Key Takeaways

• Cautious Approach: Many printers are adopting a “wait-and-see” approach in response to the tariffs, cautiously observing how the situation evolves before making significant changes or investments.

• Print Industry’s Resilience: The print industry, while affected by tariffs, is somewhat better off due to its higher concentration of domestic production capabilities. However, concerns remain about the cost pressures on raw materials and machinery components sourced internationally.

• Strategies & Opportunities: Companies in the print industry are exploring various strategies to mitigate the impact of tariffs, such as sourcing domestically, substituting materials and shortening the validity period of estimates. Some see the tariffs as an opportunity to bring back manufacturing jobs to the U.S.

When Donald Trump’s second term began in January, it was clear that he would be focusing on tariffs. But how much was still up in the air.

The results have been more expansive than most anticipated. The president has unveiled a wide-ranging series of actions that have included 145% tariffs on imports from China, baseline 10% tariffs on imports from all countries, reciprocal tariffs on a host of nations (which are currently paused until early July), levies on select products from Canada and Mexico not covered under the USMCA (United States-Mexico-Canada Agreement), 25% tariffs on steel and aluminum imports, and the elimination of the “de minimis” loophole for China imports under $800.

Industries and markets across the world have responded with concern – including the promo products industry, where the majority of products like apparel, electronics and hard goods are sourced abroad from countries like China, Vietnam and Bangladesh. Promo industry leaders have noted that price increases are forthcoming and that buyer demand may dwindle, and suppliers have begun halting their imports from China in an effort to wait out the heightened tariffs, prompting fears of renewed supply chain disruption.

But what’s the impact of tariffs on the print industry, where fewer products are imported and much is printed and manufactured in-house? Printers and print distributors who spoke with Print & Promo Marketing are taking a cautious approach and waiting to see how it all plays out.

Jennifer Hoyt, director of marketing and e-commerce for Counselor Top 40 supplier Stouse (asi/89910), says that the general vibe was “concern but not surprise,” as the tariffs had been bandied about by the administration for a while. And while she admits that print is not immune to supply chain issues, she acknowledges Stouse is particularly well-placed to avoid serious impact.

“As a U.S.-based printer primarily serving domestic customers, we’re in a strong position to continue delivering high-quality products without significant disruption,” Hoyt says. “That said, certain raw materials, specialty films and machinery components still originate from international sources, and it’s too soon to tell if we’ll feel cost pressure in those areas.”

“Certain raw materials, specialty films and machinery components still originate from international sources, and it’s too soon to tell if we’ll feel cost pressure in those areas.”

Jennifer Hoyt, Stouse (asi/89910)

Machinery components, depending on where they come from, could be a real sticking point for print if the tariffs continue.

“Depending on the piece of equipment, you could be talking about a lot of money,” says Jim Gingle, general manager for Independent Printing & Packaging (asi/62554), which placed No. 10 on Print & Promo Marketing’s 2024 Top Print Suppliers list.

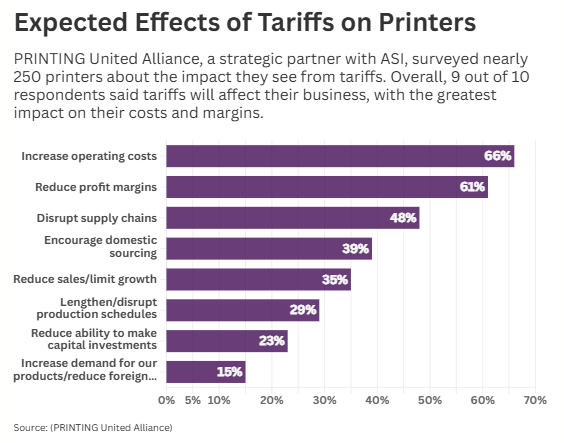

A recent survey of the print industry from ASI strategic partner PRINTING United Alliance showed that 90% of printing companies (including commercial printers, apparel decorators and others) said their business would be affected in some way by the tariffs.

Among those respondents, two-thirds think it will result in increasing operating costs and over 60% believe it will reduce profit margins. In addition, nearly 40% believe that it will encourage domestic sourcing, and only 23% believe that it would reduce a company’s ability to make capital investments.

Printers also expressed concern over how the general uncertainty surrounding tariffs will spill over to end-buyers, who may dial back on their budgets and marketing as they deal with their own issues.

“What we have now is chaos – and for no good or proper reason,” one print distributor told PRINTING United Alliance in the survey. “For example, I want to run an aggressive promotion to offer a special pricing opportunity to attract some new customers. How can I do that if I don’t know what the prices for T-shirts will be? My customers are already acting like they are afraid to plan and afraid to order.”

