Key Takeaways

• White-Collar Hiring Slowdown: Industries like finance and tech have seen a significant drop in hiring over the past two years, leading to reduced spending in some promo initiatives.

• Employer Leverage: The shift in the job market has given employers more power, allowing them to cut back on retention initiatives without fearing mass resignations. Quit rates are at a record low, reflecting employees’ uncertainty about finding new jobs.

• Promo Spending Shift: The labor market could be affecting how companies are allocating their promo budgets. Instead of general appreciation, there’s a focus on targeted promotional activities and executive gifting.

• Hiring Impact: Hiring in the promo industry has also been affected by these broader trends, including noticing a wider talent pool and higher application numbers than in previous years.

Though the U.S. economy managed to stave off a recession in 2024, the same can’t be said about the white-collar labor market.

After a surge in early 2022 as companies scrambled to recover from openings and lost income during COVID-19, hiring in industries like finance and tech has taken a steady tumble – in some cases flatlining at its lowest levels since the 2008 recession.

For the promo industry, that means less business in onboarding initiatives or new hire gifts. But these slowdowns are also indicative of a broader trend in the labor market that has shifted power back toward employers, rather than applicants, in the job hunt.

Quit rates are at a record low, as employees are uncertain about their ability to get a new job in such a tough market. It’s giving employers – especially those in industries dealing with lagging sales and cutbacks in marketing budgets – an opening to decrease retention and appreciation initiatives without losing employees, despite low job satisfaction levels.

Welcome to the white-collar recession.

What Is a ‘White-Collar Recession?’

Last year’s job growth was largely attributable to just three industries: healthcare, leisure and hospitality, and government. Three-quarters of job creation came from those sectors alone.

In contrast, hiring for traditional white-collar industries like finance, tech and business services has dropped dramatically. It was 2009 that the business services hiring rate, for example, was as low as it is now, according to data from the Bureau of Labor Statistics.

Business Services Hire Rate at Lowest Level Since 2009

The business services category includes jobs like accountants, consultants, legal workers and human resources.

There’s similar data coming from hiring platforms like Indeed. The Job Postings Index from Indeed’s Hiring Lab compares the number of job postings to their level on February 1, 2020. While the overall number of postings has stabilized at about 10% above Feb. 2020 levels, openings in the finance sector still hover about 5% below baseline.

Other industries, like information and software development, are well below that, at roughly 30% below their levels in 2020.

Indeed Job Openings Index Shows Lower Job Openings for White-Collar Sectors

Job postings for white collar jobs like banking and software development has leveled out at well below pre-pandemic levels, according to data from Indeed’s Hiring Lab.

With the increasing prevalence of “ghost jobs” – job positions posted with no intent to hire someone – the number of actual openings available to applicants could be even

lower. The practice is often meant to signal to current employees and outsiders alike that the business is growing, or to stockpile mass numbers of resumes without a specific role in mind. For applicants, though, these “ghost jobs” are just another dead end in the job hunt; hiring software Greenhouse estimates that roughly one in five jobs posted on its platform in any given quarter are ghost jobs.

Even recent Ivy League MBA graduates are struggling – a recent Wall Street Journal report found that 23% of Harvard MBA students who graduated last May were still looking for employment three months after graduation.

That figure was 10% in 2022.

“There are fewer job opportunities now than there were in early 2020,” Indeed Economist Cory Stahle tells ASI Media. “And so, for job seekers, that means that it’s going to be likely a more difficult labor market than we saw a couple years ago.”

Effects On Promo Spend

The promo industry hit another record sales mark in 2024, notching about 1.8% overall sales growth year over year despite economic uncertainties and buyer hesitancy, according to ASI Research’s most recent Quarterly Distributor Sales Survey.

But some distributors noted significant slowdowns in tech and financial market promo spending last year. Jamie Mair, CEO/owner of distributor Capsule & Kitsch (asi/157354), called those markets “soft.”

