Key Takeaways

• A Tough Quarter: In Q1 2025, distributors’ sales fell 3.6%, while suppliers were down 4.8%, marking the worst quarterly retreat since Q1 2021, according to the new Quarterly Sales Survey from ASI Research

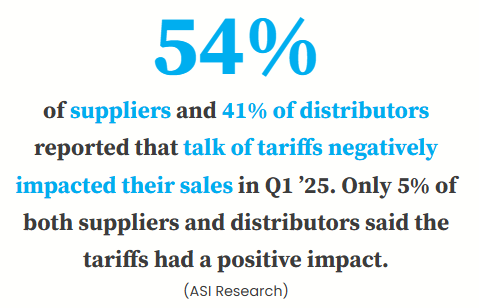

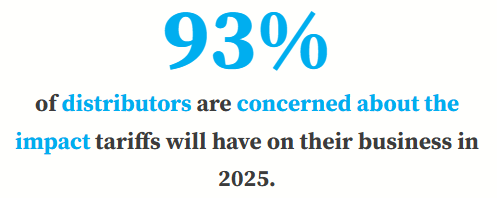

• Tariff Headaches: New and threatened tariffs from the Trump administration significantly dampened demand for branded merch in the quarter, the survey shows.

• Confidence Falls: The Counselor Confidence Index, which measures sentiment on financial health and business optimism in promo, hit a multi-year low.

• Made-in-USA Demand: Interest in domestically produced promo products surged, but a shift to widescale U.S.-based manufacturing is improbable for the merch market.

For promo, Q1 was a clunker.

Promotional products distributors and suppliers reported sharp sales declines and steep drops in business confidence in the first quarter, due in significant part to marketplace volatility spawned by sweeping new import tariffs announced and implemented by President Donald Trump’s administration, according to the just-released Distributor Quarterly Sales Survey from ASI Research.

The study, released each quarter, always analyzes distributor sales, outlook and more. For Q1 2025, the survey also evaluated supplier performance and sentiment.

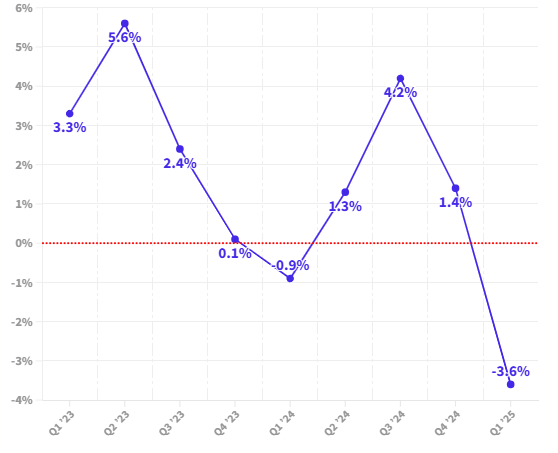

The headline finding was that distributors’ collective sales dropped by 3.6% in the quarter compared to Q1 2024. It’s the deepest annual basis quarterly decline since the first quarter of 2021, when sales plummeted 14.8% in the shadow of COVID-19. It was also the first quarterly decrease since last year’s Q1.

Promo Industry Sales Revenue by Quarter

(Year-Over-Year % Change)

Meanwhile, suppliers saw collective sales retreat, on average, by 4.8% in Q1 2025 compared to the same three-month span the year before. (ASI Research’s quarterly and full-year industry sales totals, including the $26.6 billion in 2024 sales, are calculated based on distributor performance.)

“Coming off a lackluster 2024 in which distributors increased sales just 1.8% on the year, optimism was reasonably strong for 2025,” says Nate Kucsma, ASI’s senior executive director of research, who spearheads the Quarterly Sales Survey. “However, just the threat of tariffs was enough to see end-buyers curtail some spending.”

During the first quarter, the Trump administration slapped new import tariffs on China, Canada and Mexico, as well as on materials like steel and aluminum. Trump first implemented tariffs on Canada and Mexico in February but then suspended them. Then he hit the U.S.’ North American neighbors with the tariffs again in early March, only to scale them back to apply to goods not covered by the United States-Canada-Mexico Agreement.

Throughout the quarter, Trump talked of placing tariffs, which he characterized as reciprocal, on nations around the globe, as well as threatening repeatedly to hike tariffs on China – the world’s largest manufacturing nation from which promo, and industries across the U.S. economy, import heavily.

