It’s no secret that only a few promotional products categories are selling right now. Anecdotally, distributors and suppliers have seen strong demand for PPE and hand sanitizer, making health care products one of the few reliable sources of sales, in some cases enough to significantly offset losses elsewhere.

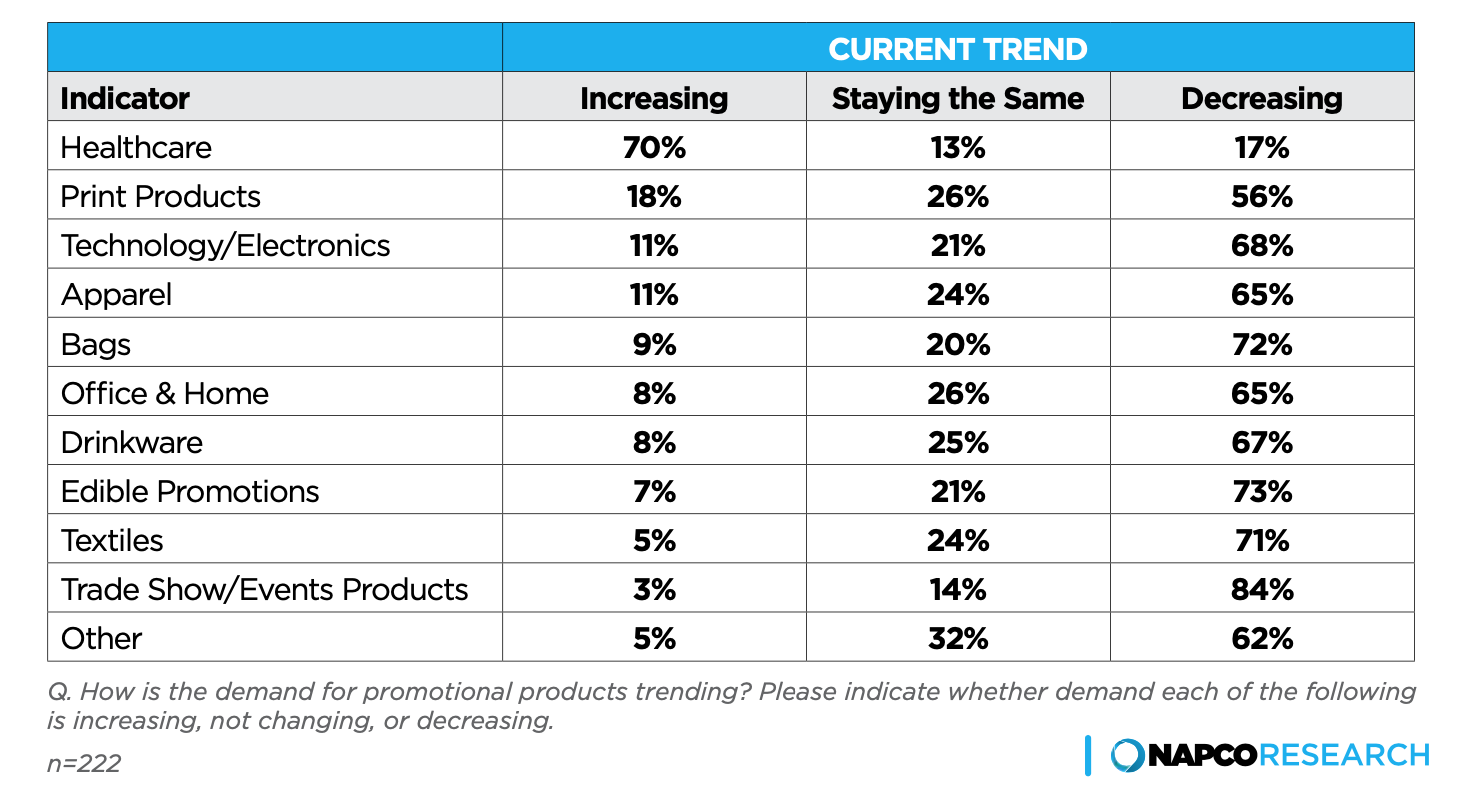

The data backs that up, as 70 percent of promo companies surveyed in our COVID-19 Promotional Products Business Indicators Research study, conducted by NAPCO Research, said they were seeing increasing demand in the health care category. A further 13 percent of companies, which for the survey include promo distributors, promo suppliers, apparel decorators, print distributors and commercial printers, said demand for health care products was staying the same, leaving just 17 percent of companies to report declining demand in the category.

None of that is surprising, given what we’ve seen and heard across the industry. But, after health care, what promotional products categories are performing best? We should first note that no other category is performing well, with the majority of promo companies reporting predominantly decreasing demand in all categories but health care. But some products are faring better than others, based on our data.

• Demand for print products, for example, was increasing for 18 percent of surveyed companies and staying the same for 26 percent. That means 44 percent of companies were able to at least maintain prior sales here.

• After print products, apparel was the most reliable performer, with 11 percent of companies seeing increasing demand and 24 percent staying the same, for a total of 35 percent at least maintaining prior sales.

• Office & home also saw 35 percent of companies at least maintaining sales (8 percent seeing increasing demand, 26 percent staying the same). This was likely driven by end-buyers looking to equip remote staff with work-from-home products.

• Technology/electronics was next, with 32 percent of companies at least maintaining sales (11 percent increasing demand, 21 percent staying the same). It’s likely that this category also saw some steady orders for remote-work products.

Here is the full data table:

Clearly, outside of the health care category, all of these numbers indicate net negative demand. But the data shows a few categories where some level of sales may be available. Unsurprisingly, things were bleakest in the trade show/events products category, which saw 84 percent of companies report decreasing sales.

If there’s a silver lining, it’s that 38.2 percent of promo businesses surveyed expect business conditions to improve over the next month, versus 23.7 percent that expected conditions to decline. (A further 16.4 percent expected conditions to stay the same, while 21.7 percent were not sure.)

“We’ve seen a strong comeback in the past few weeks,” one respondent wrote on May 8. “Each week is a positive away from the bottom in March,” wrote another respondent on May 12.

We’ll see how these projections have played out in the next installment of the research study, due out at the end of July. For now, you can download the full Volume 1, Number 1 COVID-19 Promotional Products Business Indicators Research study here.

About NAPCO Research

NAPCO Research develops research and economic models that solve customer business problems. Market research is valuable for making strategic business decisions, solving challenges, and pursuing opportunities, and the NAPCO Media research team surveys, analyzes, and monitors critical trends related to marketing, printing, packaging, nonprofit organizations, promotional products, and retailing. To learn more about how the team can leverage its research and industry subject matter experts to support your organization’s needs, contact Nathan Safran, vice president of research for NAPCO Media, at [email protected].