This article originally appeared as part of Counselor’s State of the Industry. To view the full report, click here.

Kelly Moore sources about 30% of the products she provides for clients directly from overseas vendors. The owner of Florida-based distributorship Moore Promotions (asi/601617) says she always tries to work with a domestic supplier first, but that’s not always feasible.

Sometimes, Moore says, she simply needs a better price point to win the business – or she needs a custom product built to satisfy an end-buyer’s demand for a singular solution. Moore gets those things by buying direct. “In 2017, I did an initial order, and it went great, so I started doing more and forged relationships,” Moore shares. “Thanks to those relationships, sourcing direct has become easy and lucrative; my margins are out of the park and I can still offer great pricing to my clients.”

Sometimes, Moore says, she simply needs a better price point to win the business – or she needs a custom product built to satisfy an end-buyer’s demand for a singular solution. Moore gets those things by buying direct. “In 2017, I did an initial order, and it went great, so I started doing more and forged relationships,” Moore shares. “Thanks to those relationships, sourcing direct has become easy and lucrative; my margins are out of the park and I can still offer great pricing to my clients.”

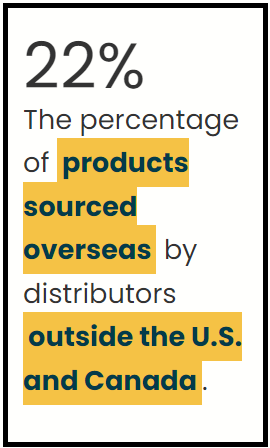

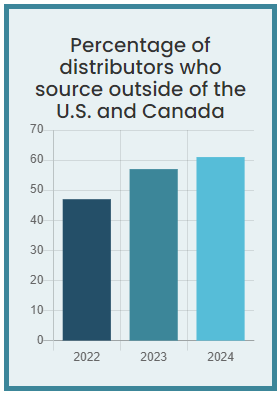

Like Moore, a growing number of distributors are sourcing products directly from vendors outside of the U.S. and Canada – particularly from vendors located in China and other East Asian nations. More than 6-in-10 distributors sourced direct in 2024, up from 47% in 2022. It’s an extension of a trend that’s been developing for a number of years, and received renewed energy in the wake of the pandemic, when distributors more readily went overseas to source PPE and suppliers had to increase prices due to supply chain disruption. Those distributors doing so cite reasons like Moore’s: lower pricing, better margins and expansive custom product creation options.

Quinn Schwalk, owner of North Dakota-based distributorship Red Wake Promotions (asi/305818), started conducting orders directly with internationally based vendors about a year ago. He now generates a small percentage of his business from such orders. Schwalk says he sought overseas partners because he couldn’t secure good enough pricing from domestic suppliers to compete in some cases and was losing orders. Persistent sourcing work led him to connect with foreign-based suppliers.

Still, he prefers working with domestic suppliers. In part, that’s because going overseas comes with challenges like longer lead times, communication issues and greater risks. If something goes wrong, Red Wake may have less recourse to rectify things. “The buying experience is better with domestic suppliers,” Schwalk states, “but sometimes it comes down to being able to get a better price overseas.”

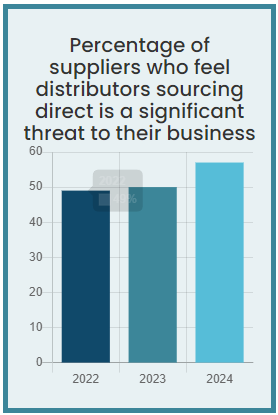

Suppliers are well aware of this trend and have become increasingly worried about distributors buying direct. Nearly 6-in-10 (57%) suppliers say direct sourcing is a significant threat to their businesses. “Just as it would be devastating for an end-user to go directly to a factory for a large order, cutting the distributor out, so too is it devastating for distributors to remove domestic suppliers out of large orders, but then expect them to have inventory, equipment and labor for the day-to-day orders,” says a top executive at a leading supplier who asked to remain anonymous.

Suppliers are well aware of this trend and have become increasingly worried about distributors buying direct. Nearly 6-in-10 (57%) suppliers say direct sourcing is a significant threat to their businesses. “Just as it would be devastating for an end-user to go directly to a factory for a large order, cutting the distributor out, so too is it devastating for distributors to remove domestic suppliers out of large orders, but then expect them to have inventory, equipment and labor for the day-to-day orders,” says a top executive at a leading supplier who asked to remain anonymous.

There are potential industrywide pricing impacts too. “If distributors continue to take the largest orders directly overseas, they’ll force suppliers to spread their cost structures across smaller, day-to-day orders, driving up the prices for such orders,” the supplier executive asserts.

