Key Takeaways

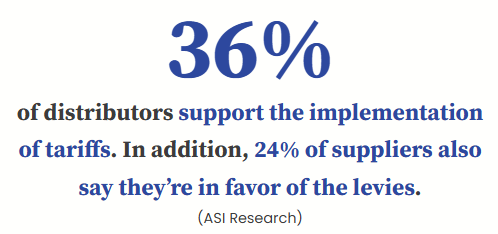

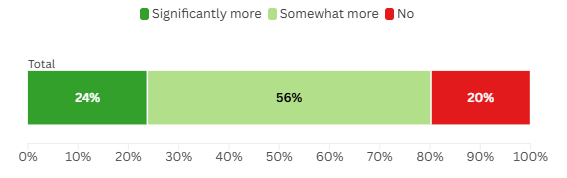

• Support for Tariffs: ASI Research has found that more than a third of promo industry distributors and nearly a quarter of suppliers support tariffs, believing they will drive business back to the United States and ensure fair trade.

• Economic Impact: While there are concerns about the short-term economic impacts, especially price hikes, some industry professionals believe the tariffs are already working, citing examples of countries reaching out to negotiate.

• Standing Out From Competitors: Industry professionals say that since the tariffs will apply more or less equally to everyone, companies will succeed by differentiating themselves through their sourcing, creativity and differentiation.

The promotional products industry – as well as businesses in all industries – has been rocked over the past few weeks with a dizzying deluge of tariff announcements, upticks and rollbacks from the Trump administration. The rapid news cycle has left suppliers and distributors alike sorting through the many potential impacts, from price increases to renewed interest in Made-in-America products to the possibility of decreased consumer spending.

Despite the uncertainty about how the situation will ultimately play out, the reality is that not every promo pro is against the tariffs. In fact, according to new findings from ASI Research, more than a third of distributors and nearly a quarter of suppliers say they personally support the tariffs.

In conversations with ASI Media, supporters point to a number of reasons they’re in favor of the levies, including bringing jobs back to the U.S., lowering America’s global trade deficits and “leveling the playing field” between companies in the United States and foreign manufacturers, especially those in China.

Brent Hadaway, CEO of Texas-based distributor BKH2 Productions (asi/140655), knows it’s impossible to deny the short-term impacts, including price hikes and fears of an economic downturn amid unsettled financial markets. But he’s focused more on statements from the current administration that the tariffs are meant to be a negotiation tactic to reduce trade imbalances.

“I honestly believe it will drive business back to this country, create jobs here and stimulate the economy,” Hadaway says. “And other countries will have no choice but to back off on their tariffs or suffer the economic consequences.”

And, he says, he believes it’s already working.

Whether Suppliers & Distributors Personally Support Tariffs

36% of distributors and about a quarter of suppliers say that they support tariffs, according to new findings from ASI Research.

After President Donald Trump announced an initial round of higher-than-expected reciprocal tariff rates – calculated based on each country’s trade imbalance with goods from the United States and the quantity of imports to the U.S. – more than 75 countries reached out with efforts to negotiate, Trump officials have said. And Trump paused the implementation of those heightened so-called reciprocal tariffs for 90 days mere hours after they went into effect on April 9. While the pause is in effect, import tariffs on most nations will be at Trump’s baseline rate of 10% – with the exception of China, which still faces an additional 145% tariff hike, as well as a recently announced 120% tariff on goods previously duty-free under the “de minimis exemption.” (China retaliated late last week with 125% tariffs on imported U.S. goods.)

“It’s a negotiation,” says Laura Maret-Puls of KB Best Promos, an authorized owner under Counselor Top 40 distributor Kaeser & Blair (asi/238600). “We’ve all been involved in negotiations – your first offer is not usually your final resolution.”

Tracy Willis, owner of distributor The Peachtree Group (asi/292497) in Smyrna, GA, agrees.

Because China and the United States are one of each other’s top trading partners, he says, both countries should be motivated to make trade between them easy, and fair.

In the meantime, businesses are likely going to have to make sacrifices in support of what Trump has stated are his long-term goals for the heightened tariffs, including ensuring fair trade between the U.S. and other nations (America has historically had, for example, one of the lowest average tariff rates in the world, according to data from the World Trade Organization), paying down the national debt, offsetting planned tax cuts and stimulating the U.S. economy.

But Willis thinks the negotiations will settle down within a matter of months to a trade agreement that’s acceptable to both countries.

“China cannot afford any kind of trade war with the United States, any more than we can with them,” Willis says. “I think they’re going to want to sit down at the table.”

Returning Jobs to America

One of the biggest reasons cited by Trump for the tariffs? To restore U.S. manufacturing.

Over the course of his lifetime – and his four decades in the promotional products industry – Richard Budd said he has watched the decline of the U.S. manufacturing sector as many factories closed or relocated to other countries, including China.

The United States is still the second-largest manufacturer in the world, but its American workforce has declined over the past 50 years. In 1971, nearly a quarter of Americans worked in the manufacturing sector, according to a data compilation from the St. Louis Federal Reserve Bank. In 2025, that figure is less than 10%.

Today, Universal Printing Company – a Dunmore, PA-based decorator where Budd is executive vice president of national sales – primarily imprints apparel, mugs and other hard goods entirely imported from China.

He knows his ideology in support of the tariffs seems conflicting because of that business model – but he’s such a strong believer in a return to American manufacturing that he doesn’t mind the hit his business might take.

“Why in the world would I be in favor of what the Trump administration is doing with tariffs?” Budd says. “The answer is because I know what our country used to be like and what our country is now. This country means more to me than it all being about my needs.”

