Last year, ASI Research debuted a landmark data-backed study that provided a first-of-its-kind comprehensive estimate of total promotional products distributors’ sales across the United Kingdom and European Union.

The analysis was never meant to be a one-off. Rather, it was intended to be the launching pad of an envisioned annual study of Europe’s promo business performance. And that’s just what it’s now become.

Following months of study, ASI Research has released its second-ever annual estimate of promo sales in Europe. This year’s report is larger than last year’s, adding three new nations to the mix that are geographically in Europe but not politically part of the U.K. or EU – Iceland, Norway and Switzerland.

The study also once more includes a nation-by-nation sales breakdown for the U.K. and each of the 27 countries that comprise the supranational political and economic union known as the EU.

The topline 2023 tally for all U.K. and European (EU and the three others) distributor sales? Nearly $14.1 billion.

The total is more than half the size (54%) of the North American promo market, in which distributors collectively produced sales of $26.1 billion in 2023 on the back of 1.2% year-over-year growth, according to ASI Research.

Nate Kucsma, ASI’s senior executive director of research and the leader of the study, said the performance across the U.K./Europe was strikingly similar to that of the North American promo market in that sales broadly increased but did so moderately amid a plethora of challenges.

“The growth rates across nations were fairly measured, and there was not significant variation in the sales expansion rates among the various countries,” says Kucsma. “It shows a remarkable degree of interconnectivity.”

Keen observers may note that a comparison between 2023’s $14.1 billion figure and ASI Research’s estimate of $12.48 billion for the year before would indicate a year-over-year increase of about 13% in the U.K./Europe. Still, Kucsma explains that’s not an apples-to-apples comparison, as additional countries were added to the study this year and estimates for some countries, like Portugal and Spain, were reassessed in light of additional information that showed actual performance was stronger.

ASI Research developed the sales estimates through a combination of efforts that included intensive number-crunching and extensive first-person research conducted with key leaders in the U.K./European promotional products market.

ASI was able to leverage those executive connections, in part thanks to its several decades of transcontinental promo relationship-building, being a lead member/co-founder of international industry partnership organization PromoAlliance and through providing consistent media coverage of the merch market in Europe, including boots-on-the-ground reporting of major trade shows like PSI in Germany and Merchandise World in the U.K.

As for the number-crunching, researchers used the North American market as a sales benchmark.

With that in mind, ASI Research developed an algorithm that incorporated evaluations of gross domestic product per capita, advertising spend per capita and the number of small- and medium-sized businesses in every European country assessed. Researchers used the resulting formula and insights from European industry leaders to determine total promo spend estimates for the U.K. and the various European countries, then added those up for a combined total.

As promo increasingly globalizes, with more business interaction between the North American and European promo markets, it’s important to have industry-wide sales estimates that provide a scope for the addressable markets on both continents, says Kucsma.

“These numbers help orient the industry and aid every company in understanding where they stand and how they’re performing relative to the larger marketplace,” the research executive says. “We plan to continue to evolve our study in the years ahead.”

Big Players

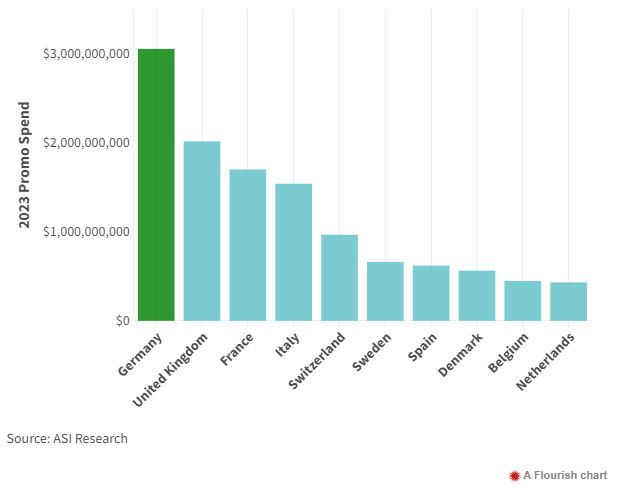

When it comes to the U.K. and Europe, the top five countries for promo sales are Germany ($3 billion+), the United Kingdom ($2 billion+), France (nearly $1.7 billion), Italy (about $1.54 billion) and Switzerland (nearly $966.5 million).

