Marketing budgets have been decimated across just about every major industry in the U.S. as COVID-19 has upended ordinary life and business. A lot of cities and states are dealing with a second, increasing wave of infections that has stifled some of the mid-year positivity about flattening the curve, but there are still silver linings to be found.

For one thing, marketers are spending money again in multiple major industries, or at least their marketing budgets haven’t decreased at all. For promotional distributors, this may be an indicator of the main verticals that are able to spend some money again.

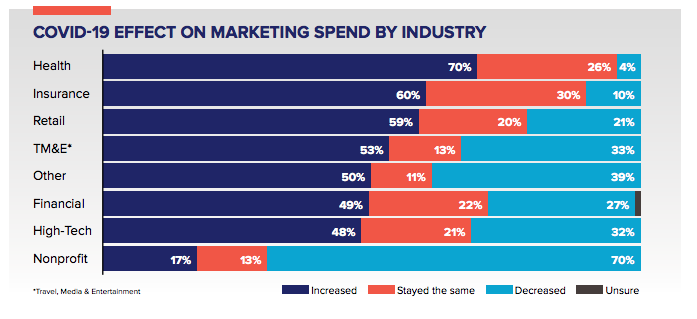

In a Merkle survey of industries such as health care, retail, finance, tech and nonprofit, 52 percent of respondents said they’ve increased their marketing spend over the last few months.

The largest increase was in health care, with 70 percent of respondents saying they’ve increased marketing budgets. Twenty-six percent said they have kept their budgets the same, and only 4 percent said they have decreased.

Other industry increases included 60 percent for insurance, 59 percent for retail, 49 percent for finance and 48 percent for tech. Perhaps the most notable of these increases was actually in the travel, media and entertainment industry, which has been kneecapped by the nature of preventative measures, such as canceling in-person events and halting travel. Those industry respondents indicated a 53 percent marketing increase, with 13 percent of respondents staying the same.

The only industry outlier here was nonprofit, which only saw 17 percent of respondents increasing budgets, 13 percent staying the same, and 70 percent decreasing.

Colin Stewart, senior vice president and GM of the nonprofit sector for Merkle, said that this is likely due to nonprofits tightening their belts and allocating money where it’s most efficient. In short, they’re taking the quality-over-quantity approach.

“With events revenue being wiped out, we’re seeing many large nonprofits trying to balance the need for their programming, staff and marketing budgets,” he said in the report. “The smart nonprofits are focusing their efforts on localized, relevant message and getting more efficient in their marketing spend by focusing on the individuals who can deliver the highest ROI.”

Another interesting aspect of the report is a breakdown of customer marketing approaches, and how likely respondents are to implement changes like new channels, new analytics and prospect for new audiences.

Fifty percent of respondents said they would try new marketing technologies or features. Thirty-nine percent said they’d implement a new marketing channel completely. And 33 percent said they would try to identify new audiences for their marketing efforts.

For promotional products distributors, things are certainly still difficult and uncertain. And these numbers aren’t a magic cure for all of that. But, seeing so many industries that promotional products distributors rely on as their most stable customer verticals is encouraging to say the least. If they are increasing their marketing budgets, it points to something to celebrate at the end of 2020.