In May, we released the latest installment of our ongoing Promotional Products Industry Recovery Research (Vol. 2, No. 1) in partnership with NAPCO Research. The report, which tracks how the promotional products industry is recovering from issues faced during the pandemic, was largely positive, with indicators showing business activity increasing overall for the first time since the research began in mid-2020.

The latest report also captured some revealing product demand trends—almost all of them positive. Let’s take a look at four of those trends and dig a little deeper into what each means. For the rest of the data and more findings from the research, download the full report here.

1. Trade Show Products Bounce Back Huge

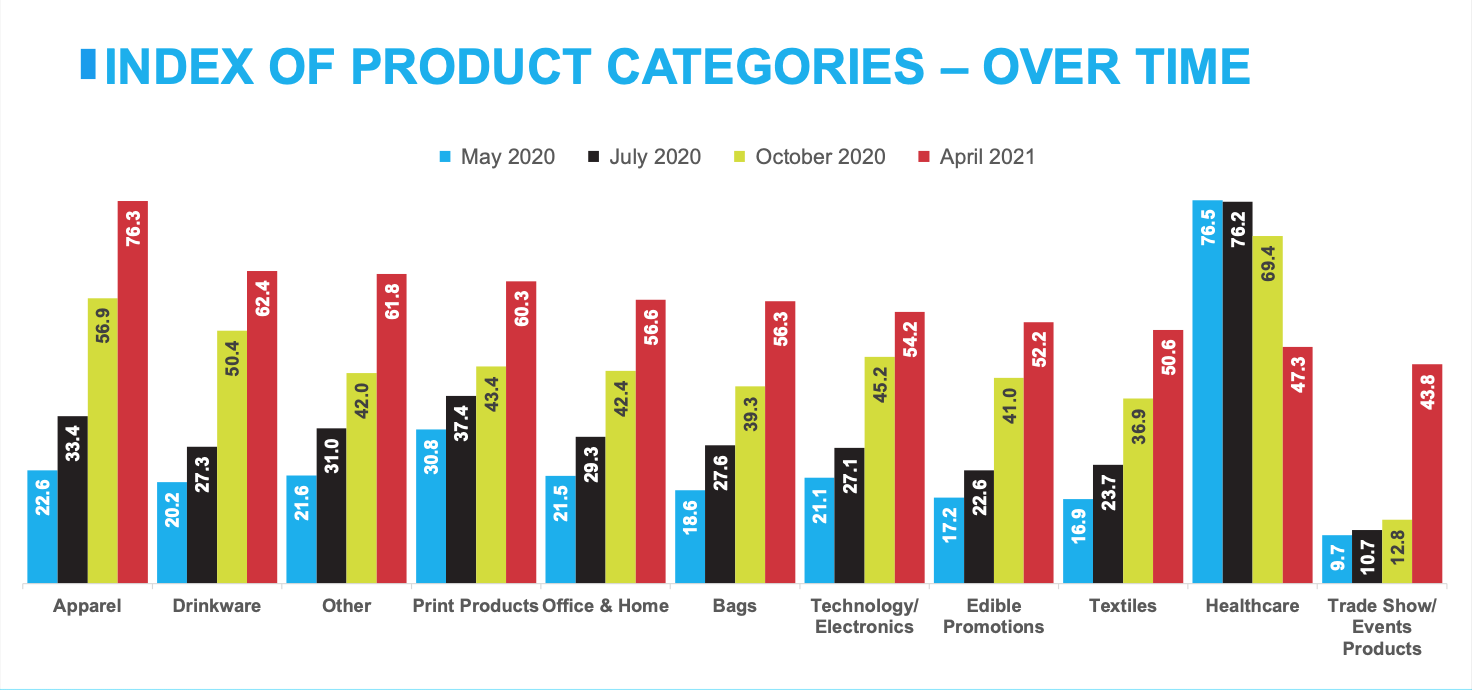

After taking a beating for all of 2020 and routinely ranking dead last among all product categories in demand, trade show products made a massive jump in the first quarter of 2021. For the previous survey period (late 2020), the product category had an index reading of 12.8. In the most recent period, that jumped to 43.8—the single largest jump for any product category over any span since we began our research.

