Key Takeaways

• Tariff Uncertainty Impacts Sales: Despite a temporary pause in tariffs and some legal clarity, year-over-year sales in May were slow or stagnant for most promo suppliers and distributors.

• Confidence Rebounds Slightly: The Counselor Confidence Index rose in May, with suppliers showing increased optimism for 2025 sales. Concerns about tariffs, while still high, dropped compared to the previous month.

• Price Hikes on the Rise: Over 70% of suppliers and nearly two-thirds of distributors have raised prices due to tariffs, with many suppliers implementing increases of over 10%.

If April was a whirlwind for promo, then May was the industry learning how to navigate the whirlwind.

Headway in negotiations with China meant a 90-day break on the highest of the announced tariffs starting in mid-May, while back and forth court rulings on whether the tariffs could remain in place (the short answer right now: yes) closed the month. At the beginning of June, just before ASI Research’s now-monthly sales survey was fielded, the Trump administration announced heightened tariffs on steel and aluminum products.

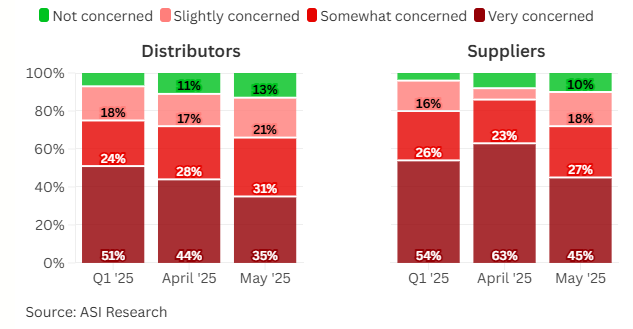

Greater certainty and a reduction in the highest China tariffs had a notable effect within the promo industry. Even as the vast majority of companies still report they’re at least slightly concerned about the impact of tariffs on 2025 business, the percentage of both suppliers and distributors who described themselves as “very concerned” dropped in May.

Concerns About Tariffs on 2025 Business

Nearly all distributors and suppliers are still at least slightly concerned about the impact of tariffs on 2025 business, but the percentage of those who are “very concerned” dropped significantly after May, especially for suppliers.

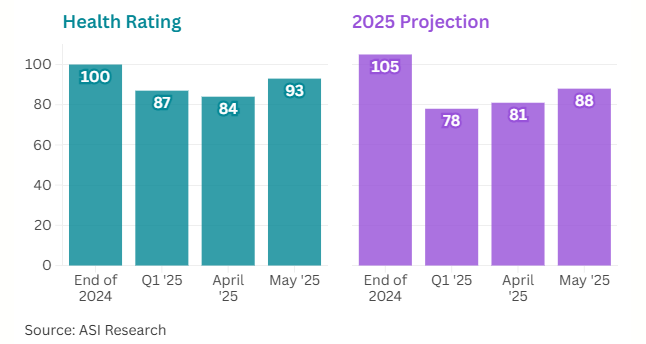

Not surprisingly, the Counselor Confidence Index, which measures the industry’s financial health and business optimism, also ticked up for May. Distributors’ health ratings for the industry were up to 93 from 84 at the end of April, and projections for the remainder of the year were up as well.

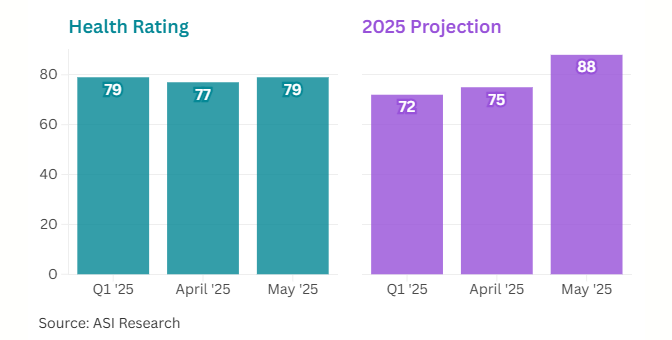

For suppliers in particular, current business health ratings remained stagnant – but 2025 projection ratings jumped up 13 points, from 75 to 88, between the April and May reports.

Counselor Confidence Index

Industry confidence — both current health ratings and year-end projections — rebounded by the end of May for both suppliers and distributors. Year-end projections for the health of the industry made a particularly big jump on the supplier side.

Distributors

Suppliers

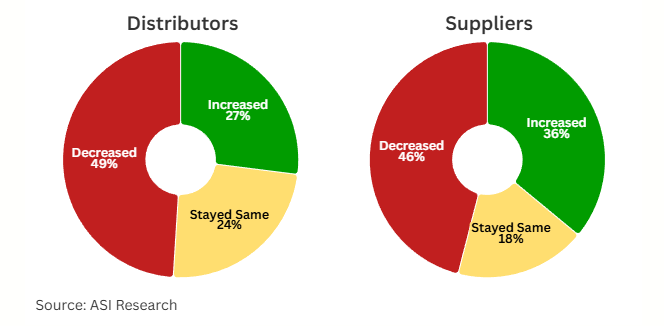

The increased optimism for the rest of the year wasn’t reflected however in the May promo industry sales results. ASI Research found that year-over-year sales last month were slow or stagnant for the majority of both suppliers and distributors.

