditions to decline (down from 23.7 percent).”

For more insights and data on how promo businesses have been impacted by the pandemic, download the full Volume 1, Number 2 COVID-19 Promotional Products Industry Recovery Research study here or click the image below.

About NAPCO Research

NAPCO Research develops research and economic models that solve customer business problems. Market research is valuable for making strategic business decisions, solving challenges, and pursuing opportunities, and the NAPCO Media research team surveys, analyzes, and monitors critical trends related to marketing, printing, packaging, nonprofit organizations, promotional products, and retailing. To learn more about how the team can leverage its research and industry subject matter experts to support your organization’s needs, contact Nathan Safran, vice president of research for NAPCO Media, at [email protected].