The risks may be considerable as well. “Whether it’s a distributor dealing with a delayed shipment, a quality problem, a compliance issue, an import/export challenge or being defrauded by an unscrupulous overseas contact,” the executive says, “we, as suppliers, have fielded panicked phone calls from distributors looking for a quick, domestic solution after being taught an expensive lesson in global sourcing.” The exec adds that the onus falls on the distributor to make sure products meet safety standards and there aren’t human and environmental abuses in the production chain.

Some larger distributors have created their own supply chains. Counselor Top 40 distributor BAMKO (asi/131431) has sourcing professionals in China, Vietnam, India, Haiti and El Salvador. BAMKO audits factory partners for social, environmental and regulatory compliance, and utilizes quality control agents, says company President Jake Himelstein, a member of Counselor’s Power 50 list of promo’s most influential people. Sourcing direct provides considerable advantages, he adds.

“We source overseas to create customized products for our customers that cannot be purchased off the shelf from domestic suppliers. This could be a water bottle with a custom shape and size, a custom box for a giveaway or a uniform for a flight attendant,” Himelstein says. “We plan to continue our overseas sourcing strategy and are diversifying our supply chain to be less China-centric.”

Some think the higher risks, lengthier lead times and greater complexity that can come with direct sourcing will ultimately limit the practice. Others feel it may become more popular as roadblocks to global partnerships lessen, including the ability to produce lower-minimum-quantity orders. “Across the industry,” says Moore, “I think the practice will continue.”

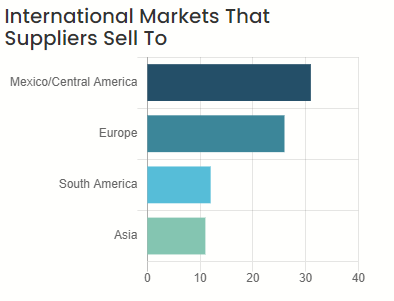

International Snapshot

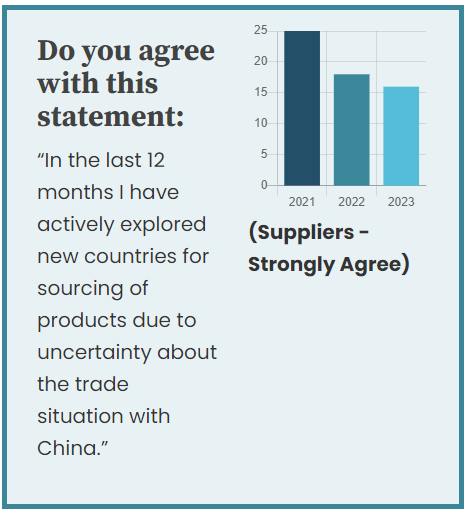

The push to diversify beyond China is quickly losing steam

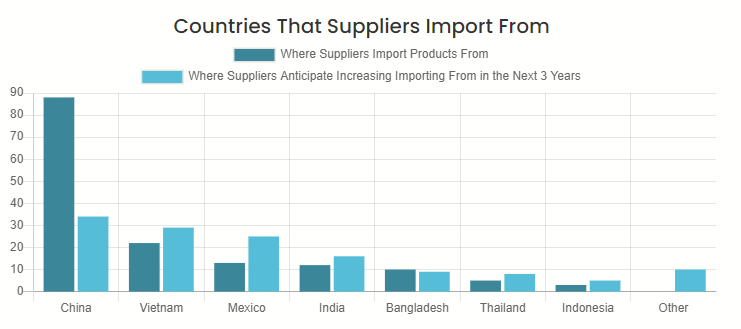

When the supply chain was at its worst, the promo industry’s rallying cry was “We have to get out of China.” Now, it’s more “It might be nice to eventually get out of China.” Less suppliers are actively exploring new countries to source from, and in 2023 the same percentage of suppliers (88%) brought in products from China as in 2022. And in fact, a third of suppliers (34%) anticipate increasing their importing from China in the next three years – more than any other country.

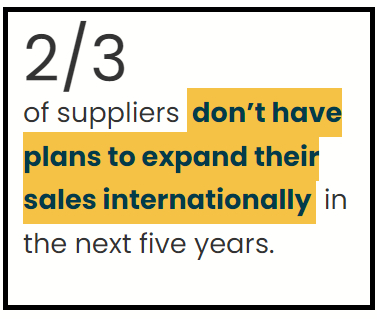

Both suppliers (and select globally connected distributors) are diversifying their sourcing into other countries – but it’s a very slow process that they stress takes time. Which all translates to this: China’s status as the premiere international sourcing hub appears very secure.