This is, without a doubt, the most encouraging sign for the promo industry’s rebound. While the index reading still indicates that demand is down overall (a reading above 50 would indicate rising demand), enough companies are now reporting increasing demand in the category to bring the index up 31 points over a single quarter. This aligns with what we’re seeing anecdotally as live events begin returning, and the data now backs that up: Trade shows and events are coming back, and companies are again buying promotional products for those events.

2. Health Care Products Are (Way) Down

This is the other side of the coin. In the first two installments of our research, the health care product category was the only one with an index over 50. Health care products, mainly PPE, were more-or-less single-handedly keeping the promo industry afloat. That changed over time as a few other categories—primarily apparel and drinkware—began recovering as the economy improved. But even then, health care remained on top.

Not anymore. Coinciding with the rise in vaccinations and decrease in COVID-19 infections, the health care product category saw a massive drop in the first quarter of 2021, falling from an index reading of 69.4 to 47.3. It’s the first time since the start of the pandemic that promo businesses are reporting falling demand for health care products.

This is expected—and also encouraging. The index readings for all other product categories outside of health care and trade show products are now over 50. Demand for traditional promotional products is returning across the board (see chart below). That, alongside the drop in health care products, further shows that the industry is on a path to relative normalcy as we emerge from the pandemic.

3. Apparel Still Surging

As noted above, apparel was one of the first categories to bounce back as 2020 progressed. That trend continued, with the apparel category’s index reading increasing from a solid 56.9 in late 2020 to a stellar 76.3 in the most recent quarter. This was the highest reading for any product category by a significant margin, again indicating positive developments for the industry.

In normal times, apparel is the industry’s top-selling product category, so it makes sense that it would be the first to recover as the pandemic recedes. But the pace and magnitude of its recovery—jumping from an index reading of 22.6 to 76.3 over the course of four research periods and rising nearly 20 points in the last period alone—shows that promo’s top seller is bouncing back strong. Other categories should soon follow.

4. Across-the-Board Recovery

Speaking of other categories: In the previous installment of the research, just three product categories—apparel, drinkware and health care—had index readings of 50 or above. Now, nine out of 11 categories are above 50, with only one (health care, as noted) trending down. More significantly, every product category outside of health care saw its index reading rise by at least nine points, with categories like bags (+17 points), print products (+16.9) and office & home (+14.2) posting impressive gains as they jumped from below to above 50. The other category also jumped 19.8 points to an index reading of 61.8, third highest among all product categories.

With 61.1% of promo companies indicating rising quote activity, 56.5% reporting an increase in new orders and virtually all pandemic restrictions lifted in the U.S., we’ll likely see these numbers to continue to rise.

Participate in the Promotional Products Industry Recovery Research:

In today’s unprecedented business environment, making decisions based on facts has never been more important. In the weeks and months ahead, reliable industry business indicators will be essential for monitoring what’s happening in all industry segments. The Promotional Products Industry Recovery Research is an essential resource for monitoring industry conditions, and the NAPCO Research and Promo Marketing teams invite you to join our business panel and contribute to the research on an ongoing basis. Companies that join the panel will receive an exclusive version of the report that includes additional data and analysis. To join the COVID-19 research panel, please click here.

About NAPCO Research:

NAPCO Research develops research and economic models that solve customer business problems. Market research is valuable for making strategic business decisions, solving challenges, and pursuing opportunities, and the NAPCO Media research team surveys, analyzes, and monitors critical trends related to marketing, printing, packaging, nonprofit organizations, promotional products, and retailing. To learn more about how the team can leverage its research and industry subject matter experts to support your organizations needs contact NAPCO’s vice president of research, Nathan Safran, at [email protected].