When Kate Ivory, owner of GIDI Promotions, started out as a distributor more than 20 years ago, something happened that really bothered her. She was immediately offered end-quantity pricing (EQP) by suppliers – even though she’d never worked with those suppliers before.

“It’s like, I’ve done nothing to deserve that,” says Ivory, who’s based out of Portland, OR. “If you’re giving that to me, you’re giving it to the universe. So what that’s telling me is that’s not your real pricing.”

For decades, distributors and suppliers have conducted business using industry-wide pricing rules meant to shield end-buyers from the actual cost of the goods they’re purchasing. The basic premise – that both the list price and net cost are increasingly discounted as the quantities go up – has powered billions of dollars of growth over the decades.

The truth, however, is that the pricing on the page doesn’t match how business is being conducted in the real world. Price breaks – encompassing everything from EQP and rebates to free shipping and waived decoration charges – should be a building block of the supplier-distributor relationship. Instead, it’s become a source of frustration and a flash point of controversy.

The Cost of Discounts

Counselor’s 2024 State of the Industry report found that three-quarters of suppliers and distributors believe that communication with their supply chain counterparts is “strong.” But that doesn’t mean each side doesn’t have their long-standing issues with the other. Count price breaks among them.

Some suppliers say they’re being pushed for lower prices constantly. “Most distributors ask for discounts or EQP and claim to receive preferential pricing from other suppliers,” says Amberlea Barnes, general manager of Drum-Line (asi/50873). “They’re often disappointed when we tell them our price structure isn’t set up for instant discounts. The problem is distributors expect special pricing on small orders regardless of their overall sales. Discounted price structures only work when a customer buys enough for their overall volume to offset the low profit margins.”

Rebates and other price breaks on the whole were originally meant to “help cover costs distributors incurred to promote a select group of preferred suppliers to their salespeople,” Barnes continues. Instead, she now sees companies requesting rebates from every supplier – even without showing an opportunity for sales growth.

In addition, says Lawrence Giles, national sales director at Vu Line Direct (asi/94226), “suppliers have an enormous amount of overhead, including product costs, warehousing, salaries, benefits, machinery, real estate, and this further compounds the matter. The distributor, on the other hand, doesn’t take on the same amount of financial risks and expects various pricing concessions like waived charges. This puts added pressure on the supplier, as they not only have various costs but also a market-dictated price ceiling, so there’s pressure from all sides – the market, the client and the costs.”

Some distributors say it’s the suppliers who are extending discounts right out of the gate. “In our experience, the price breaks are proactively being presented to our AIA community, rather than being driven by distributor request,” says Katrina Willis, senior vice president of marketing and supplier relations at Counselor Top 40 distributor AIA (asi/109480).

Many distributors, though, note that they don’t expect price breaks all the time – but they do need to compete, which the added discounts help with. Zack Ottenstein, president of The Image Group (asi/230069), says distributors are experiencing more pricing pressure from customers. In addition, customers are asking for less expensive products overall.

Both suppliers and distributors that Counselor spoke with don’t believe that rebates and price breaks on promo products orders are a bad thing – it just means the practice is potentially being taken advantage of on both sides.

“I think the industry’s rebate structure has benefits,” Ottenstein says. “It encourages higher volume spending with key relationships, reduces upfront discounting and creates flexibility when needed for business opportunities where a permanent price adjustment would create issues.”

Tim Holliday, co-owner of Children’s World Uniform Supply (asi/161711), agrees. “Rebates and price breaks are a double-edged sword,” says Holliday, whose company appeared on Counselor’s 2024 Best Places to Work list. “I belong to a buying group that gets those things for me as a part of the group, and those are a great way to improve margins. For whatever reason, somewhere back in time, it was decided that a 40% profit (or even less on some products) was good in this industry, compared to most other service and retail industries that have 50% profit margins. Being able to get better margins from rebates and price breaks allows you to have a healthier business and discounts where you need, like with nonprofits, and still be OK.”

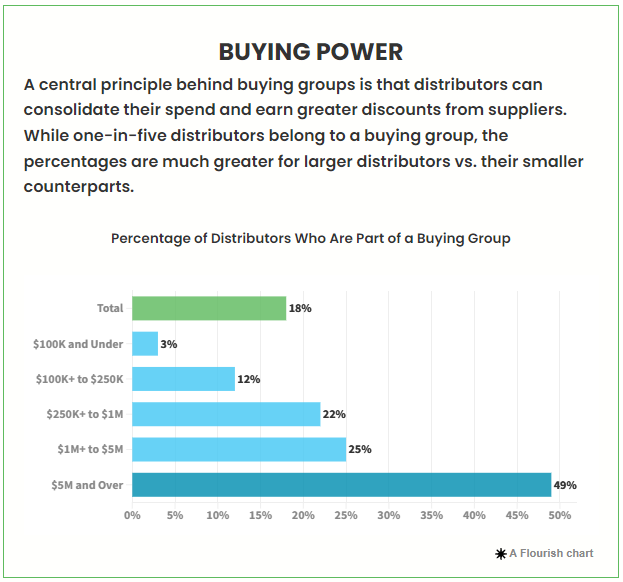

Buying groups’ role in this discussion can’t be ignored. The idea is that independent distributors combine their purchasing power and funnel their collective spend to preferred suppliers to secure better pricing and stronger vendor relationships. Counselor’s SOI report found that 18% of all distributors belong to a buying group – but just 3% of distributors with $100,000 and under in revenue, compared to nearly half (49%) of extra-large distributors at $5 million and above.

