NAPCO Research and Promo Marketing have released the third iteration of the COVID-19 Promotional Products Industry Recovery Research, which aims to gauge the effects of the pandemic on the promotional products industry.

While respondent data from late October indicates that industry activity is still declining, it is doing so at a much less drastic rate when compared to the first two reports. Nearly an equal amount of companies are now saying that sales are trending upward (39.1 percent) and downward (40.9 percent), which is an improvement over the 74.3 percent of companies reporting downward trends in May and the 57.3 percent in July (Figure 1). Average weighted sales fell by an average of 24.7 percent in the first report and 16.0 percent in the second, but since then, this number has greatly improved, as the most recent reading showed a decline of 2.1 percent—still negative, but moving in the right direction.

The Index of Leading Indicators Points to Potential Growth in the Near Future

The research tracks two groups of indicators that provide insight into both current industry activity as well as future activity. The index of current indicators, which include sales, employment, prices and pre-tax profitability, closed at 48.2. A reading below 50 means that more companies report declining activity trends as opposed to those who indicate activity is rising. This reading has improved in each of the survey periods, as it read 33.1 and 38.6 for the April-May and June-July survey periods, respectively.

The index of leading indicators, which tracks quote activity, new orders and business confidence, closed at 55.7 for the most recent survey period. This is the first time that this index has reached a level over 50 since the research began in April. A reading over 50 here is a good sign of what is to come, as increases in quotes, new orders and confidence can translate to industry activity increasing across the board sooner rather than later. This index has also improved since the research began, measuring 35.2 in May and 46.6 in July.

Health Care, Apparel and Drinkware Improve, While Those in the Trade Show and Event Space Continue to Struggle

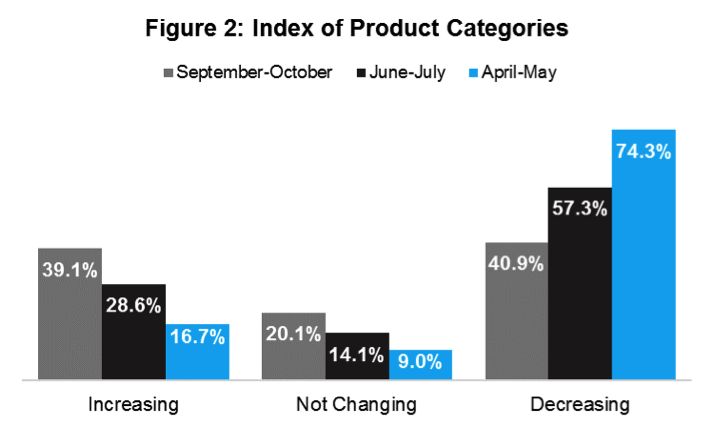

Product demand across the industry continues to decline, but a few product categories have been bright spots. The demand for health care, apparel and drinkware products has risen significantly from previous iterations of the survey, and all three product categories now have index readings over 50 at 69.4, 56.9 and 50.4, respectively (figure 2).

Burdened by restrictions that prevent travel and events from taking place, demand for products in this category continues to decline. Only 4.4 percent of companies say that they have seen increased demand here, while 78.9 percent continue to see decreases. This will likely continue until a vaccine is widely distributed and people feel comfortable gathering in large groups.

Shifts to PPE Production Aided Survival But Cut Into Margins

Many who shifted their capacities to produce PPE throughout the pandemic have been pleased with their ability to maintain some sales and employees, but many did indicate that margins for these products were smaller. While decreased profitability is never something business owners want to face, this year has been an extraordinary circumstance where any profit, no matter how small, is better than no profit at all. These firms must understand that PPE will not be in demand forever, and many have started to think about getting back to business as usual.

A Majority of Companies are Beginning to Plan for a Post-COVID Business Environment

Most respondents (79 percent) have indicated that they have started thinking about their company and how it must change when COVID-19 is gone. There will be a variety of business opportunities that present themselves and those in the promotional marketing space have already recognized some of them. Many discussed their belief that a new work-from-home culture will require them to make changes in how they communicate with clients and how their sales teams operate. Others pointed to the fact that competition may not survive the pandemic and there will be opportunity to pick up new clients, equipment or even whole operations. Those in the industry have proven to be forward looking and the recent wave of uncertainty has not curtailed their ability to continue to act in this manner.

Analyst Projections Point to Growth in 2021

According to the latest Wall Street Journal Economic Forecasting Survey, it appears that 2021 GDP will see its largest growth rate since 2004. Following a projected decline of 2.7 percent for 2020, analysts believe that GDP will grow by about 3.6 percent in 2021. This means that about $748 billion more will be put back into the economy. This growth will be driven by reduced restrictions, pent-up demand and the eradication of virus-related fears. While it may take some time for everyone to receive a vaccine and for all protective measures to be lifted, it does appear that a majority of these issues can be solved by late spring.

Markets have also reacted positively to reduced uncertainty. Investor sentiment is sometimes seen as a leading indicator for economic growth and much of the recent news has sent the Dow Jones Industrial Average (DJIA) soaring past 30,000. News of vaccine development and distribution has certainly increased confidence for many as we now have more of a concrete answer as to when a majority of U.S. citizens will be able to receive their dose. 2020 being an election year also heavily added to uncertainty. Now that a decision has been made on this front, we can now begin to understand the implications of a new administration and potential policy plans moving forward.

Many industries were affected in different ways by COVID-19, and since the promotional products industry is so wide-reaching, companies who work in different segments had different fortunes. This will continue to be the case moving forward and as certain industries begin the recovery process, so too will the promo companies that serve them. All we can do it be patient and not lose sight of the future. Recovery is on the horizon, and although it may come at varying paces for different groups, it does appear that it will materialize in 2021.

Download the full third report here.

Participate in the COVID-19 Promotional Products Industry Recovery Research

In today’s unprecedented business environment, making decisions based on facts has never been more important. In the weeks and months ahead, reliable industry business indicators will be essential for monitoring what’s happening in all industry segments. The COVID-19 Promotional Products Industry Recovery Research is an essential resource for monitoring industry conditions, and the NAPCO Research and Promo Marketing teams invite you to join our business panel and contribute to the research on an ongoing basis. Companies that join the panel will receive an exclusive version of the report that includes additional data and analysis. To join the COVID-19 research panel, please click here.

About NAPCO Research

NAPCO Research develops research and economic models that solve customer business problems. Market research is valuable for making strategic business decisions, solving challenges, and pursuing opportunities, and the NAPCO Media research team surveys, analyzes, and monitors critical trends related to marketing, printing, packaging, non-profit organizations, promotional products, and retailing. To learn more about how the team can leverage its research and industry subject matter experts to support your organizations needs contact NAPCO’s Vice President of Research, Nathan Safran, at [email protected].