Once upon a time the days of “instant gratification” shopping was purchasing something from a mail-order catalog and waiting 6-8 weeks. Now, Amazon packages arrive the same day you order. With our collective patience at an all-time low, rush orders and lightning-fast turnarounds grew in popularity in promo.

“I equate this to a child in a way,” says Howard Schwartz, founder and CEO of HDS Brands (asi/216807) in Pittsburgh, PA. “They want what they want when they want it.”

Then the world shut down, and everyone just had to sit and wait. And wait. And wait.

As everything opened up, business returned to something like normal – except for promo rush orders. Supply chain disruption and inventory woes upended pre-pandemic norms of being able to buy almost anything at the last minute.

As everything opened up, business returned to something like normal – except for promo rush orders. Supply chain disruption and inventory woes upended pre-pandemic norms of being able to buy almost anything at the last minute.

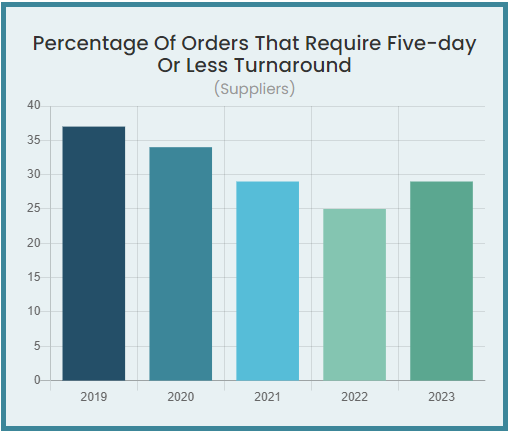

The effect was felt in promo. In 2019, suppliers reported that 37% of their orders required five-day or less turnaround. In 2022 when supply chain issues were at their worst, only a quarter of orders met those criteria.

Last year, however, as the supply chain issues settled, quick-turn orders began to creep back up. It hints at the fact that everyone didn’t suddenly become more patient during the lockdown. Chris Johnson, general manager of 2 Oceans Promotions (asi/347899), says rush orders only take up about 10% of his company’s order total, but “I see the requests for them about the same as I did before the pandemic,” says Johnson, whose company has locations in South Carolina, Atlanta and Phoenix. “I definitely see a lot of the suppliers advertise them again now, which is fine.”

Especially large suppliers. Counselor State of the Industry data shows that suppliers with $5 million and over in revenue in 2023 fulfilled 42% of their orders in five days or less, compared to 27% for medium-sized suppliers ($1 million+ to $5 million) and 24% for small suppliers ($1 million or less).

Michael Bistocci, chief revenue officer for Counselor Top 40 supplier Logomark (asi/67866), says that rush orders account for more than half of the company’s overall orders, and the company doesn’t see the appetite for quick turnarounds slowing down any time soon.

“We believe demand for rush orders will continue to increase,” Bistocci says. “We have instituted a three-to-five-day turnaround on all of our drinkware orders and re-instituted our Advantage 24 on select high-demand items.”

Another wrinkle? Companies are increasingly baking quick-turn programs into their DNA that turn “rush” into “standard.”

“Today, our percentage of rush orders is nominal,” says Rachel Rosario, senior director of marketing for Counselor Top 40 supplier Koozie Group (asi/40480). “That’s because in the last 12 to 15 months, we’ve changed our approach by focusing on shortening our lead times overall. We’ve been able to leverage our manufacturing capabilities as well as high stock levels on best-sellers to shorten our standard production times. Over 650 of our items are available with standard two-day service, which was something IMAGEN Brands was known for, and 75% of our products have a standard production time of five days or less.” Koozie Group acquired Imagen Brands in 2020 and fully integrated the company this year.

Koozie Group also currently has almost 500 products available for 24-hour service, which the company made free in the fall of 2023.

On the apparel side, Counselor Top 40 supplier Edwards Garment (asi/51752) also has naturally quick turnaround on certain products, so the actual rush jobs tend to be for decorated products. However, while President/CEO of Edwards Garment Jose Gomez says that these only account for as low as 10% of orders, it’s another case of speed being a part of the supplier’s MO. “Because we ship blanks in one to two days, we don’t get many requests for rushes there,” says Gomez. “Most of them come in our decorated product, where we do 24-hour expedites to improve on our regular turn time of two-to-three days. This is a frequent request, but still not a high percentage of work – probably less than 10% of orders or 20% of units.”

The question for distributors is whether they want to hold the line or try to win more business on speed. For Johnson and 2 Oceans, a lot of times a rush order just isn’t worth the variables. There are too many things that can go wrong and need to be fixed, and something like an issue with art can be too much to handle in such a tight window of time.