The first four countries, which all experienced promo spend above $1 billion, are probably not a surprise. They’re home to Europe’s big national populations, major brands/corporations, and the continent’s largest national economies, all of which would be expected to drive swag spend.

Switzerland, however, counts a population just below 9 million. The Central European nation powered its way to the top five thanks, in significant part, to being a primary international center for banking and corporate headquarters, Kucsma says.

As such, a lot of merch investment decisions were made in Switzerland, resulting in nearly $1 billion in swag spend transacting through the nation, even if high proportions of the actual products were distributed beyond the geographically small country’s borders, according to ASI Research.

“Switzerland punches above its relative population weight due to its importance to the global economy,” says Kucsma.

Rounding out the top 10 countries were Sweden (nearly $661.2 million), Spain ($620 million), Denmark ($563.7 million), Belgium ($448.1 million) and the Netherlands ($431.4 million).

Spain is one of Europe’s most populated countries (about 48 million) and has one of the continent’s more advanced economies, with tourism and other industries driving commerce – all of which helped spark investment in swag. ASI Research developed additional information this year that enabled a more accurate estimate of Spain’s promo market, leading to a figure of $620 million for 2023, Kucsma notes.

In population terms, Spain is about eight times bigger than Denmark, more than four times bigger than Sweden and Belgium and nearly three times bigger than the Netherlands. However, those affluent Northern European countries have fairly robust economies, advanced marketing/advertising sectors and relatively high per capita GDP – all of which contributes to spurring comparatively muscular promo spending, research shows.

An Uneven Year

In North America, distributors’ sales growth in the second half of 2023 slowed. In the fourth quarter, for example, sales were essentially flat with a 0.9% increase reported, according to ASI Research.

Broadly speaking, the 2023 business performance of U.K./European distributors mirrored their cross-Atlantic counterparts.

“The second half of 2023 was a slower period for promo sales in Europe,” says England native Chris Lee, a member of Counselor’s Power 50 list of promo’s most influential people and CEO of The Pebble Group, the U.K.-headquartered parent company of promo software maker Facilisgroup and global distributor Brand Addition (asi/202515).

Lee continues: “Following the post-COVID bounceback, a whole host of macroeconomic factors led to caution on corporate spending in the year’s latter half, with many buyers holding onto their budgets and cash, delaying decisions around marketing investment.”

Business hurdles that had merch buyers balking included inflationary pressures, high interest rates, hesitancy to spend due to marketplace uncertainty and recession in economic powerhouse Germany, intensifying regulations that complicated business and even, in cases, political instability.

The recession in Germany contributed to promo distributor sales declining 0.68% in the country. “The general economic situation and mood in Europe, especially in Germany, has been rather negative,” shares Tobias Roesch, co-CEO of elasto GmbH & Co. KG (asi/51817), a large Germany-based supplier.

The Deutschland doldrums had a knock-on effect throughout Europe, given the nation’s pride of place as the continent’s largest national economy and biggest promo market.

“The German economy floundered, and that weighed on overall demand,” asserts John Lynch, founder of Krakow, Poland-based Lynka, one of Europe’s leading producers and suppliers of imprinted activewear, corporate clothing and accessories, which in 2021 became part of Counselor Top 40 supplier Vantage Apparel (asi/93390).

Despite Germany’s struggles, the promo market there still remained above the $3 billion mark – the only nation in the U.K./Europe in that category and about a third larger than the second-place United Kingdom. As importantly, promo distributors in the overwhelming majority of nations studied, including nine of the top 10, engineered collective year-over-year sales increases, even if those rises weren’t off the charts, according to ASI Research.

Distributors executed the gains through a variety of means, including capitalizing on what remained of the post-COVID momentum – like the return of in-person business events and festivals.

“Events and travel were full-force again in the U.K. and the EU, with tourism as an economic driver,” says Power 50 member Jo-an Lantz, CEO/president of Counselor Top 40 distributor Geiger (asi/202900), a Maine-headquartered firm that operates in North America as well as the United Kingdom and continental Europe. “Similarly, an uptick in activity from the financial and retail markets helped drive promo sales.”