“We’re still seeing good growth in industrials: mining, metallurgy, oil and gas,” says Mair. “But the knowledge work/white-collar category – I don’t want to say that it’s regressing, but it’s definitely flat.”

Even where inquiries were up, there was a shift in what companies were spending on. For companies that previously concentrated their marketing dollars on recruitment or onboarding initiatives, says Mair, there’s been a pivot to focus more on employee retention.

Still, some clients with previously strong employee retention or customer appreciation programs in place have been pulling away from those initiatives. Promo campaigns, even employee-based ones, right now have a very specific purpose, rather than giving a gift out just for appreciation’s sake, says Mair.

“We’re still seeing good growth in industrials markets. But the knowledge work and white-collar category – I don’t want to say that it’s regressing, but it’s definitely flat.”

Jamie Mair, Capsule & Kitsch (asi/157354)

New business from the finance sector was up in 2024 for Brand+Aid (asi/145153), says the distributor’s CEO Renya Nelson. But projects for one of her biggest global banking clients have been almost exclusively focused on executive meetings rather than employee kits. Meanwhile, a telecommunications brand has shifted its promo focus toward a customer group Nelson calls the “one-percenters” – targeting promo campaigns at a football game, for example, toward the people with season tickets for box seats rather than aiming wide for all attendees. And a major tech company spent a fortune on employee gifts during the pandemic but didn’t feel the need to keep it up.

“The next year, they decreased that size quite a bit, and then the next year they didn’t do it – and again, last year they didn’t do it,” says Nelson. “So, it’s been interesting to see how the play for keeping employee retention was so strong and now it’s so much less so.”

An ‘Arms Race’ For Job Applicants

That decreased emphasis on employee retention could be, in part, due to another current trend in the labor market: the power balance shifting back to employers.

Coming out of the pandemic, companies were eager for workers after 2021’s “Great Resignation” saw many employees voluntarily quitting their jobs. They snatched up anyone they could get their hands on – which often resulted in overhiring, says Indeed’s Stahle.

That trend carried over into the promo industry, says Nelson.

“We were hiring out of desperation,” she says. “If anyone barely knew the industry, it was like, ‘Come aboard, jump on in, get to work.’”

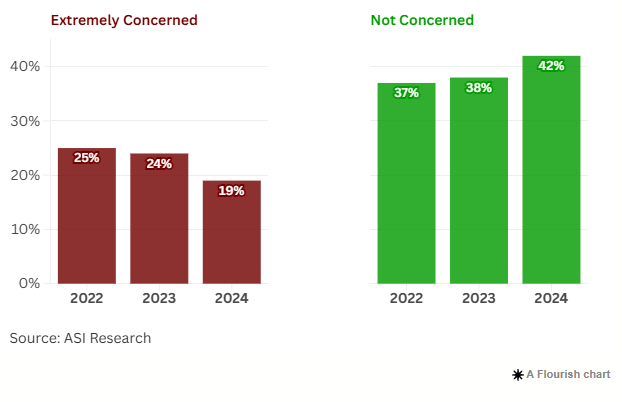

Promo Firms Are Now Less Concerned About Finding Qualified Workers

The percentage of suppliers who are “extremely concerned” about finding qualified workers has gone down since 2022, while the percentage who are “not concerned” has doubled. The distributor side experienced smaller changes but the trend persists.

Suppliers

Distributors

The need for workers during that time put the power in the hands of applicants throughout the hiring process, resulting in increased wages and benefits in order to compete in a tight market and continue attracting qualified applicants.

Now, however, labor trends paint a different picture.

Competition in the market is on the applicant side. The number of submitted job applications was up 31% during the first half of 2024 compared to the first half of 2023, based on a Workday report. Greenhouse found that its customers received an average of 222 applications per job opening in 2024, almost three times as many as what they were getting at the end of 2021.

With industries like finance growing at a slower rate than many other sectors, that means particular competition for white-collar roles.

