Executives say they’ve finalized the single biggest acquisition in the history of the North American promotional products industry.

Counselor Top 40 supplier S&S Activewear (asi/84358) announced today that it has completed the purchase of fellow Counselor Top 40 supplier alphabroder (asi/34063).

Financial terms of the deal between the privately held companies were not announced. However, the acquisition is undoubtedly a blockbuster, wedding an apparel supplier that generated an estimated $2.106 billion in 2023 promo revenue – S&S – with alphabroder, a provider of apparel and hard goods that tallied just over $2 billion in industry revenue last year.

S&S and alphabroder ranked second and third, respectively, on Counselor’s 2024 list of the largest suppliers in the industry.

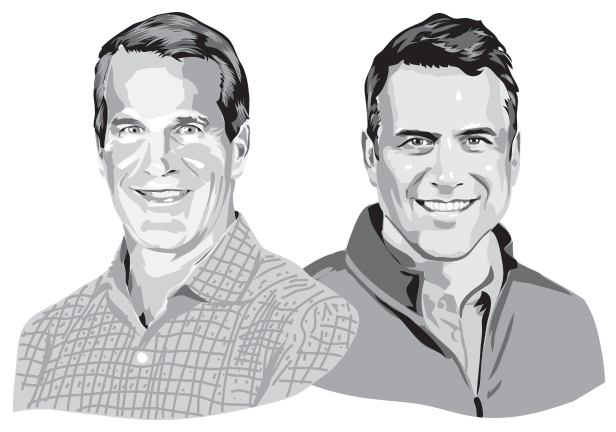

“Today marks the start of an exciting new chapter for our company, as we build on the unique strengths of S&S and alphabroder to enhance the customer experience, strengthen our relationships with our industry partners and continue to invest in growing our sales force and technology capabilities,” said S&S CEO Frank Myers, a member of Counselor’s Power 50 list of the most influential people in promo.

Going forward, Myers will lead the combined company. Dan Pantano, alphabroder’s CEO and a Power 50 member, will provide support through the integration process. For now, S&S and alphabroder will continue to go to market under their respective brand offerings backed by their existing distribution channels.

“We are pleased to officially join with S&S and kick off the integration process,” said Pantano. “Together, we are focused on building on our business momentum, while continuing to exceed the expectations of our customers and our partners as we begin our next phase of growth as a combined company.”

The companies announced the acquisition in August. However, the deal still needed to be officially closed. That’s now occurred.

Changes To Decoration Offerings Are Planned

As part of the finalized acquisition, S&S plans to gradually exit the apparel decorating business – an alphabroder offering – with the expectation that this will be completed by the end of March 2025.

Hard goods decoration will remain an offering for the alphabroder brand, and customers can continue to access such products and services through their existing channels. Looking ahead, S&S plans to create a standalone hard goods decoration business division that will be led by a general manager and supported by a sales and service team.

Myers noted that over the past few months S&S has had discussions with customers and vendors that will inform the strategic direction of the company. The intent, he said, is to make certain that S&S is best-positioned to deliver for its partners into the future.

“As we work to bring this combination to life, our top priority is ensuring our employees, customers and vendors continue to succeed alongside S&S,” Myers said.

Both S&S and alphabroder were private equity-backed at the time of the deal. PE firm Clayton, Dubilier & Rice (CD&R) is the majority owner of S&S and played a key role in supporting the acquisition.

S&S’s purchase of alphabroder marks the biggest move to date in the firm’s remarkable growth story. Little more than a decade ago, the company was a solid regional supplier, mainly serving customers in the Midwest.

Now, through advancements that include savvy acquisitions, which include buying former Top 40 supplier TSC Apparel, and the expansion of its footprint with the opening of facilities in strategic points throughout North America, the company is poised to potentially become the single biggest supplier in the promo industry. The firm also announced the recent deployment of advanced mobile robots, which help streamline distribution center operations.

“With the addition of alphabroder’s dedicated and experienced employee base, strong portfolio of brands and distribution capabilities, we will not only expand our product offering, but will also accelerate our investment in the customer experience, including our marketing, technology and supply-chain capabilities,” Myers said.

Promo mergers and acquisitions cooled in the latter half of 2023, but the business buying and selling in the merch space has picked up again in 2024, with top industry firms making deals domestically and internationally. With interest rates poised to lower, some though not all industry leaders believe M&A activity could accelerate in the months ahead.

Executives noted that UBS Investment Bank, Barclays, Deutsche Bank Securities Inc., TD Securities, BMO Capital Markets, BNP Paribas, Societe Generale, Citizens Bank N.A., Natixis, RBC Capital Markets LLC and Truist Securities provided financing and served as financial advisors to CD&R on the acquisition.

Solomon Partners and SG Americas Securities LLC also served as financial advisors to CD&R. Debevoise & Plimpton LLP served as legal advisor to the PE firm. Harris Williams was the exclusive financial advisor and Sheppard Mullin LLP served as legal advisor to alphabroder.