Just after the first quarter ended, in early April, Trump vastly accelerated the incremental tariff rate on China-made products to 145%, instituted a baseline duty on all imports of 10% and placed nation-specific reciprocal tariffs on more than 90 countries, basing the levies, he said, on tariffs and trade barriers those nations have set against the United States. However, the president then paused the reciprocal tariffs for 90 days, dropping the levies on affected nations to the 10% baseline.

But even before those April tariffs took effect at the outset of Q2, the specter of them alone, combined with the opacity and instability surrounding the White House’s rollout of other tariffs in Q1, created uncertainty that wasn’t good for business, merch industry executives say. It all weighed on performance during the quarter.

“While we understand that tariffs can be an effective tool when used with clear intent, unpredictability in implementation has a negative ripple effect on our business and the broader supply chain,” says Mark Gammon, CEO of Counselor Top 40 supplier Cap America (asi/43792), which experienced a year-over-year sales setback in the first quarter. “Broad or poorly defined tariff policies create real instability.”

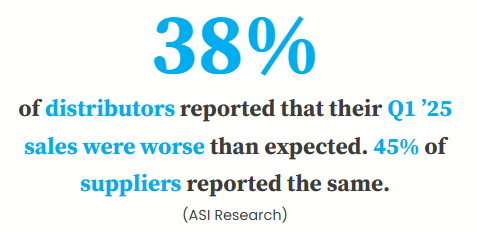

Notably, about 4 in 10 distributors and almost half of suppliers reported that their promotional products industry sales for Q1 2025 were worse than they anticipated. Bison Coolers (asi/40588), a family-owned Texas-based supplier, was among those that had a tough quarter.

“Sales in Q1 2025 were about half of what they were in Q1 2024,” says Jeremy Denson, CEO/co-owner of Bison Coolers. “An impending tariff war, inflation, recession [fears] and economic uncertainty were the primary drivers.”

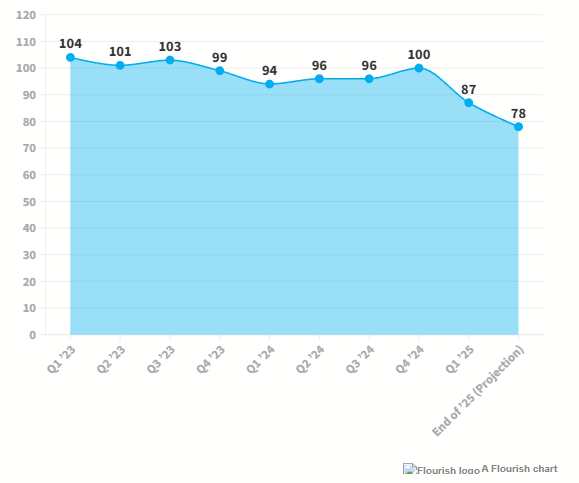

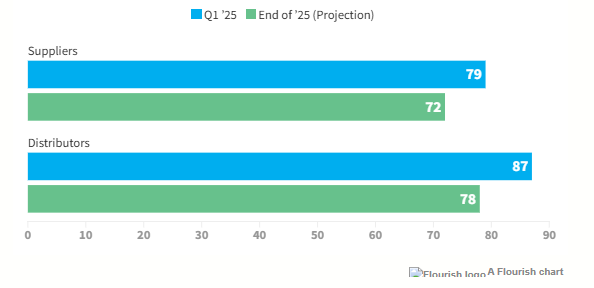

As a result, pessimism is permeating the outlooks of both suppliers and distributors. The Counselor Confidence Index, which has a 24-year history of measuring distributor financial health and business optimism, retreated from a reading of 100 (the Index’s baseline) in the fourth quarter of 2024 to a tally of 87 in Q1 – the lowest level since it sat at 86 in the first quarter of 2021.

Things looked starker glancing further out, as the projected distributor Counselor Confidence Index for the end of 2025 was 78. Just three months ago, the projected reading for the end of 2025, based on distributor sentiments, was 105.

