This is no ordinary time for commercial printing. Extreme uncertainty created by no-one-knows-what’s-next tariff policies has dampened sales, inflated operating costs, and squeezed profit margins across the industry. Meanwhile, transformative technologies such as artificial intelligence (AI), the Internet of Things, and smart robotics redefine what’s possible and widen the gap between top performers and everyone else.

Results from the PRINTING United Alliance State of the Industry Survey (SOI) show how challenging business conditions have been for the 83 commercial printers who participated. Through the first three quarters of 2025 and on average, sales increased just 0.3%, operating cost inflation ran ahead of price increases 3.9% to 2.1%, real (inflation-adjusted) sales, a measure of production, declined 1.8%, and pre-tax profitability was flat or down for 72.3% of respondents. Conditions are described as “troubled waters, with tariffs and rising costs all over the place,” and “confusion and economic uncertainty, which are causing clients to delay or defer projects and reduce run size.”

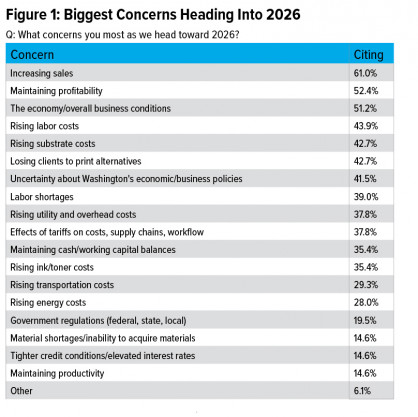

Commercial printers surveyed broadly agree that the challenges of 2025 will continue in 2026. Specifically, 61% are most concerned about increasing sales, 52.4% about maintaining profitability, and 51.2% about the economy. Persistent cost inflation, particularly labor and substrate costs, losing work to print alternatives, and uncertainty created by Washington, each cited by more than two-fifths, follow (Figure 1).

Collectively, our research panel listed more than 30 priorities for the year ahead, ranging from focusing on core services and business fundamentals (getting back to basics) to cybersecurity. The most widely cited priorities, summarized in Figure 2, fall into four categories:

- World-class efficiency. Increasing productivity companywide, controlling costs — finding and plugging leaks — and automation ranked first, second, and third, respectively. Quality control makes the list (because markets are too competitive to pass inefficiencies on to clients) and so does increasing production speed to meet client demand for faster job turns.

- Profitable revenue growth. Capture value-added, high-profit sales. Promote the company’s full range of capabilities and the value created for clients. Improve the customer experience by reducing response times and expanding e-commerce capabilities. Diversify beyond commercial printing. (Nearly 65% have added graphic and sign printing and nearly 42% package and label printing.)

- Artificial intelligence. Explore how AI can help most. Sales prospecting? Market analysis and forecasting? Preventive maintenance?

- Business intelligence. Strengthen ERP, MIS, CRM, and comparable systems for more timely, complete data on what’s happening internally and externally, and base decisions on that data.

Read the full feature on Printing Impressions, a publication of PRINTING United Alliance, ASI’s strategic partner.