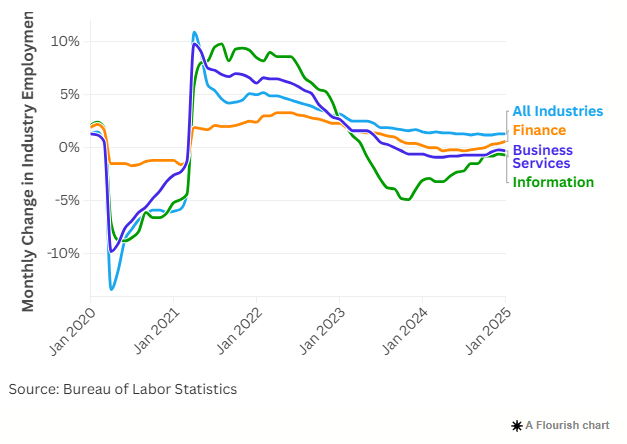

White-Collar Sectors Are Adding Jobs at a Slower Rate

After plummeting during the start of COVID-19 and then spiking during pandemic recovery, total employment growth has settled at about a 1% per month, year-over-year. But growth in white-collar industries hasn’t kept pace — in some cases, shrinking rather than growing in 2024.

Jon Stross, co-founder of Greenhouse, also recently told CNBC that AI tools like ChatGPT make it easier for candidates to apply to dozens or hundreds of jobs in much less time – and ramping up.

“Candidates are feeling like they’re in an arms race with each other around how many jobs you apply to,” Stross said. “You hear people on social media saying, ‘Oh, I applied to 150 jobs.’ And so you feel pressure that if you’re not applying to tons of jobs, you’re falling behind.

But, Stross noted, those tools also make people more likely to apply for positions that aren’t actually a great fit, inundating hiring managers with the resumes of unqualified candidates. A survey fielded ahead of ASI’s Power Summit in October, for example, indicated that half of attendees were concerned about finding employees with the appropriate skill set.

“It’s been interesting to see how the play for keeping employee retention was so strong and now it’s so much less so.”

Renya Nelson, Brand+Aid (asi/145153)

This push to “apply, apply, apply” fuels the cycle of competition – more rejections will likely prompt even more robust application numbers – but it also can make it tough for companies to find actually good employees amid the weeds.

“We have clients now who don’t have problems getting business but rather getting workers,” Craig Nadel, CEO of Counselor Top 40 distributor Nadel (asi/279600) and a member of Counselor’s Power 50 list of promo’s most influential people, says. “So we sell to that.”

Hiring – And Not Quitting

Just because job applicants may be struggling to get offers, though, doesn’t necessarily mean that they’ve lowered their expectations for new positions.

A survey from the Federal Reserve Bank in November found that the lowest wage respondents would be willing to accept for a new position increased to more than $82,000 on average, a jump of more than $10,000 since November 2021.

And findings from ASI Research’s State of the Industry report showed that in 2023, a higher percentage of suppliers (86%) and distributors (34%) reported having to raise wages for new employees compared to 2021.

Nelson, for example, has kept high wages and full benefits on the books at Brand+Aid to continue attracting the best talent, but she’s also being more intentional about ensuring a culture fit than she was during the hiring craze of 2022.

Percentage of Suppliers & Distributors Who Named Recruiting/Retaining Employees as Most Anticipated Challenge

After spiking amid lingering fears of the “Great Resignation,” promo industry concern about recruiting and maintaining employees dropped ahead of 2024 as hiring across industries began to slow dramatically.

In general, though, it seems to be easier for companies to hire than it once was. NC Custom (asi/44900) CEO Lance Stier, a member of the Counselor Power 50 list, for example, says that while top talent is always in high demand, the current labor market has been much more accommodative for ensuring they bring the best people onboard.

Boost Promotions (asi/142942) also added several new employees in 2024, says CEO Chris Faris, and he found the process easier than the year before.

“I think I’ve seen more talent out there,” Faris says. “People are willing to move – not necessarily having lost their job or anything, but just dissatisfied with their current positions.”