Counselor Confidence Index (Distributors)

“Tariffs and the lack of clarity regarding them from this presidential administration is really threatening to businesses like ours,” says Gary Gattullo, CEO of Brooklyn Made Co. (asi/146698), a small distributor that suffered a sales decline in Q1. “The haphazard way in which the tariffs have been implemented is making planning very difficult. We’re trying to remain flexible in our marketing approach and hoping, for all of 2025, to at least do the same level of revenue as last year.”

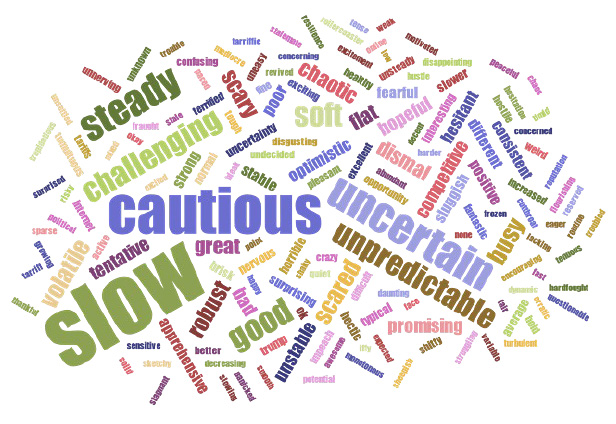

Which One Word Describes Q1 ’25? (Distributors)

Tim Holliday, co-owner of Florida-based distributor Children’s World Uniform Supply/Business World Promo Supply (asi/161711), says the outlook for 2025 is uncertain at best.

“It’s going to be interesting to see how things shake out,” says Holliday, whose firm’s sales dropped about 9% in Q1. “With big tariffs going on China-made goods, and how many of the goods in our industry come from China, I see increased prices, which will result in reduced orders or order totals.”

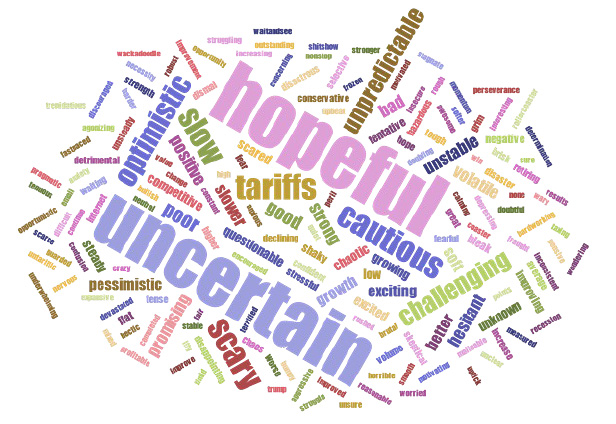

Which One Word Describes Your Q2 ’25 Expectations? (Distributors)

When it came to Q1 confidence and outlook for the year, suppliers were more downbeat than distributors. ASI Research determined, based on survey feedback, that supplier confidence sits at 79 – eight points below that of distributors. For the full year, supplier confidence was projecting a reading of just 72.

“Tariffs mean inflation, and inflation is the hardest challenge we’ve ever faced,” says Denson. “This is a make-or-break moment.”

Counselor Confidence Score

Growth Amid Uncertainty

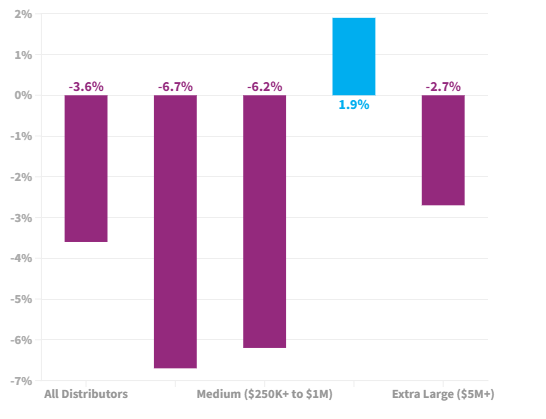

As part of the study, the Distributor Quarterly Sales Survey from ASI Research evaluates how distributors of different annual revenue classes perform. The classes are “Small” ($250K and below), “Medium” ($250K to $1M), “Large” ($1M to $5M) and “Extra Large” ($5M and above). In Q1 2025, the industry’s smaller firms fared the worst – with small and midsized companies both down by over 6% compared to last year’s first quarter.

