Given that it’s been the hottest product category of the past decade, you may think we need to finally put a lid on this drinkware talk. But the market for cups, mugs and tumblers continued to soar in 2023 as consumers prioritize healthy habits and sustainability.

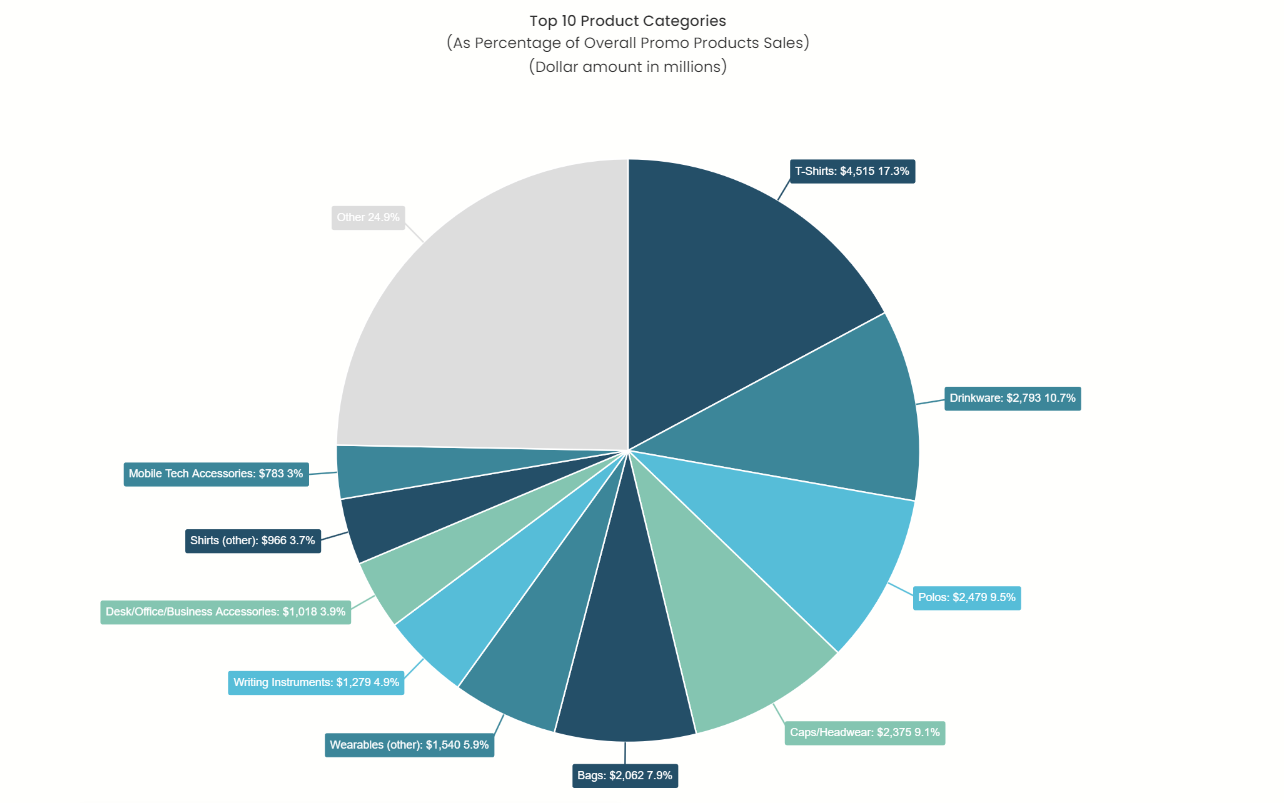

Drinkware market share has grown five of the last six years (the only exception was 2020) and accounted for 10.7% of total industry sales last year. That translates to $2.8 billion, second to only T-shirts with over $4.5 billion. It’s the highest market share for promo drinkware since ASI started tracking the data in 2008.

Brandon Bell, president of ETS Express (asi/51197), says the drinkware-exclusive supplier has seen “tremendous growth” in its sales, and attributes the growth of the category as a whole to trendy brands like Stanley and Owala (the latter of which ETS offers).

Perhaps the biggest reason for the category’s growth in 2023 was Stanley, a massive mainstream success, inciting consumers to raid retail stores shelves and camp out for limited-edition varieties. Those who couldn’t get or afford Stanley quickly snapped up other tumblers with handles and straws. It was a similar breakout success on the promo side, as Stanley’s 40-oz. Quencher tumbler was named ASI Media’s 2023 Product of the Year. ESP data showed that searches for Stanley peaked in January, and are currently generating more monthly searches than most months in 2023.

Meanwhile, the Owala brand – known for its brightly colored 24-oz. Free Sip bottle – is heralded by Bell as a product that’s “going off like crazy.” And in fact, ASI Research shows that ESP searches for the brand in May increased by over 2,600% compared to May 2023. “For a company only to be in the hydration category for three or four years,” says Bell of Owala, “lends to the fact that, hey, people will still support new, innovative, forward-thinking products in the category.”

The beginnings of trendy brands like Hydro Flask, YETI, Stanley and Owala can often be attributed to social media virality. But beyond that, suppliers and distributors point to the sustainability and wellness benefits of drinkware, alongside their easy integration into everyday routines as factors popularizing the product category.

The elephant in the room is the overcrowding of bottles in end-users’ possession, which both distributors and suppliers acknowledge. “I have so many of them. Everybody is starting to get fatigue,” says Julie Krause Wallace, owner of Ant Farm Specialties (asi/122342), who admittedly sells “a lot of drinkware” and leans into specialized items like frost cups.

Bell attributes this not to a failure of the market, which he acknowledges has “become saturated,” but to the durability of the product. (ASI’s Ad Impressions Study findings show that 63% of consumers would keep/use promo drinkware for at least one year.)

“With some of the slowdowns, I think people are learning that, in a good way and from a sustainable way, drinkware lasts a long time,” Bell says. “T-shirts wear out. Hydration bottles tend to stack up.”

Still, the wisdom is that buyers will still make room for drinkware that’s trendy, unique and high quality. Plus, as end-buyers and users prioritize sustainable promo, Ericson says she doesn’t see the market for drinkware slowing down.

“I’ve been in it for so long that it’s always something,” says Ericson. “If it’s not the Stanleys, it’s something else. It’s always a product that’s up-and-coming that everybody needs to have and then, it will go away. But I don’t think drinkware is going away.”

Products Snapshot

Most of the top-selling products remain the same, but certain categories are displaying positive momentum.

While seemingly staid on the surface – with nine of the top 10 the same as last year – the top promo product categories harbor some interesting findings the more you dig. Yes, we noted how drinkware reached a record high, but so did T-shirts, which was the top-selling category for the 10th consecutive year. Items like writing instruments and mobile tech accessories, both of which had their market share halved during the pandemic, increased for the third straight year. The biggest increase belonged to bags (growing by over a full percentage point) – perhaps a sign that buyers are warming back up to the category after the reusable bag boom of yesteryear.