Pricing & Opportunities

Some print industry professionals, however, are bullish on the tariffs, echoing language from the Trump administration regarding perceived “fairness” of international trade.

“I believe that tariffs are the only way to level the playing field and/or bring back manufacturing jobs to America,” says Tony Wright, owner and graphic designer for Pro Design Graphics (asi/590153) in Plymouth, MI.

Even those who are more gung ho about the tariffs, though, admit that any light at the end of the tunnel still requires going through a tunnel.

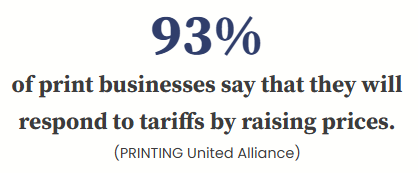

“I think that, short-term, prices will go up,” Wright says. “But I also believe that the other countries will negotiate and things will level off long-term.” In PUA’s survey, 93% of printers said they will have to raise prices, though 70% also said they will be able to absorb some of the cost increase in the margins.

Even as Wright says he will be forced to raise prices on some products and services, he hopes those increases will be short-lived as the U.S. continues to negotiate with its trade partners and manufacturing starts to return to the U.S.

“At the end of the day,” he says, “it would be nice to buy USA-made products.”

On the promo side, the demand for USA-made products has already increased, with suppliers fielding requests from distributors looking to avoid the tariff price hikes. “We’ve seen a significant increase in inquiries for Made-in-USA products, and much of that surge is tied directly to the tariffs and broader economic uncertainty surrounding global trade,” Jordan Scaduto, partner/executive vice president at cut-and-sew manufacturing supplier LBU Inc. (asi/65952) in Paterson, NJ, told ASI Media.

Companies who serve both the print and promo industry definitely see a difference in how both mediums will be affected.

“The print industry is potentially somewhat better off – though still impacted – due to a higher concentration of domestic production capabilities compared to the promotional hard goods market, which heavily relies on overseas manufacturing,” Hoyt says. “Many printed products, including our decals, roll labels, magnets, signs and plastic products, are sourced and produced within the U.S.”

Robert Ross, president and COO for Helm (asi/223630), which placed No. 8 on Print & Promo Marketing’s 2024 Top Print Distributors list, also acknowledges that the tariffs situation is disruptive but sees opportunities for print that might not exist in other industries.

“I’m looking at this as a possible opportunity for bringing some of the manufacturing back that we might’ve outsourced in the past,” he says. “We have an opportunity for print. But for promo, everybody’s scurrying.”

Tangible Paths Forward

Ross outlines three options that both promo and print companies can take.

The first, he says, is “identifying orders that you haven’t processed and seeing how those orders are going to be affected, and working with your suppliers overseas and your clients in order to come up with an amicable solution for all three parties involved.”

Option two, he says, is looking at your business and operations, and for changes in pricing to maintain an equitable business. “You can’t just arbitrarily gouge and raise prices because the products that are on your site must be marketable and saleable,” he says. “You still have to be competitive and efficient.”

Option three is pivoting to different products sourced domestically or from other countries. “Most customers’ budgets are going to be reduced rather than expanded,” he says. “So you’re going to have to get creative and find new ways to either provide something that’s comparable at a lower price or provide something that works to accomplish the same deliverables as the original item that is now possibly two to three times what it was costing you before.”

“You can’t just arbitrarily gouge and raise prices because the products that are on your site must be marketable and saleable. You still have to be competitive and efficient.”

Robert Ross, president/COO of Helm (asi/223630)

Printing companies who responded to PUA’s survey noted they were considering actionable strategies like shortening the time for which estimates are valid, building inventories, substituting materials for cheaper options and finding alternative suppliers domestically and abroad. Some of those options include countries less affected than China, like Pakistan, India and South Korea.

Another possible action for printing companies is to accelerate their ongoing transition from offset printing to inkjet due to tariffs on offset plates. One respondent to the PUA survey said they were “putting a hold on investing in additional equipment and staff until there is stability and clarity” – a philosophy that could be picked up by other printing companies in the short-term.

Indeed, even if printing companies aren’t being impacted as dramatically as promo businesses or other industries, they’re in no position to ignore the major events going down right now.

“Tariffs directly and indirectly disrupt markets, and every market disruption creates opportunity,” writes Andrew D. Paparozzi, chief economist for PRINTING United Alliance. “Every company in our industry, even if they have not been affected yet, should be asking: How can we capture those opportunities? How can we be the disruptor rather than the disrupted?”