Meanwhile, with companies focused on retaining talent in the new hybrid working model, there was a growing trend of using promotional products to boost employee morale and engagement, including investment in employee onboarding kits, says Pieter Boonekamp, general manager of PF Concept, Europe’s largest merch supplier. More than a few distributors capitalized on that, he says.

“We’ve seen a trend toward merchandise that creates stronger ties between employees and their employer,” says Power 50 member Jay Deutsch, CEO of Washington-based Counselor Top 40 distributor BDA (asi/137616), which operates in key European markets like the U.K. and Germany. “The power of merchandise to show appreciation, incentivize, reward, inspire and welcome is unmatched.”

Some distributors and suppliers say demand for retail items and, relatedly, perceived higher value products helped pump up sales numbers, too. “We’ve definitely seen a shift to more high-end products,” shares André Noordwijk, owner/general manager of Netherlands-based promo firm BeGlobal Promotions.

In the U.K. in particular, a greater acclimatization to the post-Brexit reality among businesses and a general adaptability among distributors were among the additional factors that helped distributors keep business moving, executives say.

“Since COVID, many companies in the industry have been running leaner than before in terms of staff and overhead. This put them in a strong position to handle a challenging market,” says David Long, founder/executive chairman of Sourcing City, an ASI partner, PromoAlliance member and trade service organization that provides a suite of solutions for the U.K. promo market.

M&A’s Uptick

Another way some promotional products companies are driving sales in the U.K./Europe is through strategic acquisitions that enable them to increase market share.

Large North American-headquartered distributorships have been among the active when it comes to M&A.

To wit, Geiger has been consistently acquiring competitors in Europe since 2018, including this year’s acquisitions of Brandelity in England and WER GmbH in Germany. Building on past European acquisitions, BDA last year bought Germany-based ipm | gruppe and this year purchased U.K.-based sports merch firm The Great Branding Company. Counselor Top 40 distributor Myron (asi/278980) has gotten in on the action too, buying German distributor Schneider GmbH in February.

“The last few years have seen a number of the major U.S. distributors making multiple acquisitions across Europe,” says Lynch. “As global corporations increasingly demand global solutions to their merchandise needs, these moves are inevitable.”

To be sure, European-based companies are also purchasing competitors. In part, some executives say, their moves are related to North American firms’ acquisitions in the market.

“U.S. distributors being relatively acquisitive in the European market inevitably triggers a broader impact,” says Mike Oxley, the U.K. CEO of distributor Prominate (asi/300426).

Supplier-side deals are happening, too. Europe-based supplier Premium Square Group has been busy. “We have completed three acquisitions in the last two years to add territory and products to our range, and we’re definitely looking for others,” says Counselor Power 50 member Jeff Lederer, who holds a co-majority stake in Premium Square and is a leader of the investment firm that owns Myron.

Nonetheless, European promo leaders assert that M&A in the U.K. and on the continent is not happening at the rate seen in North America, where acquisitions have been on an upward arc, with massive deals – including the biggest the North American industry has ever seen – occurring. “It feels like there are slowly more M&As in Europe, but it’s nowhere near comparable to the U.S. market,” says Roesch.

Promo leaders in the U.K. and EU aren’t expecting promo M&A to rapidly intensify on their shores, nor do they believe vast consolidation of their fragmented markets is in the cards. Still, many say they anticipate a gradual rise in mergers and acquisitions in the years ahead.

“With intense competition and market saturation,” says Boonekamp, “I would expect to see a continued approach to M&A, as businesses look to increase market share.”

Adds Oxley: “I do expect further M&A as some companies struggle/fail and as other U.S. distributors take an interest. However, I think a wholesale shift in the market is unlikely.”

The Sustainability Impetus

Get this: In 2023, Netherlands-based BeGlobal Promotions experienced 35% year-over-year growth in sales of sustainable products within its portfolio.

The increase was driven by end-buyer demand and government regulations that have clamped down on easily disposable products with short life cycles, says firm principal Noordwijk.

BeGlobal’s experience with sustainable product sales, and the reasons for it, are representative of perhaps the broadest product phenomenon sweeping promo Europe from Reykjavik to Rome: customers’ rampant demand for ethically made items that minimize impact on the planet, and the industry’s intense impetus to meet the need.

“It seems that all new products now have sustainability credentials,” says Long. “This focus on the environment has been prevalent in the U.K. for several years now, and most suppliers have ranges of products that have some claim to be environmentally friendly.”