Extra-large distributors did better, but their collective revenue was still lower on average by nearly 3% in Q1 2025 as measured against Q1 2024. Large distributors eked out a win though, inching up sales by just under 2%.

Q1 ’25 Distributor Revenue Increase/Decrease by Company Size

(Year Over Year From Q1 ’24)

Garden City, ID-based Hoopla (asi/444064) was among the large distributors that increased sales. The firm generates ample business with clients in the technology, banking and finance markets, and end-buyers were investing in merch. “We got a couple of big accounts in Q4” that helped spark early-year business in 2025, says Hoopla CEO Christina Maag. “We expect our sales to be up this year.”

Indeed, there were positives to report from Q1, too. One is that, despite all the marketplace headwinds, about 40% of all distributors still managed to execute a sales increase. And it wasn’t just distributors in the $1M to $5M revenue range.

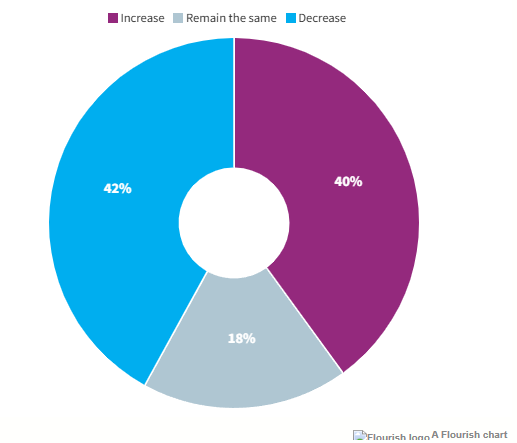

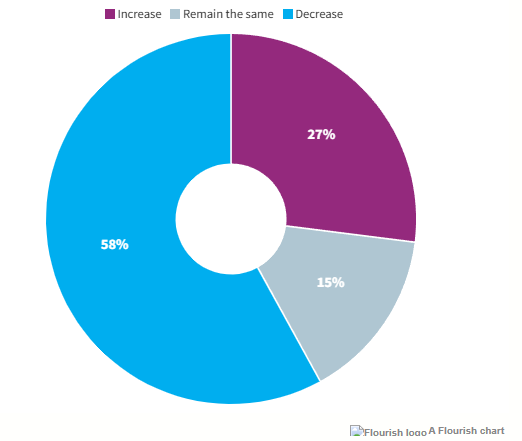

Sales Performance: Distributors

(Q1 ’25 vs Q1 ’24)

Tom Goos, president and CEO of Counselor Best Place to Work Image Source (asi/230121), says the extra-large revenue class distributorship increased sales a whopping 53% in Q1. “One of our top focuses” Goos says, “is on growing our share of wallet with key accounts and we saw significant growth with our enterprise clients.”

While noting that “tariffs are creating havoc on our business with some clients cancelling orders and others being hesitant to move forward with large products,” Goos still believes that Image Source’s sales will remain on an upward trajectory this year. “The instability from tariffs could create some bumps in the road, but in the end I expect Image Source to grow,” he says.

There were other success stories too. Counselor Top 40 distributor Zorch (asi/366078) increased sales in Q1 about 10%, a gain CEO Mike Wolfe says the firm delivered thanks to “a very strong March and activity from new accounts.” Josh King, CEO of Counselor Best Place to Work distributor You Name It Specialties (YNIS, asi/365123), reports that sales rose in the double-digit percentage range in the first quarter, thanks in part to an acquisition made last year.

“We’ll end the year with high single-digit revenue growth,” King forecasts. “Our business retention metrics historically average in the high 90s so when we can add additional revenue through growth opportunities it has translated into top-line growth.”