“I honestly believe the tariffs will drive business back to this country, create jobs here and stimulate the economy.”

Brent Hadaway, BKH2 Productions (asi/140655)

It’s a common view among tariff supporters, even among those who aren’t fully in support of the rapid-fire cadence of the announcements. Dave Jackson, president of IC Group-Marketing (asi/170276) in Salt Lake City, is steadfastly opposed to how the past few months have played out – but he is aligned with the long-term goal of focusing more on American-made products and reducing reliance on overseas production for everything from promo to pharmaceuticals.

“I think industry in the United States benefits when we re-shore – when we bring things back here, and we can manufacture at a high quality and bring those jobs back to the United States,” Jackson says. “That’s the kind of leveling of the playing field I’m talking about.”

Supplier executives and promo sourcing experts have told ASI Media previously that they believe the vast majority of products sold in the $26.6 billion promo industry will continue to be produced overseas. They and economic experts cite a litany of reasons why manufacturing jobs won’t return en masse to the U.S., and certainly not quickly: lack of infrastructure, not enough resources and raw materials, and a shortage of people willing to work factory jobs for low wages. If it were to happen, it would take years to establish enough supply lines in America to service the entirety of the industry at scale.

“Realistically, you can’t set up a factory overnight and start producing complex products like stainless-steel bottles or premium backpacks at a promo price,” says Counselor Power 50 member Heather Smartt, head of Counselor Top 40 supplier Goldstar (asi/73295), a hard goods supplier.

Still, there is evidence that demand for Made-in-USA products will increase in the coming months. ASI has already noted increases in the percentage of searches using “Made in USA” filters on its ESP and ESP+ platform, including a 66% year-over-year spike from April 1 to April 6 in the wake of the president’s announcement of reciprocal tariffs.

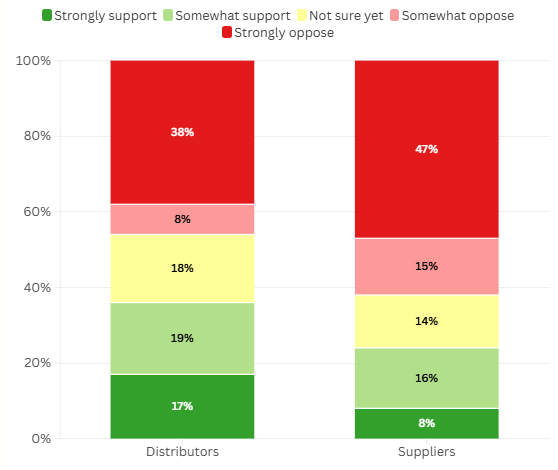

New data from ASI Research also shows that 80% of distributors are planning to purchase more Made-in-the-USA products in the near future, including nearly a quarter of distributors who said they plan to purchase “significantly more.”

Do distributors anticipate purchasing more Made-in-the-USA products in the near future?

4 in 5 distributors reported that they expect to purchase more American-made promo items in the coming months, according to new findings from ASI Research.

The tariffs, especially the high ones still on China, could also make American-made products more comparable in price to their imported counterparts, said Daniel Gottlieb, president of Gott Marketing (asi/212278), a marketing agency that serves the building products and construction sectors.

“My customers also appreciate American-made products to begin with,” says Gottlieb. “With tariffs, the gap in price between the cheap knockoff and the American-made product is negligible.”

Industry Competition

Willis sees tariffs more or less having the same impact on any given promo firm. The same price increases that affect him at The Peachtree Group are going to affect his fellow distributor down the road, he says.

In that way, the tariffs can be an opportunity for suppliers and distributors alike to leverage their relationships and sourcing skills to differentiate themselves within the promo market, says Randy Chen, president of New Jersey-based Impex International Inc., which provides direct import services and warehousing for promo industry suppliers.

Take, for example, a product that’s available in both China and Taiwan, says Chen. China’s base price on the item may be cheaper, but because Taiwan isn’t currently subject to the 145% tariff increase on Chinese imports, your overall costs for importing from Taiwan now may be lower than they were.

“You’re going to see who can be more creative so that they can stand out in that monotone, competitive sourcing field,” Chen says. “That might be advantageous to you, to have the ability to source from somewhere else.”

“As businesspeople and salespeople, we have to do our jobs. We have to find ways to make clients’ dollars stretch and work with their budgets.”

Tracy Willis, The Peachtree Group (asi/292497)

That potential for competition extends outside of just sourcing, too, to the products themselves. Gottlieb, the distributor who services the building products sector, has noticed some stagnancy in product availability. It seems like many items are just a copy and paste of items that already exist and can be purchased cheap from China, he says – and if they’re no longer being sold purely off price, they won’t stand out.

“My customers are all looking for something different from their competitor – I can’t tell you the last time I sold a tumbler or pen,” Gottlieb says. “I think the tariffs are going to force innovation or drive a lot of the repetitive products out of the market.”

There is concern from customers, says Jackson, around all the uncertainty, particularly when it comes to spending on promo – questions about buying now to avoid further tariff-related costs or putting a hold on the budget until things settle. That’s especially true in the context of overall consumer fears about inflation and rising costs on a variety of household essentials due to tariff implications. Some estimates say the tariffs will cost the average household an extra $3,800 a year compared to 2024.

But, again, says Willis, that means the industry has to fulfill its mission of delivering for clients at all times – and especially in the face of uncertainty. “As businesspeople and salespeople, we have to do our jobs. We have to find ways to make clients’ dollars stretch and work with their budgets,” he maintains. “It’s going to be all about service, creativity, educating my customer base and finding other products and services to sell to them.”