“What we pride ourselves on is quality and reliability,” Johnson says. “We want to make sure that we get you the stuff that you want, and we’re going to make sure that it’s printed correctly, it’s done right and arrives on time. And if anything jeopardizes those statements, which is the very nature of the rush order, we’re not going to do it.”

Supply Chain Snapshot

Just as the supply chain finally reached equilibrium, costs are escalating once more.

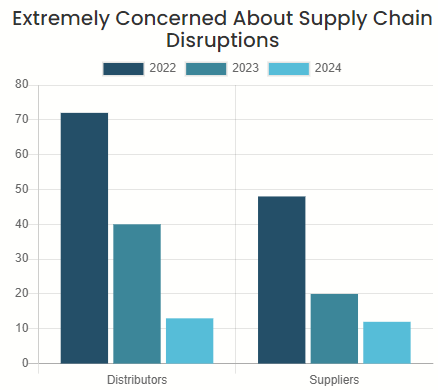

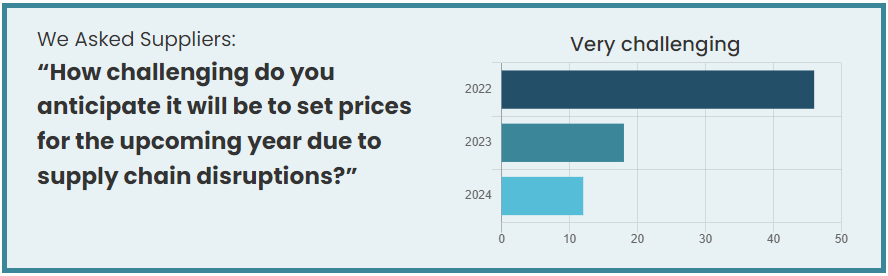

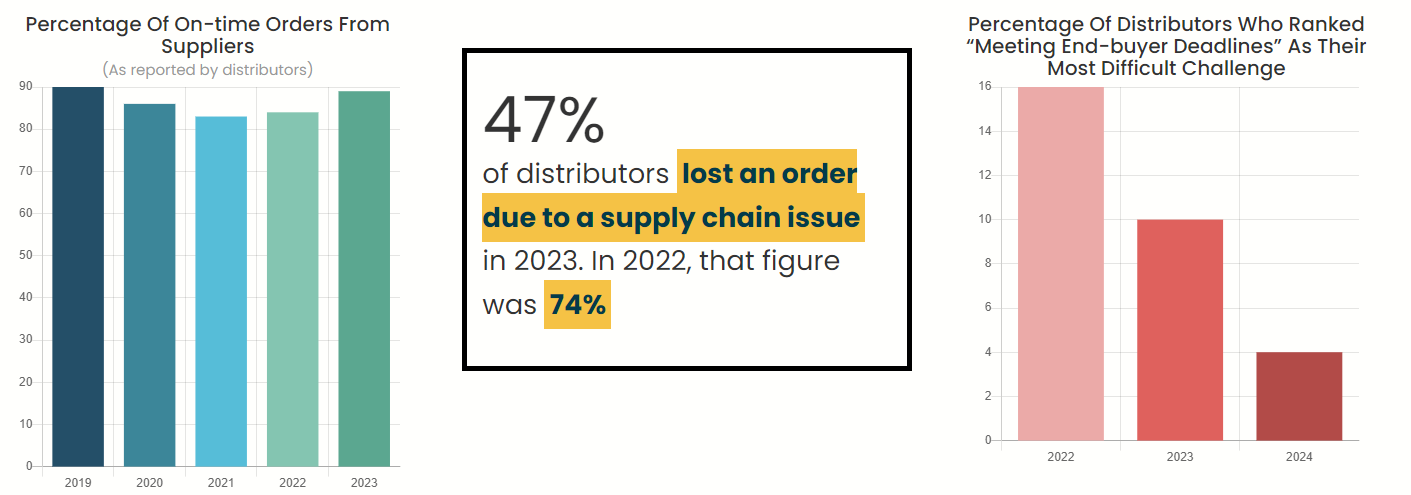

It was good while it lasted. Last year the supply chain situation finally improved, and that was reflected in the SOI data, as industry companies reported notable improvements in successfully shipped orders along with a drastic drop in their concerns about the supply chain. Just in the past couple of months, however, there’s been a sharp rise in container prices and freight rates with peak shipping season (to get products in for the holidays) starting earlier than normal. The escalating costs are still far below the worst of the COVID crisis, and it remains to be seen if the disruption will lead to price increases. Still, the latest episode is just another reminder that the state of sourcing needs constant monitoring.