One supplier executive, who wished to remain anonymous, says buying groups have been instrumental in creating a culture of price breaks, compelling distributors across the industry to compete on price and ask for discounts of their own.

It doesn’t help that, as Ivory notes, some distributors operate as “order-takers” who push for lower and lower prices – which ultimately negatively impacts the industry.

Price breaks not only set unrealistic expectations about costs but can cause problems to cascade into other areas. Shipping charges are a particular sticking point for Ivory, who says they’re being used as a profit center by suppliers. “So, initially, the practice was we’ll give you three days shipping at ground rates, which was lovely and helped foster growth for that category,” she says. But things have changed. “I know our suppliers have much better rates than most distributors due to the volume that they’re shipping out, but they’re marking up shipping to exorbitant fees, like double. I also get good shipping rates. So I know what rack rate is and I know what my shipping discount is, which is probably less than what a supplier is getting. And yet they’re coming in at higher than rack rates.”

It’s not that Ivory is against profit for suppliers, which she quickly points out. But increased shipping just adds to the tension created by a culture of price breaks, whether they’re being asked for or just handed out. “We should earn the right to have better pricing or rebates,” she concludes. “Profit is good for everybody, but gouging is not.”

Frustrated distributors and suppliers say that continually offering (and accepting) these price breaks creates a “race to the bottom” culture, where everyone is trying to offer their customers the lowest price possible without first forming a mutually beneficial relationship.

Building a Relationship

So what’s the solution? Suppliers and distributors alike agree: transparent relationships, either with one another or with a legitimate buying group, which negotiates price breaks on behalf of a collective.

“Personally, I think suppliers should limit who they give special pricing and rebates to, like to decent-sized buying groups and not just to anybody or anyone who throws together a couple of distributors and calls it a buying group,” Holliday says. “And those distributors in buying groups should have to be a decent size, by hitting some minimum sale amounts in order to get in, or stay in, any kind of buying group. Things like this would eliminate some of the suppliers’ issues, and it would eliminate the issues with at least some of the distributors who just want to get the lowest price on everything.”

When it comes to one-on-one connections, it’s all about good communication and making it known that a supplier and distributor will have a mutually beneficial relationship. Maybe a distributor will work exclusively with one supplier for towels and another for pens. And once that relationship is proven, or if both parties agree right away, then the supplier can offer things like reduced pricing or better shipping rates. Expect to go into a supplier-distributor relationship with the desire to create a functioning partnership rather than expecting discounts out of the gate.

A good way to get to the level of transparency needed for a solid working partnership is by publishing fair prices that don’t change based on special deals without a prior good relationship.

“Suppliers have created this culture where distributors believe they need EQP to compete by publishing prices and then giving special deals to everyone,” Barnes says. “The best supplier-distributor relationships are built by offering quality products at a fair price and backing it up with great service. That’s more valuable than a rebate.”

Ivory agrees. “Quit offering EQP to the universe,” she says. “For true partners, that’s where suppliers negotiate and either give EQP or rebates or reduced shipping. They can incentivize and say ‘In the next three months we’ll work with you here,’ but just to go out and give everybody EQP makes me crazy. That’s the race to the bottom.”

And for true partners, suppliers and distributors shouldn’t be afraid to be flexible to keep the relationship strong.

Holliday shares a story about how one supplier lost all future business from him, even though they had a trusted relationship. “I recently had a reorder of an item from one of my customers,” he says. “The supplier had a policy that there are no reorder charges within a two-year period. This order came in 10 days after the two-year mark.”

The supplier he was working with refused to budge on waiving the new setup charge, and his customer decided to go with a different manufacturer that doesn’t charge one at all. Now, all future orders for that particular customer will go to that new manufacturer. “Suppliers and distributors have to work together for the betterment of the industry,” Holliday says. “Sometimes, it’s not even a matter of special pricing or rebates but a matter of just doing what makes sense.”

Ultimately, it all comes down to enabling one another to do what’s best for the customer. Suppliers should share their strategic focus with distributors, says AIA’s Willis, and in return, distributors should do what they can to support them where it makes sense to do so. That’s a win-win for the entire industry.