Executives think the demand for green will only grow, continuing as not a trend but a foundational launching point from which all new products must be created. “In the apparel arena, for instance, there are a number of brands that have already gone 100% sustainable, like Mantis and Neutral,” says Lynch. “At Lynka, we have one of the most sustainable apparel decoration facilities in Europe and continue to invest in eco-friendly solutions.”

To be clear, sustainability doesn’t just mean using eco-friendly materials. It involves ensuring a product with such materials is made through a supply chain in which workers are treated humanely and properly compensated, all while operations have increasingly fewer impacts on the earth. The emphasis extends to how the products are circulated, too.

“Stricter regulations on packaging waste are pushing companies to use minimal and recyclable packaging for their promotional products,” notes Boonekamp.

Speaking of: End-buyers are increasingly demanding proofs/certifications of eco/ethical claims and government-driven laws are making certain sustainable operations a requirement. “Companies are increasingly required to conduct LCAs (life cycle assessments) to measure the environmental impact of their products from production to disposal,” Boonekamp says.

Promo Europe is working to keep up with the change, though executives admit that doing so requires continual evolutionary efforts in operations, managing tomes of additional paperwork and shouldering increased costs.

“The amount of data that needs to be collected and maintained to report under the EU’s Corporate Sustainability Reporting Directive, for example, is massive, and requires even more investments in technology to store, measure and report,” shares Boonekamp.

On an industry-wide level, more must be done to keep up, some say.

“The lack of specific information on carbon emissions of products can be an issue,” says Geiger’s Lantz. “As a result of legislation, we’re required to provide carbon emissions on products for certain clients. Suppliers are making progress in this area and will slowly improve. As a distributor, we need to implement systems and processes to hold this data and pull it forward to our clients in addition to our own efforts to reduce our carbon footprint.”

To Lantz’s point on progress, for sure some suppliers have already made pivotal advancements. Netherlands-based XD Connects, Counselor’s 2024 Sustainability Advocate of the Year, has made a mission of proving its goods are sustainable – and providing a model for others to follow in that regard.

XD Connects’ work includes implementing a virtual passport that authenticates sustainable materials throughout the production process and developing an independently verified life cycle assessment tool that calculates the cradle-to-grave carbon emissions generated by each of its products. The supplier publishes those figures on its website and in its catalogs.

Importantly, promo leaders ASI Media spoke with believe the green revolution is ultimately for the better of the merch medium – and people and planet – and thus essential to keep advancing.

“A more professional, sustainability-minded industry is necessary for the ongoing health of the European promo market, especially as it relates to buyers’ perceptions of what we do,” says Oxley. “The alternative is that some buyers will simply disengage with promo.”

A Quick Word on Product Preferences

European promo leaders say the most popular product categories tend to be fairly consistent across borders, though for sure there are degrees of regional/national variation, such as outerwear being more popular in colder climate northern countries.

In general, drinkware, writing instruments, bags and gift baskets, especially around the holidays, tend to have wide appeal. Retail/higher-end items carry cachet with buyers, too. Apparel has gained considerable steam, though still is not yet at the popularity levels seen in North America. Notably, in the garment realm, synthetic fabrics are making greater inroads; Europe has traditionally been cotton-heavy in preference. Caps/headwear haven’t caught on in a big way and, according to some, the interest in hoodies has waned of late. Unimprinted gifts are more popular than in the U.S.

“It goes without saying,” says Jo-an Lantz, president/CEO of Counselor Top 40 distributor Geiger (asi/202900), “that clients want solutions that are truly sustainable and information from cradle to grave on the products we provide.”

Outlook 2024

Promo leaders in Europe tell ASI Media that 2024 has been an uphill battle. While some believe their particular companies will grow annual revenue, the most common sentiment is that, on an industry-wide level across the U.K. and Europe, distributors’ collective sales will be flat or down compared to 2023.

“We hear from many sides that it’s currently tough times,” says Roesch. “My feeling is that our industry, as a whole, will not see increases but a decline.”

Lynch offers a similarly sobering perspective.