Half of suppliers and nearly half of distributors had lower sales last month compared to May 2024. That’s a larger percentage than reported year-over-year sales declines for April, as consumers likely continued to hesitate on spending in an uncertain economy and a tough labor market.

Sales Performance – May ’25 vs. May ’24

Roughly half of companies reported year-over-year sales declines in May – more than those reporting declines in April, both on the supplier and distributor sides.

Still, the percentage of suppliers anticipating full-year sales increases for the year jumped up compared to this time last month. Half of suppliers are now projecting year-over-year sales improvement for 2025, compared with just 32% in early May.

The outlook for distributors was less rosy, with the percentage of companies expecting sales increases ticking down slightly from the April report, but there are still more firms anticipating increases than decreases.

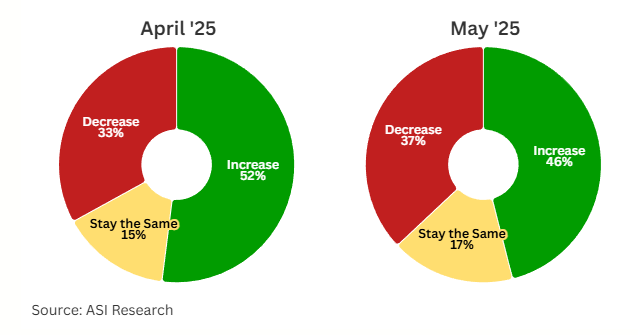

Full Year Sales Expectations – 2025 vs. 2024

At the end of May, slightly fewer distributors projected increased year-over-year sales for 2025 than they did in April. However, the percentage of suppliers projecting more optimism on the year surged from data collected during the April survey.

Distributors

Suppliers

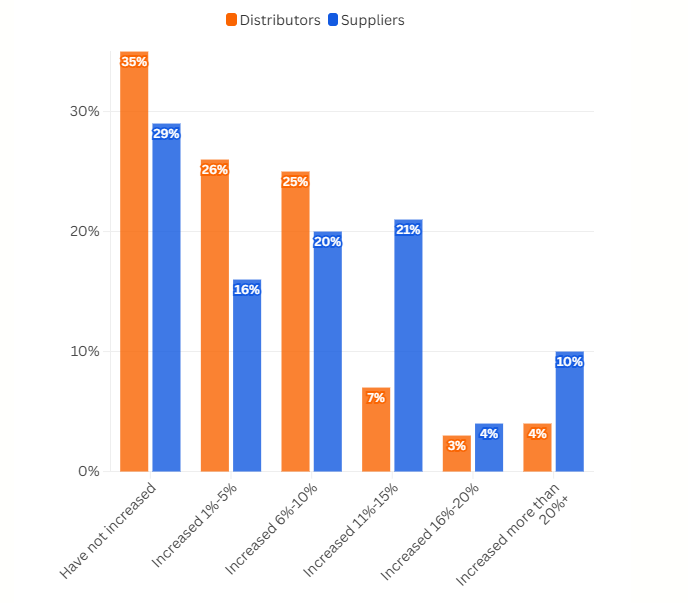

With multiple months of tariffs under their belts, a sizable percentage of promo companies by now have been compelled to raise prices. Indeed, as of early June, over 70% of suppliers have raised prices – up from 45% at the end of Q1. Of all suppliers (including those who haven’t hiked what they charge), 35% have raised their prices by more than 10%.

On the distributor side, nearly two-thirds of companies reported upping prices as of early June, compared with 54% as of early May. Distributor increases are, notably, smaller on average, with less than 15% of companies hiking prices more than 10%.

Raised Prices as a Result of Tariffs

Two-thirds of distributors and more than 7 in 10 suppliers have raised prices as a result of tariffs, a figure that’s been steadily climbing over the past few months. The price hikes have generally been steeper on the supplier side.

In the latest report, nearly half of distributors (49%) and suppliers (46%) predict their 2025 sales will decrease if the tariff situation remains unchanged. On the supplier side, this was a major improvement from the previous month’s report, where 69% of suppliers predicted their sales would decline without a change in the tariff situation. The declines in the China tariffs had a major positive impact, and the Trump administration has subsequently announced that there would be no further changes coming to tariffs on China. While that would likely mean higher prices would stay in place or continue to roll out, industry leaders have told ASI Media the stability would be more than welcome.

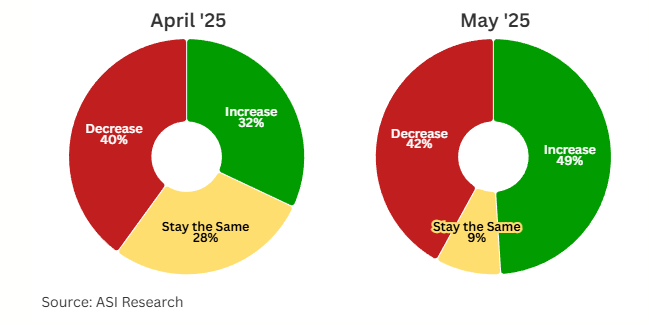

Full Year Sales Expectations If Tariffs Remain

Unsurprisingly, more suppliers and distributors project sales declines if the tariff situation remains unchanged, compared to their general projections. This figure is significantly less for suppliers now, though, than it was at the end of April.