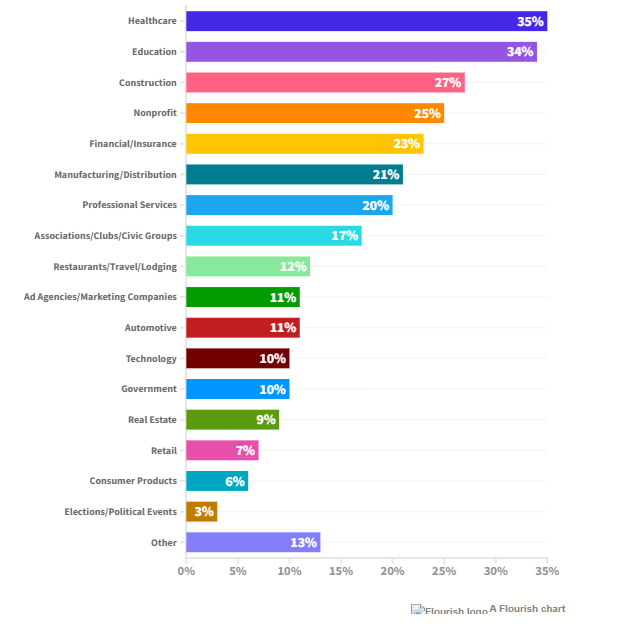

In Q1, distributors say the top five strongest end-markets for promo sales were, in order, healthcare, education, construction, nonprofit and financial/insurance. Education is historically promo’s top market, but this was the second consecutive quarter in which healthcare was labeled the most robust. Nonprofits and finance also trended up compared to Q4 2024, while retail and consumer products saw a downward trend.

Most Robust Markets in Q` ’25

Made in the USA & the De Minimis Exemption Impact

One way many distributors are working to keep business moving is by increasingly sourcing Made-in-the-USA products.

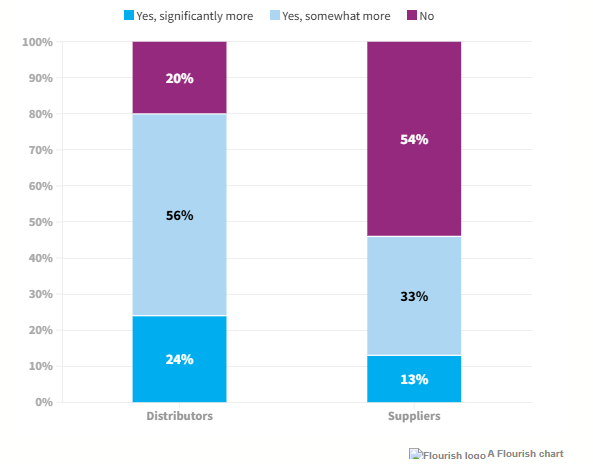

Suppliers that offer domestically produced items have been marketing such solutions aggressively amid the tariff upheaval, touting the goods as a source of stable pricing. A mid-April ASI Media report shows that demand for Made in USA is red-hot at the moment, a finding further evidenced by the Distributor Quarterly Sales Survey, which shows that about 80% of distributors plan on purchasing more U.S.-produced products in the near future.

We asked distributors and suppliers: “Do you anticipate purchasing more Made-in-USA products in the near future?”

For example, BAMKO (asi/131431), a Counselor Top 40 distributor, has developed a dedicated “Made in USA” product platform that the firm says features a curated collection of domestically manufactured promo products in categories that include apparel, drinkware, bags and writing instruments. “This strategic investment allows businesses to source premium tariff-free products with the assurance of domestic production reliability,” BAMKO notes in a blog that discusses the platform.

Meanwhile, Pittsburgh-based distributorship HDS (asi/216807) believes the current marketplace is creating conditions ripe for a continued increase in USA-made products.

“We have been actively sourcing product that is Made in the USA,” shares Mark Algeri, HDS’ chief revenue officer. “We are taking a proactive approach to address client concerns about pricing and know that transparency is the best way to build trust. Our goal is to position ourselves for continued growth and stability in the face of changing global trade dynamics.”

While distributors are clearly keen for domestic product options, it’s significant that 54% of suppliers indicate they don’t anticipate purchasing more Made-in-USA items for their product portfolios.

Supplier executives and promo sourcing experts have repeatedly emphasized the daunting hurdles that would prevent the industry, which is heavily reliant on importing, to suddenly produce most of its goods in the United States.

Industry sourcing leaders say that the branded merchandise market will continue to manufacture the vast majority of products it sells in America in overseas factories. They say there doesn’t exist the infrastructure, workforce, materials or supply lines to service promo’s needs at industrywide scale in the U.S. – and likely won’t in a cost-effective way anytime soon.

“Realistically, you can’t set up a factory overnight and start producing complex products like stainless-steel bottles or premium backpacks at a promo price,” says Heather Smartt, head of Counselor Top 40 supplier Goldstar (asi/73295) and member of Counselor’s Power 50 list of promo’s most influential people.