“We are an industry of optimists,” says the Lynka leader. “In my 33 years in promo, the only year I heard anyone openly admit to a sales decline was 2020, the COVID year. That said, in the first half of 2024 in Europe, I have heard partner after partner share their dismay over the slow start to the year. Some are openly discussing large deficits to 2023 sales, while others express their hope that the end of the year will bring a much-needed sales boost. In the end, I suspect the European industry would be quietly satisfied if 2024 turned out to be flat.”

What’s driving the dourness? In part, it’s a hangover from the COVID recovery boom days, some say. Boonekamp gives an answer that sums up the perspective of many on even more foundational causes. “The trouble is ongoing economic uncertainty, which includes inflation, rising interest rates and lingering concerns regarding potential recessions,” he says. “All that impacts business spending.”

There are internal challenges too: rising costs for labor and energy, for instance, as well as supply chain disruption. Indeed, the rerouting of cargo-carrying ships away from the Suez Canal, due to Houthi militant attacks in the Red Sea, has had a more substantial impact on European promo supply lines than North American ones, as the Suez is the primary route for many U.K/Euro firms importing from Asia.

For sure, there are positives to report, too. Long, the Sourcing City executive, says he’s optimistic, at least as far as the U.K. promo industry is concerned.

“The economy is stabilising after significant inflation, and the year has major events which increase demand for promotional merchandise, such as a general election, the European Football Championships and Olympics.” He notes that Sourcing City’s twice-annual trade show, Merchandise World, has a record number of exhibitors for the September version of the event.

Deutsch has some upbeat words as well: “We are seeing modest market segment volume increases in the U.K. and Europe in 2024. The market had a steady return following the COVID pandemic, and we are optimistic about the future.”

Ultimately, for promo growth to happen on an industry-spanning level, Lee says that businesses need to feel confident about the stability and direction of the economy. They’re not quite there yet. Even so, there is cause for encouragement, he says.

“Businesses continue to be careful in their marketing spend,” The Pebble Group executive says, “but I am hopeful that the industry will see a slow, but steady, uptick in spend in the second half of 2024 compared to the second half of 2023.”

Spotlight on Turkey

Turkey’s profile on the global promotional products scene is on the rise.

With a population of about 85 million, the country primarily lies in West Asia, on the doorstep of Southeastern Europe, with a small part of the nation actually on the European continent.

The location, along with infrastructural investment, has helped Turkish manufacturers position themselves as a cost-effective nearshoring sourcing alternative to factories in China and other East Asian nations for European promo products suppliers.

Initially, Europe-based suppliers were turning to Turkey for textiles for apparel and bags, but in recent years the scope has expanded to include hard goods too – everything from writing instruments and drinkware to medals, key rings and ceramic items. About 60% of Turkish promo exports reportedly go to nations in the European Union.

Now, Turkish promo manufacturers are working hard to expand further in North America, again positioning themselves as a reliable price-competitive-with-quality option over East Asian sourcing.

Leading the charge is Promotion and Printing Industrialists’ Business People Association (PROMASIAD), an Istanbul-based promotional products association that formed in 2019 to advance the Turkish merch industry domestically and in the international market.

PROMASIAD recently attended July’s ASI Show Chicago as part of bridge-building efforts and found the trip fruitful, believing there’s ample opportunity to grow as a production hot spot for North American suppliers.

“The U.S. no longer wants to buy promotional products from China,” asserts PROMASIAD President Ömer Karatemiz. “If we can get the right positioning here in terms of logistics and local service, secure the right investments and develop the right product concept, I believe we can capture a much bigger share of the U.S. market as a result.”

Notably, Turkey’s own domestic promotional products industry is on the upswing too, Karatemiz says, with distributors there driving business within the nation’s borders. About 35% of PROMASIAD members are distributors, 50% are manufacturers and 15% are involved with printing and press activities.

A report PROMASIAD prepared in conjunction with the Istanbul Chamber of Commerce determined that the total value of the Turkish promotional business is around $7 billion. To clarify, that figure includes much more than just distributor sales domestically, which is what ASI Research’s U.K./European study looked at; it encompasses factors like exports, for instance.

The size of Turkey’s promo industry “is increasing day by day with the investments in production facilities and growing export rates,” Karatemiz told ASI Media in a Q&A this spring. “We believe the annual growth of the Turkish promo market is 6%-7% because every day the industry is gaining importance, and companies, corporations, NGOs, etc. are investing in promotions.”