The percentage of Americans actively searching for a new job reached 28% in 2024, the highest percentage in a decade according to Federal Reserve estimates – but they’re hesitant to leave their current roles.

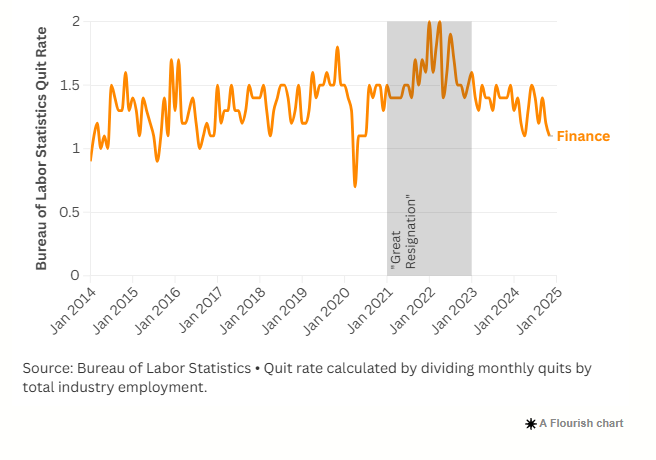

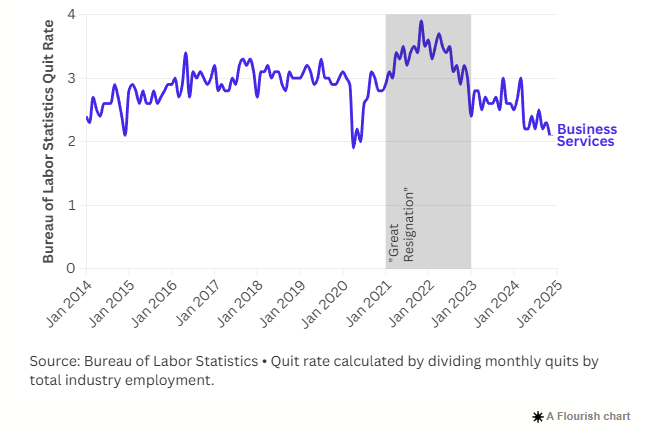

The quit rate has been steadily decreasing over the last two years and is currently at its lowest levels in the past decade, says Stahle, excepting the deep drop in early 2020 at the start of the pandemic.

Quit Rates Low Across Industries

The number of workers voluntarily leaving their current positions is at one of its lowest levels in nearly a decade, across all industries. Quit rates are down to pre-pandemic levels, if not lower, in white-collar industries.

All Industries

Information

Finance

Business Services

Companies knowing their employees are more likely to stick around is another reason they could be decreasing budgets for employee appreciation.

“I’m seeing a lot less of what I’m going to call spot merchandising, where it might just be ‘hey, let’s do this for our team, let’s do this for our department,’” Mair explains. “That money is getting moved to very specific activations that the brand would have.”

Optimism For 2025?

The good news for white-collar workers is that hiring rates and new job openings are trending toward stabilization, rather than decline. Stahle says Indeed has seen hiring metrics flatten off over the past several months, rather than continue declining at the rapid pace they did in 2023.

Stabilization could mean more of the same spending trends in 2025 – when companies are tightening their belts in general, they certainly tighten on promo spend, says Nelson. And economic uncertainty around potential impending tariffs and the cost of goods has somewhat carried over from the election run-up into the new year.

But the job market is showing some resilience as the new year rolls on. Although the 143,000 jobs added in January was slower growth than predicted, the Bureau of Labor Statistics made adjustments to November and December data that reflected an additional 100,000 jobs created during those months, which were already more robust than expected. December in particular saw more than 300,000 jobs added, according to the newest estimate.

That’s not necessarily an indicator that white-collar industries are suddenly going to go on a hiring spree – but for now, it shows that things should hold steady.

“I think there are some signs that knowledge workers might be seeing some demand come back in 2025,” Stahle says. “But right now the trend is toward stabilization.”