As promo continues to import heavily, the industry – and importers across sectors – are poised to deal with another tariff-related issue. On May 2, U.S.-based importers will no longer be able to claim the so-called “de minimis exemption” for products imported from China and Hong Kong, per a Trump executive order.

The de minimis exemption had allowed overseas shipments valued at less than $800 per person per day to enter the United States free of tariffs. Now, those shipments coming from China and Hong Kong will reportedly be subject to a 120% rate. Critics of the exemption, which include some U.S. retailers and promo suppliers that tend to always import in bulk, have decried it as an unfair loophole.

Still, other promo industry firms, including smaller suppliers and certain distributors that import directly from foreign factories, say the disappearance of the de minimis exemption for China is going to sting their businesses.

“The elimination of this exception will be extremely impactful for promo,” says YNIS’ King. “It will soon be cost-prohibitive for small orders of lapel pins, table covers, sublimated apparel, feather flags and event tents. Once this elimination has been enacted, the country, not just our industry, will realize how important this exception is to commerce.”

Chris Babiash, president/CEO of distributor Booshie Inc., says the de minimis exemption going away will definitely affect his business. “A majority of our orders coming out of China are team- or project-based and 90% of them are under $800,” Babiash states. “It will force me to look at alternatives outside of China … but we will never be able to pull all of our eggs out of that basket.”

Supplier Specifics

Suppliers labored in the first quarter as they grappled with how to adapt to everything from pricing to sourcing practices in the wake of both the quick-shifting chatter on tariffs and their actual implementation.

Not only were supplier sales down overall on average by almost 5% in Q1, but nearly 60% of suppliers experienced a sales decrease. “While we’re seeing an increase in order volume, those orders are coming in at lower average values due to tighter budgets across the board,” says Gammon, Cap America’s CEO, in describing a phenomenon many suppliers say has been in play.

Sales Performance: Suppliers

(Q1 ’25 vs Q1 ’24)

Safety Made (asi/84514), a New Hampshire-based supplier that offers everything from first aid kits and flashlights to tools and accessories, contended with a sales decline in Q1.

“It seems that we pull one lever of growth but create a deficit somewhere else, which is a frustrating dynamic,” says Paul Dubois, president of Safety Made. “I was starting to see initial indicators of growth in February and March, but I believe the disruption and noise created by the April tariff announcements is going to shock the system into a holding pattern that will take time to recover from, even if de-escalation of the tariff war occurs.”

Dubois says Trump’s April-announced tariffs were a fist to the nose. He’d been working for weeks on how to offset any pricing impacts to customers based on previously instituted tariffs of 20% on China that Trump put in place. But the April tariff tranche blew those efforts out of the water.

“The recent escalation of tariffs has put decision-making and planning on hold, as the situation is currently too volatile to react to,” Dubois says. “The impact of holding while awaiting announcements from Washington will have a detrimental impact on our ability to properly price goods, inventory planning and staffing.”

Speaking of pricing: About 45% of suppliers tell ASI Research that they have already increased product prices. That percentage is poised to skyrocket: Some 86% of suppliers say they will have to hike prices within the next three months if the tariff situation is not resolved. About 6% say the increase will exceed 50%. Nearly 3 out of 10 suppliers report they’ll be compelled to raise prices 6% to 10% – the most commonly predicted price hike range.

“We can’t afford to eat these tariffs,” says Denson, of Bison Coolers. Adds Gammon: “We’ve held steady on pricing for our stocked goods, thanks to pre-tariff inventory on hand. However, if elevated tariff rates persist, we’ll likely need to raise prices this summer to offset increased landed costs.”

As prices rise, some suppliers and distributors expect an emerging trend to take firmer hold: end-buyers undertaking more value-conscious buying. “We expect to see a shift to lower price points and more intentional purchasing,” says Smartt, of Goldstar, which introduced a price increase April 1, its first in several years. “The market may grow more slowly as a result, but companies that simplify their offering and remove friction will stand out.”

For sure, despite all the challenges, Smartt and other industry leaders believe promo can weather the storm. “By staying focused on service, inventory reliability and a friction-free customer experience,” Smartt opines, “we’ll continue to move forward together.”